When The Federal Reserve Conducts Open Market Operations It

Holbox

Mar 29, 2025 · 7 min read

Table of Contents

- When The Federal Reserve Conducts Open Market Operations It

- Table of Contents

- When the Federal Reserve Conducts Open Market Operations, It… Impacts the Entire Economy

- What are Open Market Operations?

- Buying Securities (Expansionary Monetary Policy):

- Selling Securities (Contractionary Monetary Policy):

- The Mechanics of OMO and Their Impact on the Money Supply

- The Role of the Federal Open Market Committee (FOMC)

- The Limitations and Challenges of Open Market Operations

- Open Market Operations and Different Economic Sectors

- Impact on Businesses:

- Impact on Consumers:

- Impact on the Housing Market:

- Impact on the Stock Market:

- Conclusion: Navigating the Complexities of Monetary Policy

- Latest Posts

- Latest Posts

- Related Post

When the Federal Reserve Conducts Open Market Operations, It… Impacts the Entire Economy

The Federal Reserve (also known as the Fed), the central bank of the United States, plays a crucial role in managing the nation's economy. One of its most powerful tools is open market operations (OMO). Understanding how these operations work is key to comprehending the intricacies of monetary policy and its far-reaching consequences. When the Federal Reserve conducts open market operations, it directly influences the money supply, interest rates, and ultimately, the overall health of the economy. This article delves deep into the mechanics of open market operations, exploring their impact on various economic sectors and highlighting the complexities involved in their execution.

What are Open Market Operations?

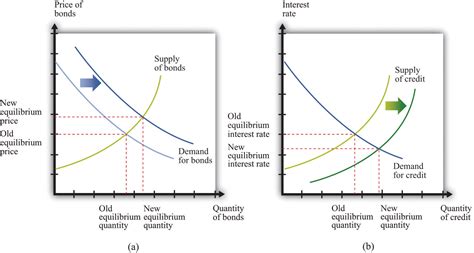

Open market operations involve the buying and selling of U.S. Treasury securities (like bonds) by the Federal Reserve in the secondary market. This seemingly simple act has profound implications for the financial system. The Fed's actions are not random; they are carefully calibrated to achieve specific macroeconomic goals, primarily managing inflation and unemployment.

Buying Securities (Expansionary Monetary Policy):

When the Fed wants to increase the money supply (an expansionary monetary policy), it buys U.S. Treasury securities from commercial banks and other financial institutions. This injection of cash into the banking system increases the reserves available for lending. With more reserves, banks can lend more money to businesses and individuals, increasing the overall money supply and stimulating economic activity. This process is often referred to as quantitative easing (QE) when conducted on a large scale.

Key Effects of Buying Securities:

- Increased Money Supply: More money flows into the economy.

- Lower Interest Rates: Increased money supply leads to lower borrowing costs.

- Increased Investment and Spending: Lower interest rates encourage businesses to invest and consumers to spend.

- Stimulated Economic Growth: Increased investment and spending boost economic activity and employment.

- Potential for Inflation: Increased money supply, without a corresponding increase in goods and services, can lead to inflation.

Selling Securities (Contractionary Monetary Policy):

Conversely, when the Fed wants to decrease the money supply (a contractionary monetary policy), it sells U.S. Treasury securities. This withdraws cash from the banking system, reducing the reserves available for lending. Consequently, banks lend less, reducing the money supply and potentially slowing down economic growth. This action helps to combat inflation.

Key Effects of Selling Securities:

- Decreased Money Supply: Less money circulating in the economy.

- Higher Interest Rates: Reduced money supply leads to higher borrowing costs.

- Decreased Investment and Spending: Higher interest rates discourage investment and spending.

- Slowed Economic Growth: Reduced investment and spending can lead to slower economic growth and potentially higher unemployment.

- Curbed Inflation: Reduced money supply helps to control inflation.

The Mechanics of OMO and Their Impact on the Money Supply

The impact of OMOs on the money supply is not instantaneous but rather a gradual process that unfolds through the banking system's fractional reserve system. Let's break down the chain reaction:

-

The Fed's Action: The Federal Reserve initiates the transaction by either buying or selling securities.

-

Impact on Bank Reserves: When the Fed buys securities, it credits the accounts of the selling banks, increasing their reserves. When the Fed sells securities, it debits the accounts of the buying banks, decreasing their reserves.

-

Money Multiplier Effect: The change in bank reserves triggers the money multiplier effect. This effect amplifies the initial impact of the Fed's actions. The money multiplier depends on the reserve requirement, which is the percentage of deposits banks are required to hold in reserve. For example, if the reserve requirement is 10%, a $100 increase in reserves can potentially lead to a $1000 increase in the money supply ($100 / 0.10 = $1000). This is because banks can lend out the excess reserves, and those loans become deposits in other banks, further expanding the money supply.

