What Is The Deadweight Loss Associated With The Price Floor

Holbox

Mar 24, 2025 · 6 min read

Table of Contents

- What Is The Deadweight Loss Associated With The Price Floor

- Table of Contents

- What is the Deadweight Loss Associated with a Price Floor?

- Understanding Deadweight Loss

- How Price Floors Create Deadweight Loss

- Graphical Representation of Deadweight Loss from a Price Floor

- Factors Influencing the Magnitude of Deadweight Loss

- Examples of Price Floors and Their Associated Deadweight Loss

- Policy Implications and Alternatives

- Conclusion

- Latest Posts

- Latest Posts

- Related Post

What is the Deadweight Loss Associated with a Price Floor?

A price floor, a government-mandated minimum price for a good or service, is often implemented with the intention of protecting producers or ensuring a minimum income for workers. While seemingly beneficial, price floors frequently lead to an inefficient allocation of resources, resulting in a significant economic loss known as deadweight loss. This article delves deep into understanding what deadweight loss is, how it arises from a price floor, its implications, and factors influencing its magnitude.

Understanding Deadweight Loss

Deadweight loss, in simple terms, represents the loss of economic efficiency that can occur when equilibrium for a good or service is not achieved or is not Pareto efficient. It’s the reduction in social surplus – the sum of consumer surplus and producer surplus – that arises from market distortions like price floors, price ceilings, or taxes. Essentially, it’s the potential gains from trade that go unrealized because the market isn't operating at its most efficient point. Think of it as value that could have been created but is now lost due to government intervention.

Consumer Surplus: This represents the difference between the maximum price a consumer is willing to pay and the actual price they pay. A higher consumer surplus indicates greater satisfaction for buyers.

Producer Surplus: This reflects the difference between the minimum price a producer is willing to accept and the actual price they receive. A higher producer surplus means greater profit for sellers.

In a perfectly competitive market, without government interference, the forces of supply and demand interact to determine the equilibrium price and quantity, maximizing both consumer and producer surplus. However, a price floor disrupts this equilibrium, creating a deadweight loss.

How Price Floors Create Deadweight Loss

A price floor, set above the equilibrium price, creates a surplus of the good or service. This is because:

-

Higher Price: The mandated minimum price increases the price consumers pay. Some consumers, unwilling or unable to pay the higher price, exit the market. Their demand is unmet.

-

Reduced Demand: The higher price leads to a decrease in the quantity demanded. Fewer consumers are willing to purchase the good or service at the artificially inflated price.

-

Increased Supply: Producers, incentivized by the higher price floor, attempt to supply more of the good or service. However, this increased supply exceeds the reduced demand.

-

Surplus: The excess supply, representing the difference between the quantity supplied and the quantity demanded at the price floor, accumulates. This surplus can lead to spoilage, waste, or increased storage costs for producers.

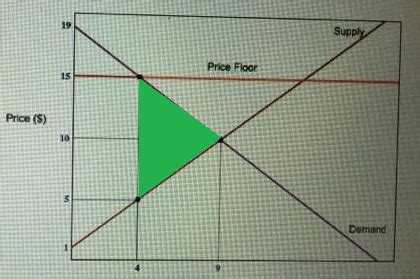

This combination of reduced demand and increased supply results in a gap between the quantity supplied and the quantity demanded at the price floor, visually represented by a triangle-shaped area on a supply and demand graph. This triangle represents the deadweight loss. It's the loss of potential gains from trade – transactions that would have benefited both buyers and sellers at a price below the floor but are now prevented due to the government intervention.

Graphical Representation of Deadweight Loss from a Price Floor

A standard supply and demand graph can clearly illustrate the deadweight loss resulting from a price floor:

-

Equilibrium: Start by identifying the equilibrium price (Pe) and equilibrium quantity (Qe) where the supply and demand curves intersect.

-

Price Floor: Draw a horizontal line representing the price floor (Pf) above the equilibrium price.

-

Quantity Demanded and Supplied: At the price floor (Pf), find the quantity demanded (Qd) on the demand curve and the quantity supplied (Qs) on the supply curve. Note that Qs > Qd.

