Working Capital Management Includes Which One Of The Following

Holbox

Mar 15, 2025 · 7 min read

Table of Contents

Working Capital Management: A Deep Dive into its Components and Strategies

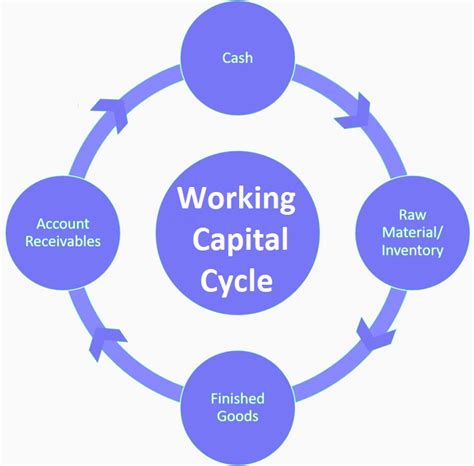

Working capital management is a critical aspect of financial management for businesses of all sizes. It encompasses the efficient and effective management of short-term assets and liabilities to ensure smooth day-to-day operations and optimal profitability. Understanding what constitutes working capital management is crucial for sustained growth and financial stability. This comprehensive guide will delve into the key components of working capital management, explore effective strategies, and highlight the importance of its various facets.

What is Working Capital Management?

Working capital management, in essence, is the process of managing a company's current assets and liabilities to ensure it has enough ready cash to cover its short-term operational expenses. It's about striking a delicate balance between having enough liquid assets to meet immediate obligations and tying up too much capital in inventory or receivables. Effective working capital management allows a business to:

- Meet short-term obligations: Pay suppliers, employees, and other creditors on time.

- Optimize cash flow: Ensure a consistent flow of cash to support operations.

- Invest in growth opportunities: Free up capital for expansion and innovation.

- Minimize financial risk: Reduce the likelihood of facing liquidity issues or cash shortages.

- Improve profitability: Efficiently manage working capital can significantly enhance profitability.

Key Components of Working Capital Management

Working capital management encompasses a broad spectrum of activities, all interconnected and influencing the overall financial health of a business. Let's break down the key components:

1. Managing Current Assets

Current assets are assets that can be readily converted into cash within one year. Efficient management of these assets is paramount:

-

Cash Management: This involves optimizing cash inflows and outflows to maintain sufficient liquidity. Strategies include forecasting cash needs, implementing effective collection procedures for receivables, and managing disbursement schedules efficiently.

-

Accounts Receivable Management: Effectively managing accounts receivable means minimizing the time it takes to collect payments from customers. Strategies include offering discounts for early payment, establishing clear credit policies, and using debt collection agencies when necessary. Analyzing aging reports is crucial to identify slow-paying customers and take proactive steps.

-

Inventory Management: This involves maintaining optimal inventory levels to meet customer demand without overstocking. Effective inventory management techniques include using Just-In-Time (JIT) inventory systems, implementing robust forecasting methods, and regularly reviewing inventory turnover rates. Excess inventory ties up capital and increases storage costs, while insufficient inventory can lead to lost sales.

2. Managing Current Liabilities

Current liabilities are obligations that are due within one year. Managing these liabilities responsibly is equally important:

-

Accounts Payable Management: This entails negotiating favorable payment terms with suppliers to extend payment periods and improve cash flow. Prompt payment, however, can also foster strong supplier relationships and secure better deals. Striking the right balance is key.

-

Short-Term Borrowing: This involves securing short-term loans or lines of credit to meet short-term funding needs. Careful consideration of interest rates and repayment terms is crucial. Understanding the cost of borrowing is essential to minimize finance charges.

-

Accrued Expenses: These are expenses that have been incurred but not yet paid, such as salaries, taxes, and utilities. Accurately estimating and planning for these expenses is important to ensure sufficient cash is available when they become due.

Strategies for Effective Working Capital Management

Several strategies can be implemented to optimize working capital management:

1. Improving Cash Flow Forecasting

Accurate cash flow forecasting is fundamental. It involves projecting future cash inflows and outflows to identify potential shortfalls or surpluses. This allows businesses to proactively manage their cash position and make informed decisions about financing and investment.

2. Accelerating Receivables Collection

Reducing Days Sales Outstanding (DSO) – the average number of days it takes to collect payment from customers – is crucial. This can be achieved by implementing effective credit policies, offering early payment discounts, and utilizing automated invoicing and payment systems.

3. Optimizing Inventory Levels

Effective inventory management techniques, such as Just-In-Time (JIT) inventory systems and robust forecasting, help minimize storage costs and reduce the risk of obsolescence. Regular inventory audits and stock rotation are also vital.

