What Does The Term Money Neutrality Mean

Holbox

Mar 21, 2025 · 6 min read

Table of Contents

What Does the Term Money Neutrality Mean?

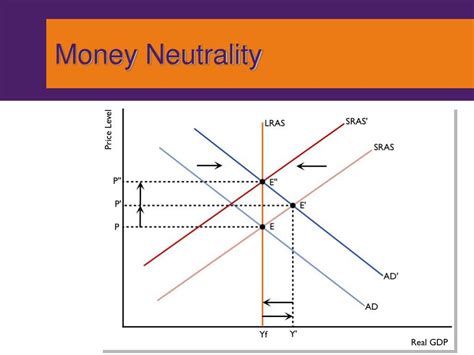

Money neutrality is a cornerstone concept in classical and monetarist economics. It posits that changes in the money supply only affect nominal variables, such as prices and nominal wages, but have no impact on real variables, like output, employment, or real interest rates. In simpler terms, a change in the amount of money in an economy affects the overall price level, but not the underlying "real" economy. This seemingly straightforward idea has been the subject of intense debate and revision throughout economic history, with significant implications for monetary policy and economic forecasting. This article will delve into the meaning of money neutrality, explore its underlying assumptions, examine its limitations, and discuss its relevance in contemporary economic thought.

The Core Principle: Money Only Affects Prices

At the heart of money neutrality lies the belief that money is a "veil" that obscures the real workings of the economy. Increasing the money supply, for instance through printing more currency or expanding credit, doesn't fundamentally alter the economy's productive capacity or the efficiency with which resources are allocated. Instead, the injection of new money primarily leads to a proportionate increase in the general price level. This is often referred to as inflation, a rise in the average price of goods and services in an economy.

Imagine a scenario where the central bank doubles the money supply overnight. Initially, individuals and businesses find themselves with more cash. This increased purchasing power leads to a surge in demand for goods and services. However, according to the theory of money neutrality, the supply of goods and services remains unchanged in the short run. Consequently, the increased demand pushes prices upward, effectively neutralizing the impact of the increased money supply on real economic variables. The economy, in terms of its production and employment, will remain unaffected. The only thing that has changed is the nominal value of transactions—everything costs twice as much.

Classical Dichotomy: Separating Real and Nominal Variables

The concept of money neutrality is closely linked to the classical dichotomy, a crucial assumption in classical economic models. This dichotomy separates the economy into two distinct sectors: the real sector and the nominal sector.

-

Real sector: This sector encompasses real variables like output (GDP), employment, capital stock, and real interest rates. These variables reflect the underlying productive capacity and resource allocation of the economy.

-

Nominal sector: This sector involves nominal variables, such as prices, wages expressed in monetary units, and the money supply itself. These variables represent the monetary values associated with the real sector.

Money neutrality implies that the nominal sector and the real sector are independent of each other in the long run. Changes in the nominal sector (e.g., a change in the money supply) only affect nominal variables, leaving the real sector untouched. This separation allows economists to analyze the real economy independently of monetary phenomena.

Assumptions Underlying Money Neutrality

The validity of money neutrality hinges on several crucial assumptions:

-

Perfect Information: All economic agents (consumers, firms, and investors) possess perfect knowledge about current and future prices, interest rates, and other relevant economic variables. This allows them to adjust their behavior optimally to changes in the money supply. In reality, information is imperfect, leading to potentially significant deviations from money neutrality.

-

Flexible Prices and Wages: Prices and wages adjust quickly and fully to changes in the money supply. This ensures that the increased demand resulting from an increase in the money supply is promptly reflected in higher prices, preventing any sustained impact on real output or employment. In reality, prices and wages are often sticky, meaning they don't adjust instantaneously. This "stickiness" can lead to significant short-run effects on real variables.

-

Rational Expectations: Economic agents make rational decisions based on all available information, including their expectations about future economic conditions. Rational expectations suggest that individuals will anticipate the inflationary consequences of an increase in the money supply, preventing any real effects. However, unanticipated changes in the money supply can still have short-run real effects, as agents may not fully foresee the inflationary impact.

-

Closed Economy: The assumption of a closed economy (no international trade) simplifies the analysis. Opening the economy to international trade introduces complexities, as changes in the money supply can affect exchange rates and international capital flows, potentially influencing real variables.

Limitations and Challenges to Money Neutrality

Despite its theoretical appeal, money neutrality faces significant empirical and theoretical challenges:

-

Short-Run Effects: Even proponents of money neutrality acknowledge that changes in the money supply can have short-run effects on real variables. Price and wage stickiness, along with imperfect information, can lead to temporary deviations from the long-run neutrality prediction. This short-run impact can be substantial, particularly during periods of economic uncertainty or instability.

-

Liquidity Effects: An increase in the money supply can initially boost liquidity in the economy, encouraging investment and spending, even before prices fully adjust. This liquidity effect can temporarily stimulate real output and employment.

-

The Role of Expectations: The impact of a change in the money supply depends crucially on whether the change is anticipated or unanticipated. Unanticipated changes are likely to have larger real effects than anticipated changes because individuals and firms are not prepared for the shift in price levels.

-

Financial Markets and Asset Prices: Changes in the money supply can significantly influence asset prices, like stock prices and real estate values. These effects can have repercussions for investment, wealth distribution, and aggregate demand, challenging the strict neutrality proposition.

-

Empirical Evidence: Empirical evidence supporting strict money neutrality is mixed. Some studies suggest that money supply shocks do have significant long-run real effects, especially in the context of hyperinflation or economic crises. However, others continue to find support for long-run neutrality, albeit with acknowledgements of short-run deviations.

Money Neutrality in Contemporary Economic Thought

The debate surrounding money neutrality continues to evolve. While few economists maintain a belief in strict long-run neutrality under all conditions, the core idea of a distinction between nominal and real variables remains relevant. Modern macroeconomic models often incorporate elements of both classical and Keynesian perspectives, acknowledging that the impact of monetary policy can vary significantly depending on the specific context.

Many modern models incorporate short-run effects of monetary policy on real variables, due to factors such as sticky wages and prices, imperfect information, and the existence of nominal rigidities. However, the long-run implications of changes in the money supply generally align more closely with money neutrality, particularly with regards to the overall price level.

Conclusion: A nuanced perspective

Money neutrality, while a simplified representation of a complex economic reality, serves as a vital benchmark in macroeconomic theory. Its core principle—that changes in the money supply primarily affect nominal values and not real variables in the long run—provides a valuable framework for understanding monetary phenomena. However, it's crucial to acknowledge the limitations and caveats associated with this principle. The short-run dynamics, the impact of expectations, and the role of financial markets add layers of complexity that challenge the strict application of money neutrality. A nuanced perspective, acknowledging both the theoretical insights and the empirical limitations of the concept, is essential for a comprehensive understanding of monetary economics and its impact on the economy. The debate surrounding money neutrality continues to shape monetary policy and guide economic research, highlighting the ongoing relevance of this fundamental economic idea. By carefully considering the assumptions and limitations, one can use money neutrality as a useful, albeit imperfect, tool for analyzing the interplay between money and the real economy.

Latest Posts

Latest Posts

-

Which Of The Following Shows The Graph Of

Mar 21, 2025

-

In The Confidence Interval The Quantity Is Called The

Mar 21, 2025

-

What Is One Current Trend In Institutional Activism

Mar 21, 2025

-

How Much Was A Loaf Of Bread In 1974

Mar 21, 2025

-

Protein Synthesis Is A Complicated Process Involving Dna

Mar 21, 2025

Related Post

Thank you for visiting our website which covers about What Does The Term Money Neutrality Mean . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.