Overapplied Manufacturing Overhead Would Result If

Holbox

Mar 17, 2025 · 6 min read

Table of Contents

Overapplied Manufacturing Overhead: Causes, Consequences, and Corrections

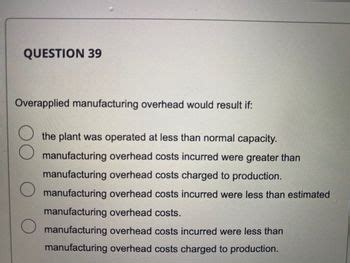

Overapplied manufacturing overhead occurs when the actual manufacturing overhead costs are less than the applied manufacturing overhead costs. In simpler terms, your business spent less on overhead than it anticipated. While this might sound positive at first glance, it signifies a potential problem in your costing system and can lead to inaccurate financial reporting and flawed decision-making. This article delves deep into the reasons behind overapplied manufacturing overhead, its implications, and the methods to rectify this situation.

Understanding Manufacturing Overhead

Before diving into the causes of overapplied manufacturing overhead, let's clarify what manufacturing overhead entails. Manufacturing overhead encompasses all indirect costs associated with the production process. These costs are not directly traceable to specific products but are essential for the manufacturing operation. Examples include:

- Indirect Labor: Salaries of supervisors, maintenance personnel, and quality control inspectors.

- Factory Rent: Cost of leasing or owning the factory space.

- Utilities: Electricity, gas, and water used in the factory.

- Depreciation: Depreciation of factory equipment and machinery.

- Factory Supplies: Consumables like lubricants, cleaning materials, and small tools.

- Insurance: Insurance premiums covering the factory and equipment.

- Property Taxes: Taxes levied on the factory property.

The Mechanics of Applying Overhead

Companies use predetermined overhead rates to allocate manufacturing overhead costs to products. This rate is calculated at the beginning of the accounting period (usually annually) based on estimated overhead costs and a chosen allocation base (e.g., direct labor hours, machine hours, or direct materials cost). The formula is:

Predetermined Overhead Rate = Estimated Total Manufacturing Overhead Costs / Estimated Total Allocation Base

During the production process, this predetermined rate is then multiplied by the actual allocation base used for each product to determine the applied overhead. For instance, if the predetermined overhead rate is $10 per direct labor hour and a product requires 5 direct labor hours, the applied overhead for that product would be $50.

Causes of Overapplied Manufacturing Overhead

Several factors can contribute to overapplying manufacturing overhead:

1. Inaccurate Estimation of Overhead Costs:

- Underestimation of Indirect Costs: This is the most common cause. If the initial estimate of total manufacturing overhead costs was too low, the resulting predetermined overhead rate will also be low. This means less overhead is applied to products than what was actually incurred. This could stem from unforeseen maintenance costs, increased utility bills, or inaccurate projections of indirect labor expenses.

- Unforeseen Events: Unexpected events like natural disasters, equipment breakdowns requiring extensive repairs, or significant changes in regulatory compliance can dramatically increase overhead costs beyond initial projections.

2. Inaccurate Estimation of the Allocation Base:

- Underestimation of Activity Levels: If the estimated allocation base (e.g., direct labor hours) is lower than the actual activity level, the predetermined overhead rate will be inflated. While the total overhead might be accurate, the application will be higher than actual due to increased activity.

- Changes in Production Methods: If the company implements new technologies or production processes that significantly alter the allocation base, the original overhead rate might become inaccurate, leading to overapplication.

3. Efficient Production and Cost Control:

Ironically, efficient operations can also result in overapplied overhead. If the company manages its indirect costs exceptionally well, resulting in lower-than-expected actual overhead, it leads to an overapplication of overhead even if the predetermined rate was correctly calculated. This is a favorable situation, but it still requires investigation and adjustment.

4. Seasonal Fluctuations:

Businesses with seasonal production cycles may experience fluctuations in overhead costs throughout the year. If the predetermined overhead rate is based on an average across the entire year, and a particular period involves lower-than-average overhead, it could result in overapplication during that specific period.

