To Increase The Money Supply The Federal Reserve Could

Holbox

Mar 20, 2025 · 7 min read

Table of Contents

To Increase the Money Supply, the Federal Reserve Could… Explore the Mechanisms of Monetary Policy

The Federal Reserve (also known as the Fed), the central bank of the United States, plays a crucial role in managing the nation's economy. One of its primary functions is controlling the money supply, a critical factor influencing inflation, employment, and overall economic growth. Understanding how the Fed can increase the money supply is essential to comprehending monetary policy and its impact on the broader economy. This comprehensive guide delves into the various mechanisms the Fed employs to achieve this goal, exploring their nuances and potential consequences.

The Importance of Money Supply Management

Before diving into the methods, it's vital to grasp why managing the money supply is so important. Too much money circulating in the economy can lead to inflation, eroding the purchasing power of the dollar. Conversely, too little money can stifle economic activity, resulting in recessions and high unemployment. The Fed's delicate balancing act aims to maintain a healthy level of money supply that promotes stable prices and sustainable economic growth. This delicate balance is often referred to as the dual mandate of the Federal Reserve.

Key Mechanisms for Increasing the Money Supply

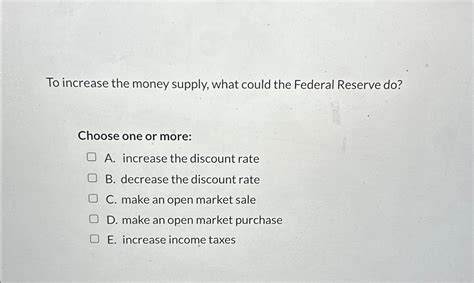

The Fed employs several tools to increase the money supply, each with its own implications and effectiveness:

1. Open Market Operations: The Fed's Primary Tool

This is the most frequently used method. Open market operations involve the Fed buying U.S. Treasury securities (like bonds) or other eligible securities from commercial banks and other financial institutions in the open market. When the Fed buys these securities, it injects money into the banking system. This increases the reserves commercial banks hold, allowing them to lend more money, thereby expanding the money supply.

How it works: Imagine the Fed buying a $100 million bond from a bank. The Fed pays the bank $100 million, increasing the bank's reserves. This bank can now lend out a portion of this extra $100 million (minus the reserve requirement set by the Fed). This new loan becomes a deposit in another bank, which can then lend out a portion of that deposit, and so on. This process, known as the money multiplier effect, significantly amplifies the initial increase in the money supply. The exact size of the multiplier depends on the reserve requirement and other factors.

Advantages: Open market operations are highly flexible and can be implemented quickly, allowing the Fed to react swiftly to changing economic conditions. They are also easily reversed if necessary.

Disadvantages: The effectiveness of open market operations can be influenced by factors such as banks' willingness to lend and the overall demand for credit in the economy.

2. Lowering the Reserve Requirement: A Powerful but Less Frequent Tool

The reserve requirement is the percentage of deposits that commercial banks are legally required to hold in reserve, either as physical cash in their vaults or as deposits at a Federal Reserve Bank. By lowering the reserve requirement, the Fed frees up a larger portion of banks' deposits for lending, thereby increasing the money supply through the money multiplier effect.

How it works: If the reserve requirement is lowered from, say, 10% to 8%, banks suddenly have more money available to lend. This leads to an expansion of credit and an increase in the overall money supply.

Advantages: A reduction in the reserve requirement has a significant impact on the money supply, potentially triggering a substantial increase in lending and economic activity.

Disadvantages: Lowering the reserve requirement is a powerful tool, and misjudging its impact can have serious consequences. It's a less frequently used tool precisely because it's so impactful and difficult to fine-tune. Sudden changes can create instability in the financial system.

3. Lowering the Discount Rate: Encouraging Borrowing by Banks

The discount rate is the interest rate at which commercial banks can borrow money directly from the Federal Reserve. By lowering the discount rate, the Fed makes it cheaper for banks to borrow money, encouraging them to increase their reserves and lend more to businesses and consumers, thus expanding the money supply.

