The Term Tax Incidence Refers To

Holbox

Mar 17, 2025 · 7 min read

Table of Contents

The Term Tax Incidence Refers To: Understanding Who Really Bears the Burden

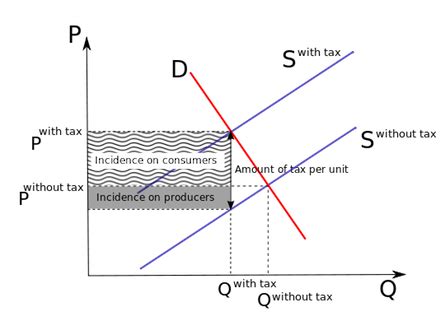

Tax incidence, a seemingly simple term, delves into the complex question of who ultimately pays a tax. It's not as straightforward as it might appear. While a tax might be levied on one party (say, a company), the economic effects can cause the burden to shift, either partially or entirely, to another party (like consumers). Understanding tax incidence is crucial for policymakers, businesses, and individuals to assess the true impact of tax policies and their implications for resource allocation and overall economic welfare.

What is Tax Incidence?

Tax incidence refers to the analysis of the distribution of the actual burden of a tax, as opposed to its nominal incidence, which is the party legally responsible for paying the tax. It examines how the tax affects the prices of goods and services, wages, and profits. The analysis distinguishes between the short-run incidence and the long-run incidence. Short-run incidence focuses on immediate impacts, while long-run incidence accounts for adjustments in market equilibrium after the tax is implemented. This dynamic shift is fundamental to understanding the true impact of taxation.

For instance, a tax on cigarettes might be levied on manufacturers. However, the tax's effect ripples through the market. Manufacturers might absorb some of the tax, reducing their profits. However, a significant portion is likely passed on to consumers through higher prices. This means that even though the manufacturer is legally responsible for paying the tax, the consumer ultimately bears a substantial portion, if not the entirety, of the burden. This illustrates the distinction between the legal incidence (the manufacturer) and the economic incidence (the consumer).

Factors Affecting Tax Incidence

Several factors influence where the burden of a tax ultimately falls:

1. Elasticity of Supply and Demand:

This is arguably the most crucial factor. Elasticity measures the responsiveness of quantity demanded or supplied to changes in price.

-

Inelastic Demand: If demand for a good is inelastic (meaning consumers are not very responsive to price changes), consumers will bear a larger share of the tax burden. This is because even with a price increase, the quantity demanded remains relatively unchanged. Examples include essential goods like gasoline or prescription drugs.

-

Elastic Demand: If demand is elastic (consumers are highly responsive to price changes), consumers will bear a smaller share of the tax burden. A price increase leads to a significant drop in demand, making it difficult for producers to pass on the entire tax. Examples include luxury goods or items with many substitutes.

-

Inelastic Supply: If the supply of a good is inelastic (producers are not very responsive to price changes), producers will bear a larger share of the tax burden. This could be due to limited resources or production constraints.

-

Elastic Supply: If supply is elastic (producers can readily adjust output in response to price changes), producers will bear a smaller share of the tax burden.

2. Market Structure:

The structure of the market plays a role. Monopolies, with their market power, might be better able to shift the tax burden onto consumers compared to firms in perfectly competitive markets. In competitive markets, firms have less individual influence over prices, making it harder to pass on the entire tax.

3. Tax Structure:

The way a tax is designed also matters. A specific tax (a fixed amount per unit) has different effects compared to an ad valorem tax (a percentage of the price). The incidence of these tax structures can vary across different goods depending on the aforementioned elasticity considerations.

4. Time Horizon:

As mentioned earlier, the short-run incidence may differ significantly from the long-run incidence. In the short run, firms may absorb some of the tax burden, but in the long run, they may adjust their production, prices, or even exit the market. This is particularly relevant for taxes on factors of production such as labor or capital.

Types of Taxes and Their Incidence

Understanding tax incidence requires examining different tax types:

1. Excise Taxes:

These are taxes on specific goods or services, such as gasoline, alcohol, or tobacco. The incidence depends heavily on the elasticity of demand. For inelastic demand goods, consumers bear a larger share.

