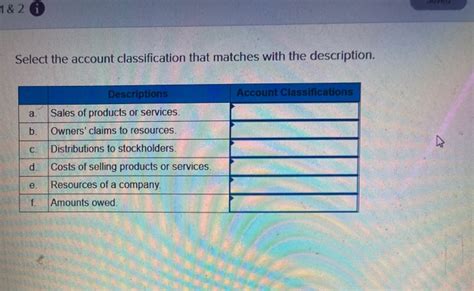

Select The Account Classification That Matches With The Description.

Holbox

Mar 19, 2025 · 6 min read

Table of Contents

Selecting the Right Account Classification: A Comprehensive Guide

Account classification is a crucial aspect of accounting and financial management. Choosing the correct classification ensures accurate financial reporting, efficient analysis, and informed decision-making. A well-organized chart of accounts is the backbone of a healthy financial system, providing a clear and consistent framework for recording and tracking all financial transactions. This article delves into the various account classifications, providing detailed descriptions and examples to help you select the most appropriate category for each of your transactions.

Understanding the Fundamental Account Classifications

Before diving into specific account types, it's essential to grasp the fundamental categories that form the basis of any chart of accounts. These major classifications provide a high-level overview of your company's financial activities. They are typically:

- Assets: These represent what a company owns. Assets provide future economic benefits.

- Liabilities: These represent what a company owes to others. They are obligations arising from past transactions.

- Equity: This represents the owners' stake in the company. It's the residual interest in the assets after deducting liabilities.

- Revenue: This represents the income generated from the company's primary operations.

- Expenses: These represent the costs incurred in generating revenue.

Detailed Account Classifications Within Each Major Category

Let's delve deeper into the specifics within each of these major account classifications:

1. Assets:

Assets are further categorized based on their liquidity (how quickly they can be converted into cash). The common sub-classifications are:

-

Current Assets: These are assets expected to be converted into cash or used up within one year or the operating cycle, whichever is longer. Examples include:

- Cash and Cash Equivalents: This includes money in the bank, petty cash, and short-term, highly liquid investments.

- Accounts Receivable: Money owed to the company by customers for goods or services sold on credit.

- Inventory: Goods held for sale in the ordinary course of business. This can include raw materials, work-in-progress, and finished goods.

- Prepaid Expenses: Expenses paid in advance, such as rent, insurance, or subscriptions.

-

Non-Current Assets (Long-Term Assets): These assets are expected to provide benefits for more than one year. Examples include:

- Property, Plant, and Equipment (PP&E): This includes land, buildings, machinery, and equipment used in the company's operations. These assets are usually depreciated over their useful lives.

- Intangible Assets: These are non-physical assets with value, such as patents, copyrights, trademarks, and goodwill. They are often amortized over their useful lives.

- Investments: Long-term investments in other companies or securities.

- Long-Term Receivables: Amounts receivable that are not expected to be collected within one year.

2. Liabilities:

Liabilities are also classified based on their maturity (when they are due).

-

Current Liabilities: These are obligations due within one year. Examples include:

- Accounts Payable: Money owed to suppliers for goods or services purchased on credit.

- Salaries Payable: Wages owed to employees.

- Short-Term Loans Payable: Loans due within one year.

- Interest Payable: Interest accrued but not yet paid.

- Taxes Payable: Taxes owed to government authorities.

-

Non-Current Liabilities (Long-Term Liabilities): These are obligations due after one year. Examples include:

- Long-Term Loans Payable: Loans with maturities exceeding one year.

- Bonds Payable: Long-term debt issued to investors.

- Deferred Revenue: Revenue received in advance for goods or services to be delivered in the future.

3. Equity:

Equity represents the owners' investment in the company and the accumulated profits retained in the business. Key components include:

- Contributed Capital: This represents the amount of money invested by the owners in the company.

- Retained Earnings: This is the accumulated net income of the company that has not been distributed as dividends.

4. Revenue:

Revenue accounts track the income generated from the company's core operations. Examples include:

- Sales Revenue: Income from the sale of goods or services.

- Service Revenue: Income from providing services.

- Interest Revenue: Income earned from interest-bearing accounts.

- Rental Revenue: Income from renting out property.

5. Expenses:

Expense accounts record the costs incurred in generating revenue. They are categorized by function or nature. Examples include:

- Cost of Goods Sold (COGS): The direct costs associated with producing goods sold.

- Selling, General, and Administrative Expenses (SG&A): Expenses related to selling, marketing, administration, and general operations. This can include salaries, rent, utilities, and marketing costs.

- Interest Expense: Expenses incurred on borrowed funds.

- Depreciation Expense: The allocation of the cost of long-term assets over their useful lives.

- Amortization Expense: The allocation of the cost of intangible assets over their useful lives.

Selecting the Appropriate Account Classification: A Practical Approach

Choosing the correct account classification involves carefully considering the nature of the transaction. Here's a step-by-step approach:

-

Identify the nature of the transaction: Is it an inflow or outflow of cash or other resources? Does it represent an asset, liability, equity, revenue, or expense?

-

Determine the specific account type: Based on the nature of the transaction, pinpoint the most accurate sub-classification within the major category. For example, if the transaction is a purchase of equipment, it would be classified as a non-current asset under Property, Plant, and Equipment (PP&E).

-

Consult your chart of accounts: Your chart of accounts should provide a comprehensive list of all accounts used in your business. This serves as a reference guide when classifying transactions.

-

Maintain consistency: Once you have established a classification system, maintain consistency throughout your accounting processes. This is crucial for accurate financial reporting and analysis.

-

Seek professional guidance if needed: If you are unsure about the appropriate classification for a specific transaction, consult with a qualified accountant or financial professional.

The Importance of Accurate Account Classification

Accurate account classification is paramount for several reasons:

-

Accurate Financial Statements: Proper classification ensures that financial statements present a true and fair view of the company's financial position and performance.

-

Effective Financial Analysis: A well-organized chart of accounts enables efficient analysis of financial data, facilitating better decision-making.

-

Compliance with Accounting Standards: Accurate classification is crucial for compliance with generally accepted accounting principles (GAAP) or International Financial Reporting Standards (IFRS).

-

Improved Internal Controls: A robust account classification system strengthens internal controls, reducing the risk of errors and fraud.

-

Streamlined Tax Preparation: Accurate account classification simplifies tax preparation by ensuring that all transactions are correctly categorized for tax purposes.

Conclusion

Selecting the correct account classification is a fundamental aspect of sound financial management. Understanding the different account classifications and applying a systematic approach to transaction categorization ensures accurate financial reporting, effective analysis, and informed decision-making. By adhering to these principles, businesses can build a robust financial foundation that supports growth and success. Remember to regularly review and update your chart of accounts to reflect changes in your business operations. This ongoing process of refinement guarantees the continued accuracy and relevance of your financial data. This comprehensive approach ensures your financial records are not only compliant but also a valuable tool for understanding your business's financial health and trajectory.

Latest Posts

Latest Posts

-

In Setting Research Objectives Marketers Have To

Mar 19, 2025

-

Which Activity Is An Example Of Poor Personal Hygiene

Mar 19, 2025

-

Draw The Condensed Structure Of An Isomer Of This Molecule

Mar 19, 2025

-

Firms Use A Differentiated Targeting Strategy Because

Mar 19, 2025

-

How Many Weeks Will It Take To Complete This Project

Mar 19, 2025

Related Post

Thank you for visiting our website which covers about Select The Account Classification That Matches With The Description. . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.