The Simple Circular Flow Model Shows That

Holbox

Mar 16, 2025 · 6 min read

Table of Contents

The Simple Circular Flow Model: A Comprehensive Guide

The simple circular flow model is a fundamental concept in economics that illustrates the interconnectedness of households and firms in a market economy. It provides a simplified representation of how goods, services, and money flow between these two key economic agents. While simplified, understanding this model is crucial for grasping more complex economic concepts and analyzing real-world economic phenomena. This article will delve deep into the simple circular flow model, exploring its components, assumptions, limitations, and extensions. We'll also discuss its relevance in understanding macroeconomic concepts and its applicability to various economic scenarios.

The Two-Sector Model: Households and Firms

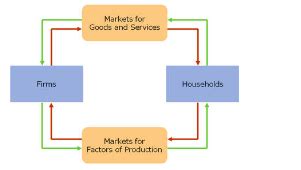

At its core, the simple circular flow model depicts a two-sector economy: households and firms. These sectors interact in two main markets:

-

The market for goods and services: Firms supply goods and services to households, who consume them. This flow is represented by the movement of goods and services from firms to households.

-

The market for factors of production: Households supply factors of production (land, labor, capital, and entrepreneurship) to firms, which use these factors to produce goods and services. This flow is represented by the movement of factors of production from households to firms.

These two markets are intertwined, creating a circular flow of economic activity. Households receive income from supplying factors of production to firms, and they use this income to purchase goods and services from firms. Firms, in turn, use the revenue generated from selling goods and services to pay for the factors of production.

The Flow of Goods and Services

The flow of goods and services represents the real flow in the circular flow model. Households consume goods and services produced by firms, satisfying their wants and needs. This flow is unidirectional in the simplest model, moving from firms to households. However, in more complex models, this flow can be bidirectional, accounting for things like the purchase of intermediate goods or the return of faulty products.

The Flow of Money (Incomes and Expenditures)

The flow of money represents the monetary flow in the circular flow model. This flow is crucial for understanding the exchange of value between households and firms. It consists of two key components:

-

Factor payments: Firms pay households for the factors of production they supply. This includes wages for labor, rent for land, interest for capital, and profits for entrepreneurship. These payments represent the income earned by households.

-

Expenditures on goods and services: Households use their income to purchase goods and services from firms. This represents the expenditure side of the circular flow.

Assumptions of the Simple Circular Flow Model

The simple circular flow model operates under several simplifying assumptions:

-

Closed economy: The model initially ignores international trade. All economic activity takes place within the confines of the economy being considered.

-

No government: The model omits the role of government in the economy, including taxation, government spending, and transfer payments.

-

No savings: Households are assumed to spend all their income on goods and services. There is no saving or investment in this simplified model.

-

No depreciation: The model doesn't account for the wear and tear of capital goods over time.

-

No inventories: Firms are assumed to sell all their output directly to consumers; there's no storage of unsold goods.

These assumptions make the model easier to understand and visualize. However, they also limit its realism and applicability to real-world situations.

Limitations of the Simple Circular Flow Model

The limitations of the simple circular flow model stem directly from its simplifying assumptions. These limitations include:

-

Oversimplification of reality: The model significantly simplifies the complexities of a real-world economy. The absence of government, savings, investment, and international trade makes it inadequate for representing many real-world scenarios.

-

Ignoring the role of financial institutions: The model doesn't account for the role of banks and other financial institutions in channeling savings into investment.

-

Neglecting the informal economy: The model doesn't capture the significant economic activity that takes place in the informal sector, where transactions often go unrecorded.

-

Limited scope for analyzing economic problems: The model is not well-suited for analyzing complex economic issues like inflation, unemployment, and economic growth.

Extensions of the Simple Circular Flow Model

To address the limitations of the simple model, economists have developed more complex extensions:

-

Adding a government sector: This extension introduces government spending, taxation, and transfer payments into the model. Government spending increases aggregate demand, while taxation reduces disposable income.

-

Adding a financial sector: This extension incorporates savings and investment. Households save a portion of their income, which is channeled to firms through financial institutions for investment purposes. This allows for capital accumulation and economic growth.

-

Adding an external sector: This extension accounts for international trade, incorporating exports and imports into the model. Exports add to aggregate demand, while imports reduce it.

The Circular Flow Model and Macroeconomic Concepts

The circular flow model, even in its simplest form, provides a foundational understanding of several key macroeconomic concepts:

-

Aggregate demand and aggregate supply: The circular flow model helps visualize the interaction between aggregate demand (total spending on goods and services) and aggregate supply (total production of goods and services). Changes in either aggregate demand or aggregate supply will impact the equilibrium level of output and prices.

-

National income accounting: The model is closely related to national income accounting, providing a framework for understanding the calculation of gross domestic product (GDP) and other national income measures.

-

Economic growth: The extended model with saving and investment helps explain how economic growth occurs through capital accumulation. Investment increases the productive capacity of the economy, leading to higher output and income.

-

Fiscal policy: The model extended to include government illustrates how fiscal policy (government spending and taxation) can affect the economy.

Applying the Circular Flow Model

The circular flow model can be applied in various contexts, including:

-

Analyzing the impact of government policies: The model can be used to analyze the effects of changes in government spending, taxation, and other policies on the economy. For example, an increase in government spending will boost aggregate demand, while an increase in taxes will reduce disposable income and aggregate demand.

-

Understanding economic fluctuations: The model helps explain how fluctuations in aggregate demand and aggregate supply can lead to economic booms and recessions. For instance, a decrease in consumer confidence can lead to a decrease in consumer spending, resulting in a decrease in aggregate demand and a potential recession.

-

Evaluating the impact of technological advancements: The model can be used to analyze the impact of technological innovations on productivity and economic growth. Technological advancements can increase the efficiency of production, leading to higher output and income.

-

Analyzing the effects of global events: The model can be used to analyze the effects of global events, such as wars or natural disasters, on the economy. These events can disrupt the circular flow of goods, services, and money, impacting economic activity.

Conclusion

The simple circular flow model, while a simplification of a complex reality, provides a valuable framework for understanding the fundamental interactions between households and firms in a market economy. Its extensions allow for a more comprehensive analysis of the role of government, financial institutions, and international trade. By grasping this basic model and its extensions, you gain a crucial foundation for comprehending more advanced macroeconomic concepts and analyzing a wide range of economic issues. The ability to apply this model to real-world scenarios enhances your economic literacy and provides a valuable tool for understanding the dynamics of our interconnected world.

Latest Posts

Latest Posts

-

A Positive Return On Investment For Education Happens When

Mar 17, 2025

-

What Is The Value Of I

Mar 17, 2025

-

The Accounts In The Ledger Of Monroe Entertainment Co

Mar 17, 2025

-

A Process Cost Accounting System Is Most Appropriate When

Mar 17, 2025

-

An Example Of A Breach Of Ephi Is

Mar 17, 2025

Related Post

Thank you for visiting our website which covers about The Simple Circular Flow Model Shows That . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.