2. Sales Taxes:

These are taxes levied on the sale of most goods and services. Incidence varies depending on the elasticity of demand for different goods. Generally, it impacts consumers disproportionately, although low-income individuals might bear a heavier relative burden.

3. Property Taxes:

These taxes are based on the value of property (land and buildings). The incidence is complex and depends on the local market conditions and the mobility of capital and labor. While landowners directly pay the tax, the burden can shift depending on local market dynamics.

4. Income Taxes:

Income taxes are levied on individuals' or corporations' income. The incidence of income taxes is more complex and depends on a variety of factors, including the progressivity of the tax system, the ability of businesses to pass costs on to consumers, and the mobility of capital and labor. A progressive income tax system intends to place a larger tax burden on higher earners, but this doesn't always translate perfectly into reality due to these other factors.

5. Payroll Taxes:

Payroll taxes, such as Social Security and Medicare taxes in the U.S., are levied on wages and salaries. While officially shared between the employer and employee, the economic incidence depends on labor market conditions. Some argue that the entire burden can fall on employees through lower wages, while others suggest that employers bear some of the burden. The elasticity of labor supply and demand is crucial in determining the final incidence.

Analyzing Tax Incidence: Tools and Techniques

Economists use various methods to analyze tax incidence:

-

Partial Equilibrium Analysis: This simpler method examines the effects of a tax on a single market, holding other markets constant. It's useful for understanding basic principles but overlooks broader economic impacts.

-

General Equilibrium Analysis: This more complex approach examines the effects of a tax on multiple markets simultaneously, considering interactions and feedback loops. It provides a more comprehensive understanding of tax incidence but is computationally demanding.

-

Mathematical Modeling: Economists employ mathematical models to simulate tax effects, varying parameters to assess changes in incidence under different conditions.

-

Empirical Analysis: This involves using real-world data to study tax incidence. This can be challenging due to difficulties in isolating the effects of a specific tax from other economic factors.

The Importance of Understanding Tax Incidence

Understanding tax incidence is crucial for several reasons:

-

Policymaking: Governments need accurate assessments of tax impacts to design effective and equitable tax systems. Knowing who truly bears the burden helps policymakers craft policies that align with their distributional goals.

-

Business Decisions: Businesses need to understand tax incidence to anticipate the impact of taxes on their costs, pricing strategies, and profitability.

-

Economic Welfare: Accurate analysis of tax incidence helps evaluate the efficiency and equity of tax systems. High tax burdens on specific groups or sectors might lead to welfare losses and market distortions.

-

Social Equity: Understanding tax incidence is crucial for assessing the fairness of a tax system. If a regressive tax disproportionately affects lower-income groups, policymakers might need to modify the tax structure or introduce mitigating measures.

Conclusion

Tax incidence is a multifaceted concept that goes beyond the legal assignment of tax liability. It requires an in-depth understanding of market dynamics, elasticity of supply and demand, market structure, and the specific characteristics of the tax itself. Accurately determining tax incidence is essential for informed policy decisions, effective business strategies, and the promotion of overall economic welfare and social equity. While simplifying assumptions are often made for analytical purposes, the reality of tax incidence is often complex and requires a sophisticated understanding of both microeconomic and macroeconomic principles. Further research and analysis, utilizing both theoretical models and empirical studies, are constantly needed to improve our understanding of how taxes ultimately affect individuals, businesses, and the economy as a whole.

Latest Posts

Latest Posts

-

Tom Is Working On A Report That Contains

Mar 17, 2025

-

In Every Choice You Weigh The

Mar 17, 2025

-

While Develping A Segmentation Approvah The Brand

Mar 17, 2025

-

Ring Opening Arrow Pushing Mechanism Under Basic Conditions

Mar 17, 2025

-

Label The Features Of A Neuromuscular Junction

Mar 17, 2025

Related Post

Thank you for visiting our website which covers about The Term Tax Incidence Refers To . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.