Which Statement Does Not Describe Operating Cash Flows

Holbox

Mar 27, 2025 · 7 min read

Table of Contents

- Which Statement Does Not Describe Operating Cash Flows

- Table of Contents

- Which Statement Does Not Describe Operating Cash Flows?

- Defining Operating Cash Flows

- Statements That DO Describe Operating Cash Flows

- Statements That DO NOT Describe Operating Cash Flows

- Analyzing Operating Cash Flow: A Deeper Dive

- Conclusion: The Importance of Accurate OCF Analysis

- Latest Posts

- Latest Posts

- Related Post

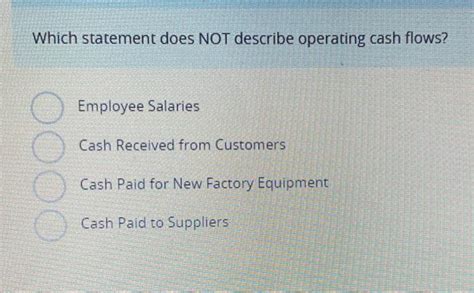

Which Statement Does Not Describe Operating Cash Flows?

Understanding cash flow is crucial for any business, regardless of size or industry. Cash is king, and accurately tracking and managing operating cash flows is vital for profitability and long-term sustainability. While the concept seems straightforward, the nuances of what constitutes operating cash flow can be confusing. This comprehensive guide will delve deep into the definition of operating cash flows, exploring what it does represent and, crucially, what it does not. We'll clarify common misconceptions and arm you with the knowledge to confidently analyze financial statements.

Defining Operating Cash Flows

Operating cash flow (OCF) represents the cash generated from a company's primary business operations. It reflects the cash inflows and outflows resulting from the core activities that directly contribute to its revenue generation. This includes, but isn't limited to, sales of goods or services, payments to suppliers, employee salaries, and operating expenses. The key takeaway is that OCF focuses solely on the cash aspect of these operations, not the accounting profits reflected in the income statement.

Key Characteristics of Operating Cash Flows:

- Cash Basis: OCF strictly adheres to the cash basis of accounting. This means it only considers transactions that involve actual cash inflows (money coming in) and outflows (money going out). Accrual accounting principles, which record revenue when earned and expenses when incurred regardless of cash movement, are irrelevant here.

- Core Business Activities: OCF isolates cash flows directly related to the core operations of the business. It excludes activities like investing and financing.

- Short-Term Focus: OCF predominantly reflects the short-term financial performance of the business. It provides a snapshot of how effectively the company is managing its day-to-day operations in generating cash.

Statements That DO Describe Operating Cash Flows

Before exploring what doesn't describe operating cash flow, let's solidify our understanding by examining accurate descriptions:

- Cash received from customers: This is a primary component of OCF. Sales revenue translates directly into cash inflows when customers pay for goods or services.

- Cash paid to suppliers: Purchasing raw materials, inventory, or other necessary supplies generates cash outflows, directly impacting OCF.

- Cash paid for salaries and wages: Employee compensation is a significant operating expense, representing a substantial cash outflow in OCF.

- Cash paid for rent, utilities, and other operating expenses: All routine operational costs are factored into OCF calculations.

- Net cash flow from operating activities: This is the summarized figure shown on the statement of cash flows, reflecting the net impact of all cash inflows and outflows from operations. It's the bottom line of the operating activities section.

- A measure of liquidity: OCF provides a valuable insight into a company's liquidity, its ability to meet its short-term obligations. Strong OCF indicates a healthy financial position.

- Indicator of operational efficiency: Analyzing OCF helps assess the efficiency of a company's operations. High OCF relative to revenue suggests efficient management of resources and costs.

- Important for financial forecasting: OCF is a critical component in forecasting future cash flows and financial planning.

Statements That DO NOT Describe Operating Cash Flows

Now, let's address the core question: which statements do not describe operating cash flows? Several elements are commonly misinterpreted or mistakenly included in OCF calculations. Understanding these distinctions is crucial for accurate financial analysis:

-

Net Income: This is perhaps the most common misconception. Net income is an accrual-based accounting figure reflecting profits based on revenue recognized and expenses incurred, regardless of when cash actually changes hands. OCF, on the other hand, solely focuses on actual cash movements. While related, they are distinct metrics. A company can have high net income but low OCF due to factors like high accounts receivable (customers owing money) or high inventory levels.

