The Conceptual Framework's Qualitative Characteristic Of Relevance Includes

Holbox

Mar 27, 2025 · 7 min read

Table of Contents

- The Conceptual Framework's Qualitative Characteristic Of Relevance Includes

- Table of Contents

- The Conceptual Framework's Qualitative Characteristic of Relevance: A Deep Dive

- Understanding Relevance in Financial Reporting

- Materiality: The Threshold of Relevance

- Predictive Value and Confirmatory Value: The Two Pillars of Relevance

- The Interaction of Relevance with Other Qualitative Characteristics

- Relevance and the Different Types of Users

- Enhancing Relevance in Financial Reporting Practices

- Challenges in Applying the Concept of Relevance

- Conclusion

- Latest Posts

- Latest Posts

- Related Post

The Conceptual Framework's Qualitative Characteristic of Relevance: A Deep Dive

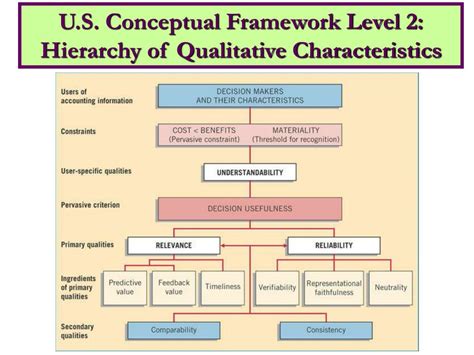

The conceptual framework underpinning financial reporting is built on a foundation of qualitative characteristics that dictate the usefulness of financial information. Of these, relevance stands out as paramount. Information is only useful if it impacts users' decisions; relevance is the bridge between financial data and informed action. This article delves deep into the qualitative characteristic of relevance, exploring its facets, implications, and practical applications within the context of financial reporting.

Understanding Relevance in Financial Reporting

Relevance, in the context of financial reporting, means that the information presented must be capable of making a difference in the decisions made by users. This seemingly simple definition encompasses a multifaceted concept with significant implications for financial statement preparation and analysis. Financial information that is not relevant is essentially useless, as it fails to provide insights that influence economic choices.

Materiality: The Threshold of Relevance

A crucial aspect of relevance is materiality. An item is considered material if omitting or misstating it could reasonably influence the decisions of users. The determination of materiality is inherently subjective and depends on the specific context of the entity and its users. A small amount might be material for a small company, while a large amount might be immaterial for a multinational corporation. The assessment of materiality requires professional judgment and a thorough understanding of the user's perspective.

Factors influencing materiality judgments include:

- The size of the item relative to the entity's overall financial position. A large misstatement in a small company’s assets is more material than a similar misstatement in a large company’s assets.

- The nature of the item. Certain types of items, such as fraud, might be material even if their monetary value is relatively small.

- The potential impact on users' decisions. An item that could significantly impact a user's investment decision would be considered material.

Professional judgment is key to determining materiality. Accounting standards provide guidance, but ultimately, the preparers of financial statements must exercise professional judgment in considering all relevant factors.

Predictive Value and Confirmatory Value: The Two Pillars of Relevance

Relevance is further broken down into two key components: predictive value and confirmatory value.

-

Predictive value refers to the ability of information to help users predict future outcomes. For example, historical sales data can help predict future sales, impacting investment decisions.

-

Confirmatory value refers to the ability of information to confirm or correct prior expectations. For instance, reported earnings can confirm or refute prior expectations about a company's performance, thus influencing investors' assessments.

Both predictive and confirmatory value are essential aspects of relevance. Information lacking either is less useful and consequently less relevant. Effective financial reporting strives to provide information that possesses both these attributes, enhancing its overall utility to users.

The Interaction of Relevance with Other Qualitative Characteristics

While relevance is a critical qualitative characteristic, it doesn't exist in isolation. It interacts and often intertwines with other characteristics to provide a more comprehensive and useful picture. The most significant interactions are with:

-

Faithful representation: Relevant information must also be faithfully represented. Information might be relevant but misleading if it is not presented accurately and completely. For example, relevant sales figures would be useless if they are intentionally manipulated. The interplay between relevance and faithful representation ensures that users receive accurate and pertinent information.

-

Understandability: Relevant information must also be understandable to users. Highly relevant data presented in an obscure or complex manner loses its usefulness. Effective communication is vital to ensure the relevance of information translates into actionable insights. The presentation style must align with the users’ knowledge and skills, balancing complexity and clarity.