-

Deadweight Loss Triangle: The deadweight loss is represented by the triangle formed by the supply curve, the demand curve, and the vertical line at the quantity demanded (Qd). This triangle visually represents the lost consumer and producer surplus due to the price floor.

Factors Influencing the Magnitude of Deadweight Loss

Several factors influence the size of the deadweight loss triangle associated with a price floor:

-

Elasticity of Demand and Supply: The steeper (less elastic) the demand curve, the smaller the deadweight loss. Similarly, a steeper (less elastic) supply curve also leads to a smaller deadweight loss. Conversely, highly elastic demand and supply curves result in a larger deadweight loss. Highly elastic markets respond more drastically to price changes.

-

Magnitude of the Price Floor: The higher the price floor above the equilibrium price, the larger the deadweight loss. A small price floor may have minimal impact, whereas a large price floor drastically reduces market transactions.

-

Market Size: Larger markets generally experience larger deadweight losses from price floors because a larger number of transactions are affected.

Examples of Price Floors and Their Associated Deadweight Loss

Several real-world examples illustrate the impact of price floors and associated deadweight loss:

-

Minimum Wage: Minimum wage laws aim to ensure a minimum standard of living for workers. However, a minimum wage set above the equilibrium wage can lead to unemployment, especially for low-skilled workers, resulting in deadweight loss. Businesses may reduce hiring or substitute labor with capital to avoid paying the higher wage.

-

Agricultural Price Supports: Governments often implement price floors for agricultural products to protect farmers' incomes. This can lead to surpluses of agricultural products, necessitating government intervention to buy up and store the excess, creating a deadweight loss. This can also distort the market, leading to inefficiencies in resource allocation.

-

Rent Control: Rent control is a type of price ceiling, but the same principles of deadweight loss apply. Setting rents below the equilibrium level can create shortages of rental housing, leading to a loss of consumer and producer surplus. While not technically a price floor, it shares similar consequences.

Policy Implications and Alternatives

The existence of deadweight loss from price floors highlights the importance of carefully considering the costs and benefits of government intervention. While price floors might offer short-term benefits to specific groups (e.g., workers or producers), they often impose significant long-term economic costs on society as a whole.

Alternatives to price floors should be explored to address the underlying problems they aim to solve:

-

Direct Income Support: Instead of price floors, governments could provide direct income support to vulnerable groups through subsidies or other social programs. This targeted approach can achieve the desired social goals without creating the market distortions associated with price floors.

-

Training and Education: Addressing skill gaps through better education and training programs could improve the earning capacity of low-skilled workers, reducing the need for a minimum wage hike to maintain a living wage.

-

Investing in Infrastructure: Improvements in infrastructure and technology can boost productivity, leading to higher wages and a better standard of living without requiring artificial price floors.

Conclusion

Deadweight loss stemming from price floors presents a significant economic challenge. While often intended to protect producers or consumers, these policies ultimately reduce overall economic efficiency. The magnitude of the deadweight loss depends on the elasticity of supply and demand and the extent to which the price floor exceeds the equilibrium price. Understanding the implications of deadweight loss is crucial for policy-makers considering price floor interventions. Exploring alternative policies that address the same social goals without generating these inefficiencies is essential for achieving more sustainable and equitable economic outcomes. By considering the intricacies of deadweight loss, we can foster more efficient and prosperous markets for everyone.

Latest Posts

Latest Posts

-

The Conceptual Frameworks Qualitative Characteristic Of Relevance Includes

Mar 27, 2025

-

Indicate Whether The Following Statements Are True Or False

Mar 27, 2025

-

Sb 1577 Exempts A Business Entity From Licensure

Mar 27, 2025

-

Art Labeling Activity Anatomy And Histology Of The Adrenal Gland

Mar 27, 2025

-

Received Customer Purchase Order No 37225

Mar 27, 2025

Related Post

Thank you for visiting our website which covers about What Is The Deadweight Loss Associated With The Price Floor . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.