-

Depreciation and Amortization: These are non-cash expenses. They represent the gradual reduction in the value of assets over time, but they don't involve actual cash outflows. While shown as expenses on the income statement, they are added back to net income when calculating OCF using the indirect method. This is because they represent a reduction in net income that doesn't reflect a corresponding cash outflow.

-

Proceeds from issuing debt or equity: This relates to financing activities, not operating activities. Raising capital through debt or equity increases cash but is not related to the core operations of the business.

-

Proceeds from the sale of long-term assets: The sale of property, plant, and equipment (PP&E) is classified as an investing activity, not an operating activity. The cash inflow generated from such sales is not included in OCF.

-

Payments for capital expenditures (CapEx): These are investments in long-term assets such as new equipment or buildings. They are considered investing activities, not operating activities, and thus excluded from OCF.

-

Interest Payments: These are financing activities and should be included in the financing section of the statement of cash flows, not the operating section. Interest expense affects net income but is not considered an operating cash flow.

-

Tax payments: While taxes are an expense related to the overall business, the cash paid for taxes is frequently (depending on accounting methodology) included in the operating activities section of the cash flow statement. However, the timing of tax payments can be significantly different from the timing of the revenue earned that caused the tax liability.

-

Changes in working capital: While changes in working capital accounts (accounts receivable, accounts payable, inventory) are integral to the calculation of operating cash flow, they do not themselves represent operating cash flow. They are adjustments made to net income to reconcile it to operating cash flow.

-

Non-recurring items: Extraordinary gains or losses, such as asset write-downs or litigation settlements, are not considered part of the normal operating cash flows of a business. These are often disclosed separately in the financial statements.

Analyzing Operating Cash Flow: A Deeper Dive

Understanding what doesn't constitute OCF is just as important as understanding what does. Misinterpreting these factors can lead to inaccurate financial analysis and flawed business decisions. By carefully reviewing the statement of cash flows and focusing on the cash inflows and outflows from core business operations, you can gain a clear picture of a company's financial health and operational efficiency.

Several methods exist for calculating OCF, but the two most prominent are the direct method and the indirect method.

-

Direct Method: This method directly tracks all cash inflows and outflows from operating activities. It provides a more transparent view of OCF, but it's less commonly used due to its complexity.

-

Indirect Method: This method starts with net income and makes adjustments for non-cash items (like depreciation and amortization) and changes in working capital. It's more prevalent because it leverages data readily available from the income statement and balance sheet.

Analyzing OCF in relation to other financial metrics offers valuable insights. Comparing OCF to net income can reveal discrepancies between accounting profits and actual cash generated. Analyzing OCF as a percentage of revenue indicates the efficiency of the company's operations in converting sales into cash. Furthermore, comparing OCF trends over time can highlight improvement or deterioration in the company's operational performance.

Conclusion: The Importance of Accurate OCF Analysis

Operating cash flow is a vital indicator of a company's financial health and operational efficiency. By understanding precisely what constitutes OCF and, equally importantly, what does not, you can make informed decisions based on accurate financial analysis. Misinterpreting components of OCF can lead to inaccurate assessments of a company's liquidity, profitability, and long-term sustainability. Mastering the intricacies of OCF analysis is crucial for investors, creditors, and business owners alike to assess financial performance accurately and make sound strategic decisions. Remember to always consult the full financial statements for a complete picture and consult with a financial professional for personalized advice.

Latest Posts

Latest Posts

-

All Competitive Markets Involve Which Of The Following

Mar 31, 2025

-

Write An Equation For The Function Graphed Below

Mar 31, 2025

-

A Carnot Refrigerator Absorbs Heat From A Space At 15

Mar 31, 2025

-

The Three Regions On A Pressure Enthalpy Chart Are

Mar 31, 2025

-

Does Oligopoly Describe Rolex Better Than Monopolistic Competition

Mar 31, 2025

Related Post

Thank you for visiting our website which covers about Which Statement Does Not Describe Operating Cash Flows . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.