Which Of The Following Is Not A Current Liability

Holbox

Mar 24, 2025 · 5 min read

Table of Contents

- Which Of The Following Is Not A Current Liability

- Table of Contents

- Which of the Following is Not a Current Liability? A Comprehensive Guide

- Defining Current Liabilities: A Clear Understanding

- Identifying Non-Current Liabilities: The Counterpoint

- Analyzing Scenarios: Which is NOT a Current Liability?

- Common Misclassifications and Pitfalls

- Impact on Financial Ratios and Analysis

- The Importance of Accurate Financial Reporting

- Conclusion: Mastering Current Liability Classification

- Latest Posts

- Latest Posts

- Related Post

Which of the Following is Not a Current Liability? A Comprehensive Guide

Understanding current liabilities is crucial for accurate financial reporting and effective business management. Current liabilities represent obligations due within one year or the operating cycle, whichever is longer. This article will delve deep into the definition of current liabilities, explore various examples, and definitively answer the question: which of the following is not a current liability? We'll cover common misclassifications and provide practical examples to solidify your understanding.

Defining Current Liabilities: A Clear Understanding

Current liabilities are a company's short-term financial obligations that are due within one year or the operating cycle. The operating cycle refers to the time it takes a business to convert its inventory into cash from sales. This means that if a company's operating cycle is longer than a year, then liabilities due within that longer operating cycle are still considered current.

Key Characteristics of Current Liabilities:

- Short-Term Obligations: They are due within a relatively short period.

- Payment Obligation: They represent a definite payment obligation.

- Current Asset Conversion: They are often settled using current assets (like cash or accounts receivable).

Examples of Common Current Liabilities:

- Accounts Payable: Money owed to suppliers for goods or services purchased on credit.

- Short-Term Notes Payable: Loans with a maturity date within one year.

- Salaries Payable: Wages owed to employees.

- Interest Payable: Interest accrued but not yet paid.

- Taxes Payable: Taxes owed to government entities.

- Unearned Revenue: Payments received for goods or services that haven't yet been delivered.

- Current Portion of Long-Term Debt: The portion of a long-term loan that is due within the next year.

Identifying Non-Current Liabilities: The Counterpoint

Non-current liabilities, also known as long-term liabilities, are obligations that are not due within one year or the operating cycle. These debts extend beyond the short-term horizon and typically involve a longer repayment schedule.

Key Characteristics of Non-Current Liabilities:

- Long-Term Obligations: Maturity dates are beyond one year or the operating cycle.

- Extended Repayment: They usually involve installment payments over several years.

- Capital Structure: They often represent a significant part of a company's capital structure.

Examples of Common Non-Current Liabilities:

- Long-Term Loans: Loans with a maturity date exceeding one year.

- Mortgages Payable: Loans secured by real estate.

- Bonds Payable: Debt securities issued to raise capital.

- Deferred Tax Liabilities: Tax obligations that will be paid in future periods.

- Pension Liabilities: Obligations to pay retirement benefits to employees.

- Lease Obligations (Long-Term): Obligations arising from long-term lease agreements.

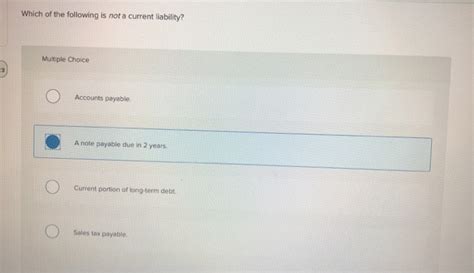

Analyzing Scenarios: Which is NOT a Current Liability?

Now, let's tackle scenarios to solidify your understanding. We'll present several examples and determine whether each represents a current or non-current liability.

Scenario 1: A company owes $50,000 to its supplier for raw materials purchased on credit, with a payment due in 6 months.

Answer: This is a current liability (Accounts Payable). The payment is due within one year.

Scenario 2: A company has a $2 million mortgage with a remaining term of 20 years.

Answer: This is a non-current liability (Mortgage Payable). The payment is not due within one year. Only the current portion due in the next year (if any) would be considered a current liability.

Scenario 3: A company has issued bonds with a face value of $10 million, maturing in 5 years.

Answer: This is a non-current liability (Bonds Payable). The maturity date is more than one year away. The current portion due within the next year would be classified as a current liability.

Scenario 4: A company owes $10,000 in employee salaries, payable at the end of the current month.

Answer: This is a current liability (Salaries Payable). The obligation is due within one year.

Scenario 5: A company received $50,000 in advance payment for a service to be provided over the next two years.

Answer: A portion of this is a current liability (Unearned Revenue). The portion relating to services to be provided within the next year would be classified as current; the remainder would be a non-current liability.

Scenario 6: A company has a deferred tax liability of $200,000, related to tax benefits from previous years.

Answer: This is typically a non-current liability (Deferred Tax Liability). While the exact timing might not be definitively known, the expectation is that these will be settled in future periods, beyond the current year.

Common Misclassifications and Pitfalls

Careless classification of liabilities can lead to inaccurate financial statements and misinterpretations of a company's financial health. Here are some common pitfalls:

- Confusing Short-Term Debt with Long-Term Debt: Failure to distinguish between short-term notes payable (current) and long-term loans (non-current).

- Ignoring the Operating Cycle: Not considering the operating cycle when classifying liabilities, especially in industries with longer operating cycles.

- Improper Treatment of Unearned Revenue: Incorrectly classifying all unearned revenue as a current liability without considering the portion related to future periods.

- Misclassifying Deferred Tax Liabilities: Incorrectly labeling deferred tax liabilities as current when they are typically long-term obligations.

Impact on Financial Ratios and Analysis

The proper classification of liabilities is critical for analyzing a company's financial position. Incorrect classification can distort financial ratios, leading to flawed interpretations of liquidity, solvency, and profitability. For example, misclassifying a long-term liability as a current liability could artificially inflate the current ratio (Current Assets / Current Liabilities), which measures a company's ability to meet its short-term obligations. This could mislead investors and creditors.

The Importance of Accurate Financial Reporting

Accurate financial reporting is essential for maintaining investor confidence, securing financing, and complying with accounting standards. Precise classification of current and non-current liabilities is an integral part of this process. By accurately classifying liabilities, companies can provide a true and fair view of their financial position, enabling better decision-making by stakeholders.

Conclusion: Mastering Current Liability Classification

Understanding the difference between current and non-current liabilities is a cornerstone of financial accounting. Accurate classification ensures reliable financial reporting, supports informed decision-making, and allows for a proper assessment of a company's financial health. By consistently applying the definitions and considering the specific circumstances of each liability, businesses can avoid pitfalls and create transparent and accurate financial statements. Regularly reviewing and updating liability classifications is also crucial to maintain accuracy as business circumstances evolve. Remember to always consult with a qualified accountant or financial professional if you have any doubts or complex situations.

Latest Posts

Latest Posts

-

Correctly Label The Muscles Of The Leg

Mar 26, 2025

-

Gathering The Information Needed And Then Setting Departmental Goals

Mar 26, 2025

-

Write The Balanced Chemical Equation For The Reaction Shown

Mar 26, 2025

-

Rewrite This Measurement With A Simpler Unit If Possible

Mar 26, 2025

-

The Bedford Guide For College Writers

Mar 26, 2025

Related Post

Thank you for visiting our website which covers about Which Of The Following Is Not A Current Liability . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.