4. Negotiating Favorable Payment Terms with Suppliers

Negotiating longer payment terms with suppliers provides businesses with more time to collect payments from customers and improve their cash flow. Building strong supplier relationships is key to securing favorable terms.

5. Utilizing Technology

Technology plays a crucial role in enhancing working capital management. Enterprise Resource Planning (ERP) systems, automated invoicing systems, and electronic payment platforms can streamline processes, improve efficiency, and reduce errors.

6. Financial Planning and Analysis

Regular financial planning and analysis are essential to monitor working capital levels, identify trends, and make informed decisions. Key performance indicators (KPIs) such as current ratio, quick ratio, and inventory turnover ratio provide insights into the effectiveness of working capital management.

7. Debt Management

Effective management of short-term and long-term debt is crucial. This includes carefully considering the cost of borrowing, securing favorable interest rates, and maintaining a healthy debt-to-equity ratio.

The Importance of Effective Working Capital Management

Effective working capital management is not just about having enough cash on hand; it's a strategic imperative that contributes significantly to a business's overall success. The benefits include:

-

Enhanced Profitability: Improved cash flow translates directly to increased profitability. Efficient working capital management reduces financing costs and optimizes resource allocation.

-

Reduced Financial Risk: Adequate working capital cushions the business against unexpected expenses and economic downturns, minimizing the risk of insolvency.

-

Improved Operational Efficiency: Streamlined processes and efficient management of assets and liabilities improve operational efficiency and productivity.

-

Increased Investment Opportunities: Freeing up capital allows businesses to invest in growth opportunities, such as expanding operations, developing new products, or acquiring other businesses.

-

Stronger Creditworthiness: Healthy working capital positions improve a business's creditworthiness, making it easier to secure loans and financing at favorable terms.

Working Capital Management and Different Business Models

The specific requirements of working capital management can vary significantly depending on the type of business. For example:

-

Manufacturing Businesses: These businesses typically have higher working capital requirements due to substantial investment in raw materials, work-in-progress (WIP) inventory, and finished goods. Efficient inventory management is critical.

-

Retail Businesses: Retailers need to manage inventory carefully to meet customer demand while minimizing storage costs. Effective cash flow management is crucial for handling daily transactions.

-

Service Businesses: Service businesses typically have lower working capital requirements compared to manufacturing or retail businesses, as their main assets are intangible. However, efficient accounts receivable management is still crucial.

Measuring Working Capital Management Efficiency

Several key performance indicators (KPIs) can be used to measure the efficiency of working capital management:

-

Current Ratio: This ratio compares current assets to current liabilities (Current Assets / Current Liabilities). A higher ratio indicates stronger liquidity.

-

Quick Ratio: This ratio is a more conservative measure of liquidity, excluding inventory from current assets ( (Current Assets - Inventory) / Current Liabilities).

-

Inventory Turnover Ratio: This ratio measures how efficiently a company manages its inventory (Cost of Goods Sold / Average Inventory). A higher ratio indicates faster inventory turnover.

-

Days Sales Outstanding (DSO): This metric measures the average number of days it takes to collect payment from customers ( (Accounts Receivable / Credit Sales) * Number of Days).

-

Days Payable Outstanding (DPO): This metric measures the average number of days it takes to pay suppliers ( (Accounts Payable / Purchase) * Number of Days).

By monitoring these KPIs, businesses can identify areas for improvement and implement strategies to enhance their working capital management.

Conclusion

Working capital management is a multifaceted process that requires a strategic and holistic approach. By understanding its key components, implementing effective strategies, and regularly monitoring key performance indicators, businesses can ensure they have the necessary resources to meet their short-term obligations, optimize cash flow, and achieve their financial goals. Effective working capital management is not simply a financial function; it's a critical driver of operational efficiency, profitability, and sustainable growth. Ignoring it can lead to serious financial difficulties, while mastering it can be a significant competitive advantage.

Latest Posts

Latest Posts

-

If A Company Recognizes Accrued Salary Expense

Mar 17, 2025

-

Utma Accounts Are Opened Under The Tax Id Of The

Mar 17, 2025

-

In Which Situations Can Simplifying Jobs Be Most Beneficial

Mar 17, 2025

-

For The Hr Planning Process How Should Goals Be Determined

Mar 17, 2025

-

How Does A Shortcut Link To Another File

Mar 17, 2025

Related Post

Thank you for visiting our website which covers about Working Capital Management Includes Which One Of The Following . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.