When The Wash Sale Rules Apply The Realized Loss Is

Holbox

Mar 19, 2025 · 7 min read

Table of Contents

When the Wash Sale Rules Apply: Understanding Realized Losses

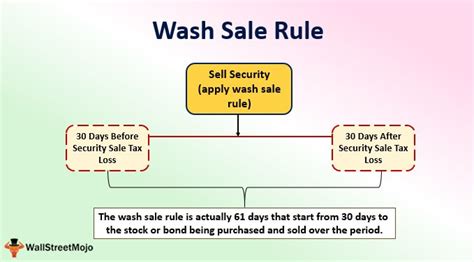

The wash sale rule is a crucial aspect of US tax law that impacts investors who sell securities at a loss and subsequently repurchase substantially similar securities. Understanding when the wash sale rules apply and how they affect realized losses is vital for minimizing your tax burden and maximizing investment returns. This comprehensive guide will delve into the intricacies of the wash sale rule, providing a clear and concise explanation of its application and implications.

What is a Wash Sale?

A wash sale occurs when an investor sells or trades a security at a loss and, within a specific timeframe (30 days), repurchases a substantially identical security. The Internal Revenue Service (IRS) considers this a wash sale, and it disallows the deduction of the loss. The disallowed loss isn't simply ignored; instead, it's added to the cost basis of the newly acquired security. This effectively postpones the recognition of the loss until a future date when the repurchased security is eventually sold.

Key Components of a Wash Sale:

- Sale at a Loss: The initial transaction must result in a realized loss. This means the sale price must be lower than the original purchase price.

- Substantially Identical Security: The repurchased security must be substantially identical to the one sold. This isn't limited to the exact same security; it encompasses similar securities with comparable characteristics. We'll explore this in detail later.

- 30-Day Window: The repurchase must occur within a 30-day period – 30 days before the sale or 30 days after the sale.

Understanding Realized Losses and Their Tax Implications

Before we deep dive into the nuances of wash sales, let's clarify the concept of realized losses and their significance in tax planning. A realized loss is the difference between the adjusted basis (original cost plus any adjustments) and the proceeds from the sale of an asset. These losses can be used to offset capital gains, reducing your overall tax liability. However, the wash sale rule prevents the immediate deduction of certain realized losses, as mentioned earlier.

Tax Implications of Realized Losses:

- Offsetting Gains: Realized capital losses can be used to offset capital gains. This means that if you have both capital gains and losses, you can use the losses to reduce the amount of taxable gains.

- Deduction Limit: You can deduct up to $3,000 ($1,500 if married filing separately) of net capital losses against ordinary income annually. Any excess losses can be carried forward to future tax years.

- Capital Gains Tax Rates: The tax rate applied to capital gains depends on your income level and the holding period of the asset (short-term or long-term).

Identifying "Substantially Identical" Securities: A Closer Look

The definition of "substantially identical" securities is crucial in determining whether a wash sale has occurred. The IRS uses a broad interpretation, and several scenarios can trigger the wash sale rule:

Examples of Substantially Identical Securities:

- Same Stock or Bond: Purchasing the same stock or bond you recently sold at a loss will clearly trigger a wash sale.

- Different Classes of the Same Stock: For example, selling Class A shares of a company and buying Class B shares within the 30-day period might constitute a wash sale. The IRS considers these substantially identical.

- Options and Underlying Stock: Buying call options on a stock you recently sold at a loss could trigger a wash sale, as could buying put options under specific circumstances.

- Convertible Securities: Converting a bond into stock or vice versa within the 30-day window might also qualify as a wash sale.

Situations that Generally Do Not Trigger a Wash Sale:

- Different Companies: Selling stock in Company A and buying stock in Company B does not trigger a wash sale, even if they are in the same industry.

- Different Classes of Bonds: Selling a corporate bond and purchasing a municipal bond would typically not constitute a wash sale due to the differing characteristics.

Calculating the Adjusted Basis After a Wash Sale

When a wash sale occurs, the disallowed loss is added to the basis of the newly acquired securities. This increases the cost basis, which in turn affects the capital gain or loss when the new securities are eventually sold.

Example:

Let's say you sold 100 shares of Stock XYZ for $10 per share ($1,000 total) after purchasing them for $15 per share ($1,500 total). This represents a $500 loss. Within 30 days, you purchased 100 more shares of Stock XYZ for $12 per share ($1,200 total).

