A 30 Year Home Mortgage Is A Classic Example Of

Holbox

Mar 21, 2025 · 7 min read

Table of Contents

A 30-Year Home Mortgage: A Classic Example of Long-Term Financial Commitment and its Implications

A 30-year home mortgage stands as a classic example of a long-term financial commitment, significantly impacting an individual's or family's financial well-being for decades. This article delves deep into the intricacies of a 30-year mortgage, exploring its advantages, disadvantages, the underlying mechanics, and crucial considerations before committing to such a significant financial undertaking. We'll also examine alternative financing options and strategies for navigating this complex financial landscape effectively.

The Allure of the 30-Year Mortgage: Lower Monthly Payments

The primary attraction of a 30-year mortgage is undoubtedly the lower monthly payments. Compared to shorter-term mortgages (like 15-year mortgages), the monthly installments are significantly smaller, making homeownership more accessible to a broader range of buyers. This affordability is particularly enticing for first-time homebuyers with limited disposable income. The reduced financial strain allows individuals to allocate more funds towards other essential expenses and investments. This immediate financial relief can feel incredibly appealing, especially when considering the significant investment of purchasing a home.

The Trade-Off: Higher Total Interest Paid

However, this seemingly attractive advantage comes with a significant trade-off: significantly higher total interest paid over the life of the loan. While monthly payments are lower, the longer repayment period translates to considerably more interest accruing over three decades. This interest constitutes a substantial portion of the total loan cost, potentially amounting to more than double the original loan principal. Understanding this crucial aspect is paramount in making an informed decision. Careful consideration of the long-term financial implications is necessary before committing to this path.

Understanding the Mechanics of a 30-Year Mortgage

A 30-year mortgage is an amortizing loan, meaning that each monthly payment comprises both principal (the actual loan amount) and interest. In the initial years of the loan, a larger portion of each payment goes towards interest, while a smaller amount is applied to the principal balance. As the loan progresses, the proportion shifts, with more of each payment gradually reducing the principal and less going to interest. This is why it's often said that you pay more interest at the beginning of the loan than later on.

Amortization Schedule: Tracking Your Progress

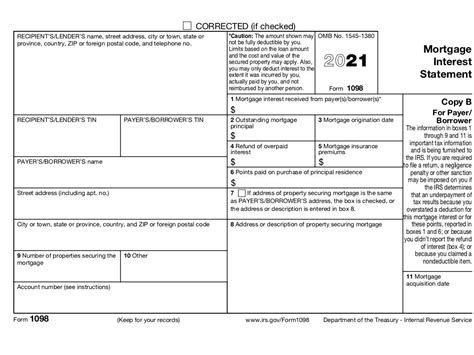

A detailed amortization schedule provides a clear picture of the payment breakdown for each month. It outlines the principal and interest portions of each payment, as well as the remaining loan balance. This schedule allows homeowners to track their progress and visualize the gradual reduction in their loan balance over time. Access to this information empowers them to make informed financial decisions and maintain a clear understanding of their debt.

Advantages of a 30-Year Mortgage: Beyond Lower Payments

While higher total interest is a notable drawback, a 30-year mortgage offers certain advantages beyond simply lower monthly payments:

-

Lower Barrier to Entry: The reduced monthly payments make homeownership accessible to a wider range of potential buyers, especially those starting their careers or with limited savings. This aspect significantly broadens the scope of homeownership opportunities.

-

Financial Flexibility: The lower monthly payments provide greater financial flexibility, allowing homeowners to allocate funds to other financial goals, such as investments, retirement savings, or children's education. This flexibility is a crucial element in managing personal finances effectively.

-

Longer Time to Build Equity: Although the total interest paid is higher, a 30-year mortgage offers a longer timeframe for homeowners to build equity in their homes. Equity represents the portion of the home's value that homeowners own outright.

-

Potential for Appreciation: Over the 30-year period, the value of the home may appreciate, potentially offsetting some of the high interest paid. However, it is crucial to remember that real estate prices can fluctuate significantly and are not always guaranteed to increase steadily.

Disadvantages of a 30-Year Mortgage: Weighing the Risks

Despite the perceived benefits, a 30-year mortgage also carries significant drawbacks:

-

High Total Interest Costs: As emphasized earlier, the substantial amount of interest paid over 30 years is a major disadvantage. This significant cost significantly impacts the overall financial outlay.

