Use The Future Value Formula To Find The Indicated Value

Holbox

Mar 29, 2025 · 6 min read

Table of Contents

- Use The Future Value Formula To Find The Indicated Value

- Table of Contents

- Use the Future Value Formula to Find the Indicated Value

- Understanding the Future Value Formula

- Deciphering the Components

- Variations of the Future Value Formula

- Future Value of an Annuity

- Future Value of an Annuity Due

- Future Value with Continuous Compounding

- Illustrative Examples: Applying the Future Value Formula

- Addressing Common Challenges

- Advanced Applications and Considerations

- Conclusion: Mastering the Future Value Formula

- Latest Posts

- Latest Posts

- Related Post

Use the Future Value Formula to Find the Indicated Value

The future value (FV) formula is a cornerstone of financial mathematics, allowing us to determine the worth of an asset at a specified date in the future, given a certain rate of return. Understanding and applying this formula is crucial for various financial decisions, from retirement planning to investment analysis. This comprehensive guide will delve into the FV formula, explore its variations, illustrate its application through diverse examples, and address common challenges encountered during calculations.

Understanding the Future Value Formula

The basic future value formula calculates the future worth of a single lump-sum investment. It considers the present value (PV), the interest rate (r), and the number of periods (n). The formula is:

FV = PV (1 + r)^n

Where:

- FV represents the future value of the investment.

- PV represents the present value or initial investment.

- r represents the interest rate per period (expressed as a decimal).

- n represents the number of compounding periods.

Deciphering the Components

Let's break down each component to fully grasp its significance:

-

Present Value (PV): This is the initial amount of money invested or borrowed. It forms the basis for calculating the future value.

-

Interest Rate (r): This is the rate at which the investment grows or the cost of borrowing money. It's crucial to express this rate as a decimal (e.g., 5% becomes 0.05). The interest rate can be compounded annually, semi-annually, quarterly, monthly, or even daily. The compounding frequency significantly impacts the final future value.

-

Number of Periods (n): This refers to the number of times the interest is compounded over the investment period. If interest is compounded annually over 5 years, n = 5. If interest is compounded semi-annually over the same 5 years, n = 10 (5 years * 2 compounding periods per year).

Variations of the Future Value Formula

The basic formula serves as a foundation, but several variations cater to different financial scenarios.

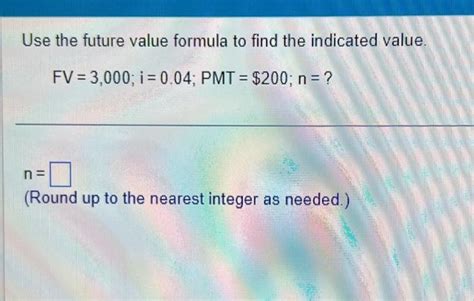

Future Value of an Annuity

An annuity represents a series of equal payments made at regular intervals. The future value of an annuity calculates the total value of these payments at a future date. The formula is:

FV = P * [((1 + r)^n - 1) / r]

Where:

- FV is the future value of the annuity.

- P is the periodic payment amount.

- r is the interest rate per period.

- n is the number of periods.

This formula is particularly useful for scenarios like retirement savings, where regular contributions are made over a period.

Future Value of an Annuity Due

An annuity due differs from an ordinary annuity in that payments are made at the beginning of each period instead of the end. This slight difference necessitates a modified formula:

FV = P * [((1 + r)^n - 1) / r] * (1 + r)

The extra (1 + r) factor accounts for the additional interest earned on the first payment due to its earlier receipt.

Future Value with Continuous Compounding

In continuous compounding, interest is calculated and added to the principal infinitely often. The formula for this scenario utilizes the exponential function:

FV = PV * e^(r*n)

Where:

- e is Euler's number (approximately 2.71828).

Continuous compounding represents a theoretical limit; however, it provides a useful benchmark for comparing different compounding frequencies.