How it works: A lower discount rate incentivizes banks to borrow more from the Fed, increasing their reserves and allowing them to extend more credit.

Advantages: This tool offers a direct way to influence banks' borrowing behavior and indirectly influence the overall money supply.

Disadvantages: The impact of changes in the discount rate can be less direct than open market operations, as banks may not always respond immediately to changes in the discount rate. It can also signal the Fed's assessment of the economy, potentially impacting market sentiment.

4. Paying Interest on Reserves: A Relatively Recent Tool

This mechanism allows the Fed to influence the money supply by adjusting the interest rate it pays on reserves held by commercial banks at the Federal Reserve. By lowering this rate, the Fed reduces the incentive for banks to hold onto reserves, encouraging them to lend more and increasing the money supply.

How it works: When interest paid on reserves is low, banks are less inclined to keep large amounts of money idle, opting instead to lend it out for higher returns.

Advantages: This tool offers a more nuanced approach to influencing the money supply, providing the Fed with another lever to fine-tune its monetary policy.

Disadvantages: The effectiveness of this tool depends on banks' assessment of risk and return in lending, and it's not always the most powerful tool for rapid expansion.

Potential Consequences of Increasing the Money Supply

While increasing the money supply can stimulate economic growth and reduce unemployment, it also carries potential risks:

-

Inflation: A significant increase in the money supply without a corresponding increase in the production of goods and services can lead to inflation, eroding the purchasing power of the dollar.

-

Asset Bubbles: Increased money supply can drive up asset prices (stocks, real estate, etc.), creating asset bubbles that can eventually burst, causing economic instability.

-

Increased National Debt: Government borrowing to finance deficits can contribute to increased money supply, but this can increase the national debt and lead to long-term economic challenges.

-

Exchange Rate Fluctuations: Changes in the money supply can affect exchange rates, impacting international trade and investment flows.

The Fed's Balancing Act: A Complex Endeavor

The Fed's task of managing the money supply is a complex and delicate balancing act. It must consider various economic indicators, forecast future trends, and weigh the potential benefits and risks of each policy tool. The ultimate goal is to achieve stable prices, full employment, and sustainable economic growth. The decisions the Fed makes profoundly impact individuals, businesses, and the entire economy. Understanding the mechanisms involved in increasing the money supply is crucial for comprehending the Fed's role in shaping the economic landscape of the United States. This intricate dance between monetary policy and economic stability is a continuous process of adjustment and adaptation. The Fed's actions – and their potential consequences – remain a topic of ongoing debate and scrutiny among economists and policymakers alike.

Conclusion: A Dynamic and Ever-Evolving Process

The Federal Reserve's ability to increase the money supply is a vital tool in its broader economic management toolkit. The various methods, ranging from open market operations to adjusting reserve requirements and interest rates, offer a range of levers for influencing the money supply. However, the delicate balance between stimulating growth and preventing inflation requires careful consideration of potential risks and consequences. The Fed's actions continuously shape the economic landscape, underscoring the importance of understanding the intricate interplay between monetary policy and the overall health of the economy. This ongoing process requires constant monitoring, adaptation, and a keen understanding of both short-term and long-term economic effects. The complexity of these economic tools highlights the importance of continuous learning and informed discussion in the field of monetary economics. Future economic challenges will undoubtedly require further refinement and innovation in these policy mechanisms.

Latest Posts

Latest Posts

-

How Many Real Zeros Does A Quadratic Function Have

Mar 21, 2025

-

Organizations Deal With Changes In The Environment Through

Mar 21, 2025

-

Chapter 4 Clinical Scenario Coaching Activity 1

Mar 21, 2025

-

A 30 Year Home Mortgage Is A Classic Example Of

Mar 21, 2025

-

What Does The Term Money Neutrality Mean

Mar 21, 2025

Related Post

Thank you for visiting our website which covers about To Increase The Money Supply The Federal Reserve Could . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.