-

Interest Rate Adjustments: The changes in the money supply directly impact interest rates. An increased money supply generally lowers interest rates, while a decreased money supply generally raises them.

-

Impact on Borrowing and Investment: Changes in interest rates influence borrowing and investment decisions by businesses and individuals. Lower rates encourage borrowing and investment, while higher rates discourage them.

-

Overall Economic Impact: The combined effects on borrowing, investment, and consumer spending ultimately impact aggregate demand, influencing economic growth, inflation, and employment.

The Role of the Federal Open Market Committee (FOMC)

The Federal Open Market Committee (FOMC) is responsible for making decisions regarding open market operations. This committee meets eight times a year to assess economic conditions and determine the appropriate course of action. The FOMC comprises seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four other Reserve Bank presidents on a rotating basis.

The FOMC's decisions are crucial because they directly influence the direction of monetary policy. Their deliberations involve detailed analysis of various economic indicators, including inflation rates, unemployment levels, GDP growth, and consumer confidence. The committee aims to achieve its mandate of maximum employment and stable prices.

The Limitations and Challenges of Open Market Operations

While open market operations are a powerful tool, they are not without limitations and challenges:

-

Time Lags: The effects of OMOs are not immediate. There is a significant time lag between the Fed's actions and their impact on the economy. This makes it challenging to fine-tune monetary policy precisely.

-

Unpredictability: The economy is a complex system with numerous interacting factors. It's difficult to predict with complete accuracy how the economy will respond to changes in monetary policy implemented through OMOs. Unexpected events, like global crises, can significantly alter the impact of these operations.

-

Liquidity Trap: During severe economic downturns, there might be a liquidity trap where interest rates are already very low, and increasing the money supply through OMOs has little effect on lending and investment. This is because individuals and businesses may prefer to hold cash rather than invest it even at low interest rates.

-

Inflationary Pressures: Excessive expansionary monetary policy can lead to significant inflationary pressures, eroding purchasing power and creating economic instability. This necessitates a careful balancing act by the FOMC.

-

Global Interdependencies: The U.S. economy is deeply intertwined with the global economy. Global economic events and policies can affect the effectiveness of OMOs within the U.S.

Open Market Operations and Different Economic Sectors

The impact of open market operations isn't uniform across all economic sectors. Their effects vary depending on the sector's sensitivity to interest rates and credit availability.

Impact on Businesses:

Businesses rely heavily on credit for investment and expansion. Lower interest rates resulting from expansionary OMOs make borrowing cheaper, stimulating investment and boosting economic activity. Conversely, higher interest rates stemming from contractionary OMOs make borrowing more expensive, potentially hindering investment and slowing down growth. Small businesses are often particularly sensitive to interest rate changes.

Impact on Consumers:

Consumers also benefit from lower interest rates, as they can obtain cheaper loans for mortgages, automobiles, and other purchases. Increased spending fuelled by lower borrowing costs can drive economic growth. Conversely, higher interest rates can reduce consumer spending and dampen economic activity.

Impact on the Housing Market:

The housing market is highly sensitive to interest rates. Lower interest rates make mortgages more affordable, increasing demand and potentially driving up house prices. Conversely, higher interest rates make mortgages more expensive, reducing demand and potentially lowering house prices.

Impact on the Stock Market:

Open market operations can also influence the stock market. Lower interest rates can boost investor confidence and lead to higher stock prices, while higher interest rates can have the opposite effect.

Conclusion: Navigating the Complexities of Monetary Policy

The Federal Reserve's use of open market operations is a complex and crucial aspect of managing the U.S. economy. These operations directly influence the money supply, interest rates, and ultimately, economic activity across various sectors. Understanding the mechanics of OMOs, the role of the FOMC, and their limitations is essential for anyone seeking to grasp the intricacies of monetary policy and its impact on the overall economic landscape. While powerful, OMOs require careful calibration and consideration of potential risks, demonstrating the constant balancing act faced by central bankers in their pursuit of economic stability and growth. The ongoing debate about the effectiveness and potential side effects of these operations highlights the dynamic and ever-evolving nature of monetary policy in a complex and interconnected global economy. Continuous monitoring and adaptation are key to mitigating risks and achieving desired economic outcomes.

Latest Posts

Latest Posts

-

When Using Gloves For Food Handling You Are Required To

Apr 02, 2025

-

What Is The Correct Classification Of The Following Reaction

Apr 02, 2025

-

Refers To A System Under Which The Winning Candidate

Apr 02, 2025

-

A Motor Drives A Pulley And Belt System

Apr 02, 2025

-

Drag The Appropriate Labels To Their Respective Targets Resethelp

Apr 02, 2025

Related Post

Thank you for visiting our website which covers about When The Federal Reserve Conducts Open Market Operations It . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.