When Should Supplies Be Recorded As An Expense

Holbox

Mar 15, 2025 · 6 min read

Table of Contents

When Should Supplies Be Recorded as an Expense?

Understanding when to record supplies as an expense is crucial for accurate financial reporting and maintaining healthy business finances. Many businesses use supplies daily, from office stationery to manufacturing components. Misclassifying these items can lead to inaccurate financial statements, impacting your tax obligations and potentially misleading investors. This comprehensive guide will delve into the intricacies of supply expense recognition, covering various accounting methods, practical examples, and best practices to ensure your financial records are accurate and compliant.

The Basics of Supply Expense Recognition

Supplies are assets until they are used. This means they are initially recorded on the balance sheet as current assets. Once consumed or used in the normal course of business operations, they are expensed on the income statement. This transition from asset to expense is a key accounting principle. The timing of this transition is what this article focuses on.

The Matching Principle

The core principle guiding this process is the matching principle. This principle dictates that expenses should be recognized in the same accounting period as the revenues they help generate. If supplies directly contribute to generating revenue during a specific period, their expense should be recorded within that same period.

The Materiality Principle

The materiality principle also plays a role. For insignificant amounts of supplies, the expense recognition might be simplified, perhaps expensing the entire purchase immediately. However, for substantial purchases, a more precise method is crucial to avoid distorting the financial picture.

Methods for Recording Supply Expenses

Several methods exist for recording supply expenses, each with its advantages and disadvantages. The best method depends on factors like the type of business, the volume of supplies used, and the desired level of accuracy.

1. The Periodic Inventory System

This method involves physically counting supplies on hand at the end of each accounting period. The difference between the beginning inventory and the ending inventory, plus any purchases during the period, represents the supplies used (and therefore expensed) during that period.

Example:

- Beginning Inventory: $500

- Purchases during the period: $1000

- Ending Inventory: $300

- Supplies Expense: $500 + $1000 - $300 = $1200

Advantages:

- Simple to understand and implement.

- Relatively inexpensive to maintain.

Disadvantages:

- Requires a physical inventory count, which can be time-consuming and prone to errors.

- Doesn't provide real-time information on supply usage.

- Less accurate than perpetual inventory.

2. The Perpetual Inventory System

This method continuously tracks the purchase and use of supplies. Every time supplies are purchased, the inventory account is increased. When supplies are used, the inventory account is decreased, and the expense account is increased. This provides a real-time view of inventory levels and supply expenses.

Example:

- Purchase of $500 worth of supplies: Inventory increases by $500.

- Use of $200 worth of supplies: Inventory decreases by $200, Supplies Expense increases by $200.

Advantages:

- Provides real-time information on inventory levels and supply usage.

- More accurate than the periodic inventory system.

- Reduces the need for extensive year-end physical inventory counts.

Disadvantages:

- Requires more sophisticated accounting software and processes.

- Can be more expensive to implement and maintain.

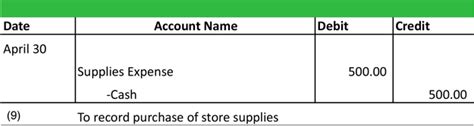

3. Expense at the Time of Purchase (for immaterial amounts)

For businesses with minimal supply usage or where the value of supplies is insignificant, it's acceptable to expense the entire cost of supplies at the time of purchase. This simplifies record-keeping, but accuracy suffers. This method should only be used when the materiality principle justifies it.

Example: A small office buys a box of staples for $5. The $5 is immediately recorded as a supplies expense.

Advantages:

- Simple and easy to implement.

Disadvantages:

- Less accurate, potentially distorting the financial statements if the total of immaterial supplies is significant across the period.

- Does not adhere strictly to the matching principle.

Factors Influencing the Choice of Method

The best method for recording supply expenses depends on various factors:

- Size and complexity of the business: Larger businesses with significant inventory often use perpetual inventory systems for better control and accuracy. Smaller businesses might find the periodic system sufficient.

- Type of supplies: The nature of the supplies influences the choice of method. High-value supplies would likely necessitate a perpetual system to track them effectively.

- Cost of implementation and maintenance: Perpetual systems demand more resources in terms of software, training, and staff time.

- Accuracy requirements: Businesses with stringent accuracy requirements should opt for perpetual systems, while those with less stringent needs may find periodic systems suitable.

Practical Examples and Case Studies

Let's consider some practical scenarios to illustrate the application of these methods:

Scenario 1: A small bakery using the periodic system. The bakery performs a physical inventory count of flour, sugar, and other baking supplies at the end of each month. The difference between the beginning and ending inventory, adjusted for purchases, is recorded as the supplies expense for that month.

Scenario 2: A large manufacturing company using the perpetual system. The company uses a sophisticated inventory management system that tracks each supply item in real-time. As supplies are used in the production process, the system automatically updates inventory levels and records the expense. This provides continuous monitoring of supply costs.

Scenario 3: A freelance graphic designer using the expense-at-purchase method. The designer buys a small pack of printer ink for $10. The $10 is recorded as an expense immediately as the value is considered immaterial.

Best Practices for Accurate Supply Expense Recording

- Regular inventory counts: Regardless of the method used, regular inventory checks are crucial to ensure accuracy and detect any discrepancies.

- Proper documentation: Maintain detailed records of all supply purchases and usage.

- Effective inventory management system: Implement a system (manual or automated) to track inventory effectively.

- Regular reconciliation: Periodically reconcile inventory records with physical counts to identify and correct any errors.

- Appropriate accounting software: Use accounting software designed to handle inventory and expenses efficiently.

Tax Implications of Supply Expense Recognition

Accurate supply expense recording is vital for tax purposes. The Internal Revenue Service (IRS) requires businesses to follow generally accepted accounting principles (GAAP) when recording expenses. Misclassifying supplies can lead to penalties and adjustments to your tax liabilities.

Conclusion: Choosing the Right Method for Your Business

Selecting the right method for recording supply expenses is a crucial decision for any business. The ideal approach depends on the factors outlined above. By carefully considering these factors and implementing best practices, businesses can ensure accurate financial reporting, streamline their operations, and maintain compliance with tax regulations. Remember, consistency is key. Once a method is chosen, it should be consistently applied for accurate and reliable financial data. If you're unsure about the best approach for your business, consulting with a qualified accountant is strongly recommended. They can provide tailored advice based on your specific circumstances and ensure your financial records are accurate and compliant.

Latest Posts

Latest Posts

-

Measured Progress Maryland Mathematics Performance Task Unstructured Answers

Mar 15, 2025

-

Lysosomes Are Membrane Bound Vesicles That Arise From The

Mar 15, 2025

-

What Intoxications Signs Is John Showing

Mar 15, 2025

-

Common Mistakes Made When Managing Current Cash Needs Include

Mar 15, 2025

-

The Amount Of Current Assets Minus Current Liabilities Is Called

Mar 15, 2025

Related Post

Thank you for visiting our website which covers about When Should Supplies Be Recorded As An Expense . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.