-

Comparability: Relevant information should be comparable across different entities and over different periods. This comparability allows users to identify trends, assess performance relative to competitors, and make informed decisions. Consistency in accounting policies significantly enhances comparability, and therefore contributes to the overall relevance of the reported information.

-

Timeliness: Relevance is also intertwined with timeliness. The sooner the information is available, the more relevant it becomes, particularly in dynamic market conditions. Delayed information might be accurate but no longer relevant for immediate decision-making. Therefore, financial reporting strives for a balance between accuracy and timely dissemination of information.

Relevance and the Different Types of Users

The relevance of financial information is heavily dependent on the user's needs and objectives. Different users of financial statements have different information requirements. This necessitates a balanced approach that addresses the needs of a broad range of stakeholders.

Investors: Need information to assess the entity’s profitability, solvency, and liquidity to make informed investment decisions. Key metrics include earnings per share, return on equity, debt-to-equity ratios, and cash flow statements.

Creditors: Focus on the entity's ability to repay debts. Information concerning debt levels, interest coverage ratios, and cash flows is crucial for their assessments. Predictive value related to future cash flows is particularly relevant to creditors.

Employees: Concerned about job security and future compensation. Information regarding the entity's financial health, its ability to continue operating, and its potential for growth directly impacts employee concerns.

Government and regulatory agencies: Require information for tax purposes, regulation compliance, and monitoring the economy. Relevant information here often pertains to compliance with legal requirements and industry regulations.

Enhancing Relevance in Financial Reporting Practices

Several strategies can enhance the relevance of financial information:

-

Focus on forward-looking information: Incorporating projections, forecasts, and management commentary provides users with insights into the future prospects of the entity, significantly enhancing the predictive value of financial reports.

-

Segment reporting: Breaking down financial information into segments allows users to focus on specific aspects of the business, improving the relevance of information for specific investment decisions.

-

Non-financial performance indicators: Including non-financial performance indicators (e.g., customer satisfaction, employee turnover) alongside traditional financial metrics presents a more holistic view of the entity's performance and increases overall relevance for users.

-

Improved disclosures: Clear, concise, and comprehensive disclosures help users interpret financial information correctly, increasing its relevance and utility. Explanatory notes should clarify potentially ambiguous information and provide context for decision-making.

-

Interactive data: Providing financial information in an interactive and readily accessible format, such as through online platforms and data analytics tools, enables users to customize and analyze data according to their specific needs, enhancing relevance and engagement.

Challenges in Applying the Concept of Relevance

Despite the importance of relevance, applying the concept in practice presents several challenges:

-

Subjectivity in materiality judgments: Determining materiality requires significant professional judgment and is prone to subjectivity. Different accountants may reach different conclusions regarding the materiality of a particular item.

-

Balancing relevance and reliability: There's often a trade-off between relevance and reliability. Forward-looking information, while highly relevant, is inherently less reliable than historical data. The challenge lies in finding the optimal balance between the two characteristics.

-

User diversity: The needs and expectations of diverse users can be significantly different. Striking a balance that caters to all users' information needs is a significant challenge for financial reporting.

-

Information overload: The sheer volume of financial information available can be overwhelming for users. Financial reporting must strive to provide information that is both relevant and efficiently communicated to prevent information overload.

Conclusion

Relevance is a cornerstone of high-quality financial reporting. Its dual components – predictive and confirmatory value – empower users to make informed decisions. Materiality provides the threshold for identifying information worthy of consideration. While challenges exist in applying the concept of relevance in practice, continued efforts to enhance transparency, improve disclosures, and incorporate user perspectives will lead to more meaningful and impactful financial reporting. The ongoing evolution of accounting standards and the use of technology offers opportunities to enhance relevance, ultimately fostering greater trust and confidence in financial information. The pursuit of greater relevance is an ongoing process that demands continuous innovation and thoughtful consideration of the evolving needs of financial statement users.

Latest Posts

Latest Posts

-

Socialization As A Sociological Term Describes

Mar 31, 2025

-

The Federal Government Taxes Which Of The Following

Mar 31, 2025

-

The Outward Stock Of Foreign Direct Investment Refers To

Mar 31, 2025

-

What Is The Major Product Of This Reaction

Mar 31, 2025

-

Which Of The Following Describes The Yerkes Dodson Law

Mar 31, 2025

Related Post

Thank you for visiting our website which covers about The Conceptual Framework's Qualitative Characteristic Of Relevance Includes . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.