When The Consumer Price Index Rises The Typical Family

Holbox

Mar 26, 2025 · 6 min read

Table of Contents

- When The Consumer Price Index Rises The Typical Family

- Table of Contents

- When the Consumer Price Index Rises: The Impact on the Typical Family

- The Direct Impact on Household Budgets

- Rising Food Prices: A Constant Struggle

- Housing Costs: A Major Expense Under Pressure

- Transportation Costs: The Rising Price of Mobility

- Healthcare Expenses: A Growing Concern

- Education Costs: A Heavy Burden on Families

- The Indirect Impact: Lifestyle Changes and Economic Uncertainty

- Reduced Disposable Income: Less Money for Non-Essentials

- Increased Debt: The Cycle of Borrowing

- Psychological Impact: Stress and Anxiety

- Impact on Savings: Erosion of Financial Security

- Impact on Investment Strategies: Protecting Wealth

- Coping Mechanisms and Strategies

- Budgeting and Financial Planning: The Foundation of Stability

- Prioritizing Needs over Wants: Strategic Spending

- Exploring Alternative Options: Saving Money in Daily Life

- Enhancing Income: Additional Revenue Streams

- Communicating Openly: Shared Responsibility

- The Role of Policymakers: Addressing Inflation

- Conclusion: Navigating the Challenges of Inflation

- Latest Posts

- Latest Posts

- Related Post

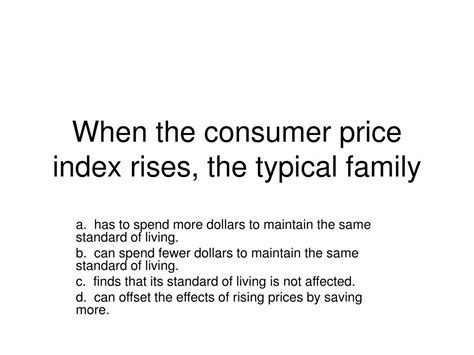

When the Consumer Price Index Rises: The Impact on the Typical Family

The Consumer Price Index (CPI) is a crucial economic indicator that measures the average change in prices paid by urban consumers for a basket of consumer goods and services. When the CPI rises, it signifies inflation – a general increase in the prices of goods and services in an economy over a period of time. This seemingly simple statistic has profound and far-reaching consequences for the typical family, impacting their finances, lifestyle, and overall well-being. Understanding these impacts is crucial for both families navigating rising prices and policymakers striving to maintain economic stability.

The Direct Impact on Household Budgets

A rising CPI directly translates to higher costs for everyday necessities. This immediately impacts the typical family's budget, forcing them to make difficult choices and adjustments.

Rising Food Prices: A Constant Struggle

Food is a fundamental necessity, and its price volatility significantly impacts family budgets. When the CPI increases, the cost of groceries, dining out, and even home-cooked meals rises. Families may find themselves resorting to cheaper, less nutritious options, potentially compromising their health and well-being. This can lead to increased stress and anxiety, particularly for low-income families who may already struggle to afford nutritious food. Budgeting for groceries becomes a meticulous exercise, requiring careful planning and often, sacrificing other expenses.

Housing Costs: A Major Expense Under Pressure

Housing, whether renting or owning, constitutes a substantial portion of most family budgets. A rise in the CPI often brings with it increased rent, mortgage payments, property taxes, and homeowners insurance. This can significantly strain household finances, particularly for those already struggling to make ends meet. Families may be forced to downsize, relocate to less desirable areas, or compromise on the quality of their housing. The emotional toll of housing insecurity adds to the financial burden.

Transportation Costs: The Rising Price of Mobility

Transportation costs are another significant expense affected by inflation. Increased fuel prices, public transportation fares, and vehicle maintenance directly impact family budgets. Families may need to reduce their driving, carpool more frequently, or explore alternative transportation options, potentially impacting their work commutes and overall lifestyle. The added time and inconvenience associated with these changes further exacerbate the stress caused by rising prices.

Healthcare Expenses: A Growing Concern

Healthcare costs are notoriously volatile and often rise disproportionately to other goods and services. A rising CPI often leads to higher medical bills, insurance premiums, and prescription drug costs. Families may find themselves delaying or forgoing necessary medical care due to the expense. This can have serious long-term health consequences, resulting in higher healthcare costs in the future and negatively impacting the family's overall well-being.

Education Costs: A Heavy Burden on Families

The cost of education, from childcare to higher education, is a significant expense for many families. Inflation can lead to increased tuition fees, childcare costs, and educational materials, placing a substantial burden on family budgets. Families may have to make difficult choices about their children's education, potentially impacting their future opportunities.