Consequences of Overapplied Manufacturing Overhead

While seemingly positive, overapplied overhead can have several negative consequences:

- Inflated Product Costs: If the overhead is not adjusted, the cost of goods sold will be overstated, potentially leading to inaccurate pricing strategies and reduced profitability.

- Distorted Financial Statements: Overapplied overhead distorts the income statement and balance sheet, hindering accurate financial analysis and reporting. This can affect key performance indicators (KPIs) and investor confidence.

- Poor Decision-Making: Misleading cost data can lead to poor decision-making regarding pricing, product mix, and investment in new projects. Managers may underestimate the true cost of production and make incorrect assumptions about profitability.

- Inventory Valuation Issues: The cost of inventory is affected, impacting the calculation of cost of goods sold and ultimately, the net income.

Correcting Overapplied Manufacturing Overhead

The most common approach to correcting overapplied manufacturing overhead is to adjust the cost of goods sold (COGS) at the end of the accounting period. This is done through a journal entry that credits the manufacturing overhead account and debits the cost of goods sold account. This adjustment reflects the accurate cost of goods sold.

The journal entry looks like this:

Debit: Cost of Goods Sold

Credit: Manufacturing Overhead

The amount of the debit and credit is equal to the amount of the overapplied overhead.

Other approaches include:

- Pro-rata allocation: Distribute the overapplied overhead proportionally to the work-in-progress (WIP) inventory, finished goods inventory, and cost of goods sold. This is more complex but provides a more accurate reflection of the cost allocation.

- Writing off to cost of goods sold: This is a simpler approach and often preferred if the overapplied amount is immaterial.

The best method to correct overapplied overhead depends on the materiality of the amount and the company's accounting policies.

Preventing Overapplied Manufacturing Overhead

Preventing overapplied overhead requires careful planning and control throughout the accounting period. Here are some preventative measures:

- Accurate Cost Estimation: Employ thorough research and data analysis to estimate manufacturing overhead costs accurately. Consider historical data, industry benchmarks, and expert opinions to create a realistic estimate.

- Regular Monitoring and Variance Analysis: Continuously monitor actual overhead costs throughout the year and conduct regular variance analysis to identify and address deviations from the budget promptly. This involves comparing actual costs to budgeted costs and investigating the root causes of any significant discrepancies.

- Refine the Allocation Base: Ensure the chosen allocation base accurately reflects the consumption of overhead resources. If the production process changes, reassess the suitability of the existing allocation base and adjust accordingly.

- Effective Cost Control Measures: Implement cost-saving measures to manage indirect costs effectively. This could involve negotiating better rates with suppliers, improving energy efficiency, and optimizing maintenance schedules.

- Improved Budgeting and Forecasting: Utilize sophisticated budgeting and forecasting techniques to improve the accuracy of overhead cost predictions. This might include incorporating flexible budgeting models that adapt to changes in production volume and activity levels.

- Regular Review of Predetermined Overhead Rate: Periodically review the predetermined overhead rate to ensure it continues to accurately reflect the relationship between overhead costs and the allocation base. Consider adjusting the rate mid-year if significant changes occur.

Conclusion

Overapplied manufacturing overhead, although seemingly beneficial, signals potential inaccuracies in cost accounting. By understanding the underlying causes, implementing robust cost control mechanisms, and employing appropriate correction methods, businesses can maintain the integrity of their financial statements, make sound decisions, and achieve a more accurate reflection of their profitability. Proactive monitoring and continuous improvement in cost estimation and allocation are key to preventing future overapplication and ensuring a healthy financial position. Remember, accurate cost accounting is the foundation of sound business management.

Latest Posts

Latest Posts

-

The Heritability Of Intelligence Refers To

Mar 17, 2025

-

Which Storage Device Uses Aluminum Platters For Storing Data

Mar 17, 2025

-

Pal Cadaver Axial Skeleton Skull Lab Practical Question 11

Mar 17, 2025

-

A Backup Of Sewage In The Operations Dry Storage Area

Mar 17, 2025

-

An Air Filled Parallel Plate Capacitor

Mar 17, 2025

Related Post

Thank you for visiting our website which covers about Overapplied Manufacturing Overhead Would Result If . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.