Theo Needs To Enter A New Income Into Quickbooks

Holbox

Mar 30, 2025 · 6 min read

Table of Contents

- Theo Needs To Enter A New Income Into Quickbooks

- Table of Contents

- Theo Needs to Enter a New Income into QuickBooks: A Comprehensive Guide

- Understanding QuickBooks Income Entry: The Basics

- Key Elements of an Income Entry:

- Different Ways Theo Can Enter Income into QuickBooks

- 1. Using the "Receive Payment" Feature:

- 2. Using the "Create Invoice" Feature:

- 3. Using the "Expense" Feature (for Reimbursements):

- Advanced Scenarios and Considerations for Theo

- Handling Multiple Income Streams:

- Tracking Income from Different Projects:

- Dealing with Deposits and Advance Payments:

- Reconciling Bank Accounts:

- Generating Reports:

- Using QuickBooks Online vs. QuickBooks Desktop:

- Best Practices for Accurate Income Entry in QuickBooks

- Conclusion: Mastering QuickBooks for Financial Success

- Latest Posts

- Latest Posts

- Related Post

Theo Needs to Enter a New Income into QuickBooks: A Comprehensive Guide

Entering income into QuickBooks is a crucial step in maintaining accurate financial records for your business. Whether you're a freelancer like Theo, a small business owner, or manage a larger enterprise, understanding how to correctly record income is vital for tax preparation, financial reporting, and overall business management. This comprehensive guide will walk Theo (and you!) through the process, covering various income types and best practices for ensuring accurate and efficient bookkeeping in QuickBooks.

Understanding QuickBooks Income Entry: The Basics

Before diving into the specifics, let's establish a foundational understanding of how income is recorded in QuickBooks. Essentially, you're creating a record of a transaction where your business receives money in exchange for goods or services. This record includes key details like the date of the transaction, the amount received, the customer involved, and the specific type of income generated. Accurate and timely recording is critical for generating accurate financial reports and avoiding potential tax issues.

Key Elements of an Income Entry:

- Date: The date the income was received or the invoice was issued.

- Amount: The total amount of money received.

- Customer: The individual or business that paid for your goods or services. This is linked to your customer list in QuickBooks.

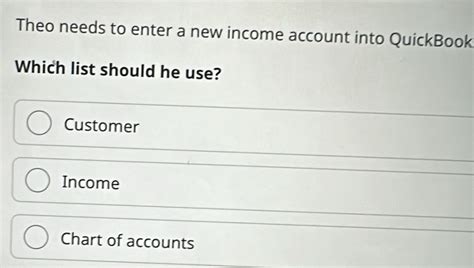

- Income Account: The specific account where the income is categorized (e.g., Sales of Goods, Service Revenue, Consulting Fees). Choosing the correct account is vital for accurate financial reporting.

- Payment Method: How the payment was received (e.g., check, cash, credit card, online payment).

- Description: A brief description of the transaction for clarity. This could include an invoice number or a short description of the service provided.

Different Ways Theo Can Enter Income into QuickBooks

QuickBooks offers several methods for recording income, depending on Theo's workflow and preference. Let's explore the most common options:

1. Using the "Receive Payment" Feature:

This is ideal for situations where Theo receives payment directly, without a prior invoice. This is suitable for cash or check payments received immediately upon providing a service.

- Steps:

- Go to the Banking menu.

- Select "Receive Payment."

- Select the customer from the dropdown menu.

- Enter the date of the payment.

- Enter the payment amount.

- Choose the payment method (Cash, Check, etc.).

- Select the relevant income account.

- Add a description (optional).

- Save the transaction.

2. Using the "Create Invoice" Feature:

This method is more appropriate when Theo issues invoices to clients. This provides a formal record of the transaction and allows for easy tracking of outstanding payments.

- Steps:

- Go to the Customers menu.

- Select "Create Invoices."

- Add the customer's details.

- Enter the invoice date.

- Add line items detailing the goods or services provided and their respective amounts.

- Calculate the total amount.

- Save and send the invoice (either electronically or via mail).

- Once payment is received, record the payment using the "Receive Payment" feature, linking it to the corresponding invoice.