- Original Loss: $500

- Cost Basis of New Shares: $1,200

- Adjusted Basis of New Shares: $1,200 + $500 = $1,700

The new adjusted basis of your 100 shares is $17 per share. When you eventually sell these shares, your gain or loss will be calculated based on this adjusted basis. If you sell them for $20 per share, your gain will be $300 (100 shares * ($20 - $17)).

Avoiding Wash Sales: Strategic Tax Planning

Understanding the wash sale rule is essential for effective tax planning. While you cannot avoid losses entirely, you can strategically plan your transactions to minimize the impact of wash sales.

Strategies to Avoid or Minimize Wash Sales:

- Wait 31 Days: The simplest method is to wait at least 31 days after selling a security at a loss before buying a substantially identical security.

- Diversify Investments: Investing in a wider range of assets can reduce the likelihood of triggering a wash sale because you're less likely to be repurchasing substantially identical securities.

- Consider Different Securities: If you believe a security will recover, consider purchasing a different, though comparable, security to avoid a wash sale. This may involve substituting a similar ETF or mutual fund.

- Consult a Tax Professional: Tax laws can be complex, and consulting with a qualified tax professional is always recommended for personalized advice. They can help you navigate these rules and develop a comprehensive tax strategy.

Wash Sales and Different Account Types

The wash sale rule applies to most investment accounts, including taxable brokerage accounts, retirement accounts (like IRAs and 401(k)s), and other investment vehicles. However, the impact might vary slightly depending on the account type. For example, in tax-advantaged accounts, while you still can't deduct the loss immediately, the loss might affect your overall account basis for future calculations.

Complex Scenarios and Exceptions

The wash sale rule can become more complex when dealing with intricate transactions, such as options trading or short sales. These scenarios often require a detailed understanding of the regulations and may necessitate professional tax advice.

Examples of Complex Scenarios:

- Options Trading: The wash sale rule can apply to options trades based on the relationship between the options and the underlying security.

- Short Sales: Short sales create unique situations that require a thorough analysis to determine if a wash sale has occurred.

Frequently Asked Questions (FAQs)

Q: What if I sell a stock at a loss and buy a similar, but not identical, stock within 30 days?

A: The IRS takes a broad interpretation of "substantially identical." If the securities are sufficiently similar, it could still be considered a wash sale. Consult a tax professional for specific scenarios.

Q: Can I deduct the loss in a future year?

A: Yes. The disallowed loss is not lost permanently; it’s added to the basis of the replacement security. When this replacement security is later sold, the loss is recognized, and you can then deduct up to the annual limit on capital losses.

Q: Does the wash sale rule apply to all types of securities?

A: Yes, the wash sale rule generally applies to stocks, bonds, options, and other securities.

Q: What if I sell multiple lots of the same stock at a loss and buy more within 30 days?

A: The disallowed losses are aggregated and added to the cost basis of the replacement shares.

Q: Is there a way to completely avoid the wash sale rule?

A: The most reliable way is to wait more than 30 days after selling at a loss before repurchasing a substantially identical security.

Conclusion: Mastering the Wash Sale Rule for Tax Optimization

The wash sale rule is a complex but critical aspect of tax law for investors. Understanding its implications is paramount to effective tax planning and optimizing investment strategies. While the rule may initially seem daunting, understanding the key elements – the realized loss, substantially identical securities, and the 30-day window – will significantly improve your ability to navigate this area of tax law. Remember, proactive planning, careful record-keeping, and seeking professional advice when necessary can help you minimize the impact of the wash sale rule and maximize your investment returns. By carefully considering your investment decisions within this framework, you can ensure your tax filings are accurate and compliant.

Latest Posts

Latest Posts

-

Contracts That Should Typically Require Sustainable Procurement

Mar 19, 2025

-

What Is True Concerning Physical And Logical Topologies

Mar 19, 2025

-

A Coffee Producer Has Two Social Media Objectives

Mar 19, 2025

-

What Is The Medial Border Of The Highlighted Region Called

Mar 19, 2025

-

Select The Account Classification That Matches With The Description

Mar 19, 2025

Related Post

Thank you for visiting our website which covers about When The Wash Sale Rules Apply The Realized Loss Is . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.