Illustrative Examples: Applying the Future Value Formula

Let's illustrate the practical application of these formulas through several examples:

Example 1: Future Value of a Single Sum

Suppose you invest $1,000 today at an annual interest rate of 7% compounded annually for 5 years. What will be the future value of your investment?

Using the basic FV formula:

FV = $1000 * (1 + 0.07)^5 FV = $1000 * (1.07)^5 FV = $1000 * 1.40255 FV ≈ $1402.55

Therefore, your investment will be worth approximately $1402.55 after 5 years.

Example 2: Future Value of an Annuity

You plan to save for retirement by contributing $2,000 annually to a retirement account that earns 6% interest compounded annually. What will be the total value of your savings after 20 years?

Using the future value of an annuity formula:

FV = $2000 * [((1 + 0.06)^20 - 1) / 0.06] FV = $2000 * [((1.06)^20 - 1) / 0.06] FV = $2000 * [(3.207135 - 1) / 0.06] FV = $2000 * (22.1189) FV ≈ $74237.8

Your retirement savings will be approximately $74,237.8 after 20 years.

Example 3: Future Value with Continuous Compounding

If you invest $5,000 at an annual interest rate of 8% compounded continuously for 10 years, what will be the future value?

Using the continuous compounding formula:

FV = $5000 * e^(0.08 * 10) FV = $5000 * e^0.8 FV ≈ $5000 * 2.22554 FV ≈ $11127.7

The future value of your investment will be approximately $11,127.7 after 10 years.

Addressing Common Challenges

Several challenges can arise when using the future value formula:

-

Incorrect Interest Rate: Ensure the interest rate is expressed as a decimal and accurately reflects the compounding period.

-

Inconsistent Time Periods: The interest rate and the number of periods must align. If the interest rate is annual, the number of periods must also be in years.

-

Misunderstanding Compounding: Clearly define the compounding frequency (annual, semi-annual, quarterly, etc.) to avoid errors.

-

Calculating with Multiple Investments: For scenarios with multiple investments at different times or interest rates, you might need to calculate the future value of each component separately and then sum them up.

-

Inflation: While the FV formula provides a nominal future value, it doesn't account for inflation. To obtain a real future value, you need to adjust for the expected inflation rate.

Advanced Applications and Considerations

The future value formula extends beyond basic investment calculations. It's invaluable for:

-

Retirement Planning: Projecting future retirement income needs and evaluating the sufficiency of savings.

-

Loan Amortization: Determining the total repayment amount for loans.

-

Investment Portfolio Analysis: Assessing the potential growth of various investment options.

-

Capital Budgeting: Evaluating the profitability of long-term investment projects.

-

Financial Modeling: Constructing comprehensive financial models that incorporate future value calculations for forecasting and decision-making.

To further enhance accuracy and practicality, consider incorporating factors like:

-

Taxes: Incorporate tax implications on interest earned or investment returns.

-

Fees: Account for any management fees or transaction costs associated with investments.

-

Risk: While the formula provides a deterministic result, remember that investments carry inherent risk, and actual future values may deviate from calculations.

Conclusion: Mastering the Future Value Formula

The future value formula is a powerful tool for financial planning and decision-making. By understanding its core principles, variations, and practical applications, you can gain valuable insights into the potential growth of your investments and make informed financial choices. Remember to carefully consider the nuances of each scenario and incorporate relevant factors like inflation, taxes, and risk to obtain a more realistic and comprehensive assessment of future value. Practice using the formula with different scenarios to build confidence and proficiency. The ability to accurately calculate future value is an invaluable skill in navigating the complexities of personal finance and investment management.

Latest Posts

Latest Posts

-

The Scores Of A Recent Test Taken By 1200

Apr 02, 2025

-

Which Of The Reactions Are Spontaneous Favorable

Apr 02, 2025

-

Two Systems Of Equations Are Given Below

Apr 02, 2025

-

Match The Hormone Abbreviations With Their Function

Apr 02, 2025

-

What Is Are The Product S Of The Following Reaction

Apr 02, 2025

Related Post

Thank you for visiting our website which covers about Use The Future Value Formula To Find The Indicated Value . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.