3. Using the "Expense" Feature (for Reimbursements):

If Theo receives a reimbursement for business expenses, this needs to be entered differently. It's not income in the traditional sense, but it needs to be accurately recorded.

- Steps:

- Go to the Expenses menu.

- Select "New Expense."

- Select the customer (if applicable).

- Choose the reimbursement account (e.g., "Reimbursements").

- Enter the date and amount.

- Select the payment method.

- Add a description outlining the expense it covers.

- Save the transaction.

Advanced Scenarios and Considerations for Theo

Let’s delve into more complex situations that Theo might encounter:

Handling Multiple Income Streams:

If Theo has multiple income streams (e.g., consulting, freelance writing, online courses), he needs to ensure each income source is categorized correctly. This means using distinct income accounts for each stream to maintain accurate financial records. For example, he might have separate accounts for "Consulting Fees," "Writing Revenue," and "Online Course Sales." This detailed categorization is crucial for generating meaningful financial reports.

Tracking Income from Different Projects:

For larger projects with multiple invoices, Theo might need to track income on a project-by-project basis. QuickBooks allows for this using customer-specific tracking categories, allowing him to generate reports showing income and expenses related to specific projects. This facilitates project profitability analysis.

Dealing with Deposits and Advance Payments:

If Theo receives advance payments or deposits before completing a project, he needs to handle them properly. The best practice is to record them as “unearned revenue” in a liability account, then transfer it to the appropriate income account once the service is delivered. This accurately reflects the company’s financial position.

Reconciling Bank Accounts:

Regular bank reconciliation is crucial for accuracy. Theo needs to compare his QuickBooks records with his bank statements to identify and correct any discrepancies. This is an essential part of financial hygiene and reduces the chance of errors.

Generating Reports:

QuickBooks offers a range of reports that Theo can use to analyze his income and overall financial performance. These reports provide valuable insights for business decisions and tax preparation. Understanding how to interpret these reports, specifically the Profit & Loss statement, is a cornerstone of successful business management.

Using QuickBooks Online vs. QuickBooks Desktop:

The method for entering income remains similar across QuickBooks Online and QuickBooks Desktop, but the interface may differ slightly. QuickBooks Online offers advantages in terms of accessibility and collaboration, while QuickBooks Desktop might be preferable for those who prefer a more traditional software experience. The best choice depends on Theo's individual needs and preferences.

Best Practices for Accurate Income Entry in QuickBooks

To ensure accurate and efficient bookkeeping, Theo should follow these best practices:

- Regular Data Entry: Enter income transactions promptly to maintain an up-to-date record.

- Accurate Categorization: Use the correct income accounts to accurately categorize income streams.

- Detailed Descriptions: Include detailed descriptions to easily identify each transaction.

- Regular Reconciliation: Reconcile bank accounts regularly to identify and resolve discrepancies.

- Backups: Regularly back up QuickBooks data to protect against data loss.

- Professional Help: If needed, don't hesitate to consult a QuickBooks expert or accountant for assistance.

Conclusion: Mastering QuickBooks for Financial Success

Entering income accurately into QuickBooks is paramount for Theo's financial success. By understanding the different methods available, considering various scenarios, and following best practices, he can ensure his financial records are accurate, up-to-date, and provide valuable insights into his business performance. With the right knowledge and diligent application, Theo can leverage QuickBooks to streamline his bookkeeping process, simplify tax preparation, and ultimately, build a thriving and financially sound business. Remember, consistency and attention to detail are key to maximizing the benefits of QuickBooks for effective financial management.

Latest Posts

Latest Posts

-

The Controllable Variance Is So Called Because It

Apr 02, 2025

-

The Graph Of The Relation S Is Shown Below

Apr 02, 2025

-

Which One Of The Following Is A Working Capital Decision

Apr 02, 2025

-

You Are Given A Colorless Unknown Solution

Apr 02, 2025

-

Minor Violations May Be Granted Upwards Of

Apr 02, 2025

Related Post

Thank you for visiting our website which covers about Theo Needs To Enter A New Income Into Quickbooks . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.