To Be Valid An Economic Model Must

Holbox

Mar 28, 2025 · 5 min read

Table of Contents

- To Be Valid An Economic Model Must

- Table of Contents

- To Be Valid, an Economic Model Must: A Comprehensive Guide

- The Pillars of a Valid Economic Model

- 1. Accuracy in Representation:

- 2. Logical Consistency and Internal Coherence:

- 3. Predictive Power and Empirical Testability:

- 4. Parsimony and Simplicity:

- 5. Relevance and Applicability:

- Examples of Model Validation Challenges

- Conclusion: A Continuous Process of Refinement

- Latest Posts

- Latest Posts

- Related Post

To Be Valid, an Economic Model Must: A Comprehensive Guide

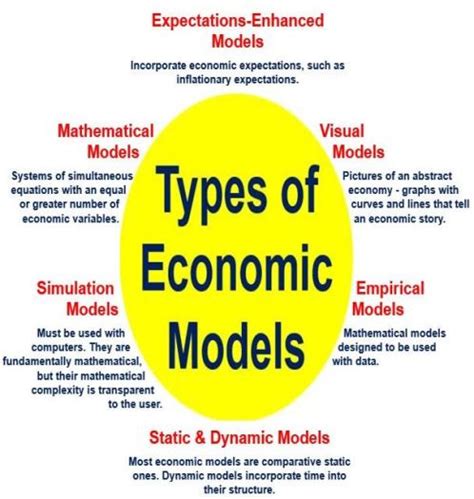

Economic models are simplified representations of complex real-world phenomena. They're essential tools for economists to understand, analyze, and predict economic behavior. However, not all economic models are created equal. For a model to be considered valid, it must meet several crucial criteria. This comprehensive guide delves into the essential characteristics of a valid economic model, exploring the theoretical foundations and practical implications.

The Pillars of a Valid Economic Model

A valid economic model isn't just a collection of equations or diagrams; it's a carefully constructed representation of reality that meets specific standards of rigor and relevance. These standards can be broadly categorized into several key pillars:

1. Accuracy in Representation:

This is arguably the most fundamental requirement. A valid model must accurately capture the essential features of the economic phenomenon it aims to explain. This involves:

-

Identifying Key Variables: The model must identify and incorporate the most relevant variables that significantly influence the economic process under investigation. Irrelevant variables can lead to inaccurate predictions and conclusions. For instance, a model predicting consumer spending should include factors like income, interest rates, and consumer confidence, while neglecting less significant variables.

-

Appropriate Functional Forms: The relationships between variables should be represented using appropriate mathematical functions. The choice of functional form depends on the nature of the relationships and the available data. Linear functions are often used for simplicity, but non-linear functions may be necessary to capture more complex interactions. A flawed functional form can lead to misleading results.

-

Realistic Assumptions: While simplification is necessary, the assumptions underlying the model must be realistic enough to provide meaningful insights. Unrealistic assumptions can render the model irrelevant, even if mathematically sound. For example, assuming perfect information in a market model might yield elegant results but fail to reflect real-world market imperfections.

2. Logical Consistency and Internal Coherence:

A valid model must be logically consistent within its own framework. This means:

-

No Internal Contradictions: The model's assumptions, equations, and conclusions should not contradict each other. A model with internal contradictions is inherently flawed and cannot yield reliable results.

-

Clear Causal Relationships: The model should establish clear causal relationships between variables. It should explain why changes in one variable lead to changes in another, not simply that they are correlated. A model simply showing correlation without establishing causality lacks explanatory power.

-

Mathematical Rigor: The mathematical techniques used in the model should be appropriate and correctly applied. Errors in mathematical derivations or calculations will invalidate the model's conclusions.

3. Predictive Power and Empirical Testability:

A model's value lies in its ability to predict future outcomes or explain past events. A valid model should:

-

Generate Testable Hypotheses: The model should generate clear and testable hypotheses about the economic phenomenon under study. These hypotheses can then be tested using empirical data.

-

Exhibit Predictive Accuracy: The model's predictions should be reasonably accurate when compared to real-world data. The accuracy of predictions can be assessed using statistical methods such as regression analysis. However, it's crucial to acknowledge that perfect predictive accuracy is rarely achievable in economics due to the inherent complexity and uncertainty of the subject matter.

-

Robustness to Data Changes: A robust model should yield similar conclusions even with slight variations in the input data. Sensitivity analysis can be employed to assess the robustness of the model to data uncertainties.

4. Parsimony and Simplicity:

While accuracy is paramount, a valid model should also strive for simplicity and parsimony (Occam's Razor). This means:

-

Minimizing Unnecessary Complexity: The model should include only the essential variables and relationships necessary to capture the phenomenon of interest. Including unnecessary variables can complicate the model without adding significant explanatory power.

-

Ease of Interpretation: The model should be easily interpretable and understandable. A complex model that is difficult to understand is of limited practical use.

-

Focus on Key Insights: The model should focus on providing clear and concise insights into the economic issue at hand. It should not be overly burdened with excessive detail that obscures the main conclusions.

5. Relevance and Applicability:

A valid economic model must be relevant to the economic question it aims to address. This entails:

-

Addressing a Meaningful Economic Question: The model should tackle a relevant and important economic problem or question. A model that addresses a trivial issue is of limited value.

-

Policy Implications: A strong model often offers meaningful policy implications. It can inform policymakers about the potential consequences of different policy choices. This practical relevance adds significant weight to the model's validity.

-

Generalizability (Where Applicable): Some models aim for generalizability, meaning their findings can be applied across different contexts or time periods. However, many models are context-specific, and their validity is limited to the specific circumstances they represent.

Examples of Model Validation Challenges

Many well-known economic models have faced scrutiny regarding their validity. Understanding these challenges illuminates the importance of the criteria outlined above:

-

The Solow-Swan Model: This neoclassical growth model has been criticized for its simplifying assumptions, such as constant returns to scale and exogenous technological progress. While influential, its limitations in explaining long-run growth patterns have led to the development of endogenous growth models.

-

The Efficient Market Hypothesis (EMH): This hypothesis posits that asset prices fully reflect all available information. While influential in finance, the EMH has been challenged by empirical evidence of market anomalies and behavioral biases that contradict its assumptions.

-

The Phillips Curve: This model depicts an inverse relationship between inflation and unemployment. The original Phillips Curve has been challenged by the stagflation of the 1970s, highlighting the need for more complex models that incorporate supply-side factors.

Conclusion: A Continuous Process of Refinement

Validating an economic model is not a one-time event but an ongoing process of testing, refinement, and revision. As new data become available and our understanding of economic phenomena improves, models must be adapted and improved to maintain their validity. The pursuit of ever-more accurate and insightful economic models is a crucial part of advancing economic knowledge and informing effective policy decisions. By adhering to the principles outlined in this guide, economists can strive to create models that meet the high standards necessary for contributing meaningfully to our understanding of the complexities of economic systems. Remember that a valid economic model is not just a tool for prediction; it's a framework for understanding and explaining the intricate workings of the economy, allowing us to make more informed choices in navigating the complexities of the global financial landscape.

Latest Posts

Latest Posts

-

Identify The Four Postulates Of Natural Selection

Mar 31, 2025

-

Select The Action For Which The Featured Muscle Is Responsible

Mar 31, 2025

-

Label The Components Of A Synapse

Mar 31, 2025

-

Cost Accounting Systems Are Used To

Mar 31, 2025

-

Under Accrual Basis Accounting Companies Typically Report Expenses

Mar 31, 2025

Related Post

Thank you for visiting our website which covers about To Be Valid An Economic Model Must . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.