-

Longer Commitment: A 30-year commitment ties up a significant portion of an individual's income for an extended period. This long-term commitment requires careful consideration of potential future life changes or unforeseen financial difficulties.

-

Risk of Negative Equity: In scenarios where home prices decline, homeowners may find themselves owing more on their mortgage than their home is worth (negative equity). This can lead to serious financial complications.

-

Limited Financial Flexibility in the Long Run: Although lower payments offer initial flexibility, the longer-term commitment can limit future financial options, especially when considering other significant investments or life events.

Alternatives to a 30-Year Mortgage: Exploring Other Options

Several alternative mortgage options offer different balances between affordability and total cost:

-

15-Year Mortgage: A 15-year mortgage requires higher monthly payments but significantly reduces the total interest paid, leading to substantial long-term savings. This option may be suitable for individuals with higher incomes and a greater capacity for larger monthly payments.

-

Adjustable-Rate Mortgages (ARMs): ARMs offer lower initial interest rates that adjust periodically based on market conditions. While they can offer lower starting payments, they carry the risk of higher payments in the future if interest rates rise. This option is usually a higher-risk option only suitable for individuals comfortable with market fluctuations.

-

Interest-Only Mortgages: These mortgages allow homeowners to pay only the interest for a specified period, often the first few years. The principal balance remains unchanged until the end of the term when a significant lump sum payment is required. This is a high-risk mortgage and rarely advised.

-

Government-backed Loans (FHA, VA): Government-backed loans offer lower down payment requirements and more favorable terms for eligible borrowers. However, these options usually come with specific eligibility criteria and requirements.

Making Informed Decisions: Key Considerations Before Committing

Before committing to a 30-year mortgage, it's vital to carefully consider several key factors:

-

Financial Stability: Assess your current financial stability and future earning potential. Can you comfortably afford the monthly payments, even with potential unexpected expenses or job changes?

-

Interest Rates: Shop around and compare interest rates from multiple lenders to secure the most favorable terms. Interest rate fluctuation plays a huge part in the long run cost of a mortgage.

-

Down Payment: A larger down payment reduces the loan amount and subsequently lowers total interest paid, while a smaller down payment might ease entry but significantly increase the total costs over the life of the loan.

-

Lifestyle Changes: Consider potential future lifestyle changes (e.g., job relocation, family expansion) that might impact your ability to manage the mortgage payments over the 30-year period.

-

Debt-to-Income Ratio: Calculate your debt-to-income ratio to ensure your mortgage payment remains manageable within your overall financial obligations. Lenders carefully check this ratio before approval.

-

Emergency Fund: Build an emergency fund to cover unexpected repairs, job losses, or other financial challenges. Having a considerable emergency fund will provide an important financial cushion should unexpected events arise.

Navigating the Complexities: Professional Advice

Securing a 30-year mortgage is a significant financial decision with far-reaching consequences. Seeking professional guidance from a financial advisor or mortgage broker is highly recommended. These professionals offer valuable insights and expertise to navigate the complexities of the mortgage market and find the best options tailored to individual financial situations. Their expertise can help minimize risks and maximize long-term financial well-being.

Conclusion: A Long-Term Perspective

A 30-year home mortgage is a classic illustration of a long-term financial commitment, offering lower monthly payments but entailing significantly higher total interest costs. The decision of whether to take on such a commitment should be carefully weighed against personal financial circumstances, risk tolerance, and long-term financial goals. Understanding the mechanics of mortgage amortization, exploring alternative loan options, and seeking professional advice are critical steps in making an informed decision that aligns with one's overall financial well-being and future aspirations. Remember, responsible homeownership requires careful planning, financial discipline, and a clear understanding of the long-term implications involved. The 30-year commitment is a marathon, not a sprint, so careful consideration is paramount for success.

Latest Posts

Latest Posts

-

Correctly Label The Following Anatomical Features Of The Tibiofemoral Joint

Mar 21, 2025

-

Label The Different Parts Of The Nucleotide Below

Mar 21, 2025

-

Which Of The Following Shows The Graph Of

Mar 21, 2025

-

In The Confidence Interval The Quantity Is Called The

Mar 21, 2025

-

What Is One Current Trend In Institutional Activism

Mar 21, 2025

Related Post

Thank you for visiting our website which covers about A 30 Year Home Mortgage Is A Classic Example Of . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.