The Indirect Impact: Lifestyle Changes and Economic Uncertainty

Beyond the direct impact on household budgets, a rising CPI has several indirect consequences for the typical family.

Reduced Disposable Income: Less Money for Non-Essentials

When the cost of necessities increases, families have less disposable income for non-essential expenses such as entertainment, travel, and leisure activities. This can lead to a decrease in quality of life and a sense of financial strain. Families may need to curtail their social activities, postpone vacations, or forgo other enjoyable experiences.

Increased Debt: The Cycle of Borrowing

To cope with rising prices, some families may resort to borrowing money through credit cards or loans. This can lead to a cycle of debt, making it harder to manage finances and increasing financial stress. The interest payments on debt further reduce disposable income, exacerbating the financial burden.

Psychological Impact: Stress and Anxiety

The constant pressure of rising prices can lead to increased stress and anxiety within families. Financial insecurity can strain relationships, impact mental health, and negatively affect overall well-being. The uncertainty of the future can be particularly challenging, especially for families with limited financial resources.

Impact on Savings: Erosion of Financial Security

Inflation erodes the value of savings. When the CPI rises, the purchasing power of savings decreases, making it harder for families to achieve their financial goals, such as saving for retirement or a down payment on a house. This can lead to feelings of insecurity and frustration, as families struggle to maintain their financial stability.

Impact on Investment Strategies: Protecting Wealth

Rising inflation often compels families to re-evaluate their investment strategies. Traditional savings accounts may not keep pace with inflation, so families may need to explore alternative investment options, such as stocks, bonds, or real estate, to protect their wealth and maintain purchasing power. However, these investments carry their own risks and complexities, requiring careful consideration and potentially professional advice.

Coping Mechanisms and Strategies

While a rising CPI presents challenges, families can employ various strategies to mitigate its impact:

Budgeting and Financial Planning: The Foundation of Stability

Creating a detailed budget and adhering to it is crucial. Tracking expenses, identifying areas for savings, and setting realistic financial goals can help families manage their finances effectively, even during inflationary periods. Seeking professional financial advice can provide valuable guidance and personalized strategies.

Prioritizing Needs over Wants: Strategic Spending

Differentiating between needs and wants is vital. Families can significantly reduce expenses by prioritizing essential expenditures and cutting back on non-essentials. This requires careful planning and a willingness to make adjustments to their lifestyle.

Exploring Alternative Options: Saving Money in Daily Life

Families can explore alternative options to reduce their spending, such as buying generic brands, cooking at home more often, utilizing public transportation, or seeking discounts and coupons. These small changes can accumulate into significant savings over time.

Enhancing Income: Additional Revenue Streams

Supplementing income through part-time jobs, freelance work, or other income-generating activities can help families cope with rising prices. Developing new skills and exploring entrepreneurial opportunities can provide additional financial security.

Communicating Openly: Shared Responsibility

Open communication within the family about financial challenges and the need for adjustments is crucial. Sharing responsibilities and collaboratively seeking solutions can foster a sense of unity and resilience during difficult times.

The Role of Policymakers: Addressing Inflation

While families can take steps to mitigate the impact of inflation, policymakers play a vital role in addressing the root causes of rising prices and maintaining economic stability. Central banks often employ monetary policies, such as adjusting interest rates, to control inflation. Fiscal policies, such as government spending and taxation, can also play a role in managing economic growth and controlling inflation. Effective policies require a comprehensive understanding of economic factors and their impact on families. Furthermore, transparent communication about economic conditions and policy decisions is vital to build public trust and confidence.

Conclusion: Navigating the Challenges of Inflation

A rising CPI presents significant challenges for the typical family. The direct impact on household budgets, coupled with indirect consequences on lifestyle and well-being, demands careful attention and proactive strategies. By understanding the mechanisms through which inflation affects their finances, families can develop effective coping strategies to navigate these challenging times. Simultaneously, policymakers play a critical role in employing effective economic policies to control inflation and ensure economic stability for all families. The interplay between individual household management and broader economic policy is crucial in mitigating the negative impact of inflation and building a more resilient and financially secure society.

Latest Posts

Latest Posts

-

The Radical Below Can Be Stabilized By Resonance

Mar 30, 2025

-

Pre Lab Exercise 23 2 Defining Pulmonary Volumes And Capacities

Mar 30, 2025

-

Overapplied Manufacturing Overhead Would Result If

Mar 30, 2025

-

What Is Each Compounds Systematic Name

Mar 30, 2025

-

Annealing Is A Process By Which Steel Is Reheated

Mar 30, 2025

Related Post

Thank you for visiting our website which covers about When The Consumer Price Index Rises The Typical Family . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.