The Mutual Interdependence That Characterizes Oligopoly Arises Because

Holbox

Mar 16, 2025 · 6 min read

Table of Contents

The Mutual Interdependence That Characterizes Oligopoly Arises Because...

Oligopoly, a market structure dominated by a few powerful firms, is characterized by a fascinating dynamic: mutual interdependence. Unlike perfect competition or monopolies, where firms can largely act independently, oligopolists are acutely aware of each other's actions and reactions. This interdependence arises from several key factors, profoundly shaping their pricing strategies, output decisions, and overall market behavior. Understanding these factors is crucial to grasping the complexities of oligopolistic markets.

The Foundation: Few Sellers, Significant Market Power

The very definition of oligopoly lays the groundwork for interdependence. A small number of firms control a significant portion of the market. This concentrated market power means that the actions of any single firm can have a noticeable impact on the market as a whole, and, critically, on the profits of its competitors. This contrasts sharply with perfect competition, where numerous small firms have negligible individual market impact.

The Ripple Effect: Actions Have Consequences

Imagine one firm in an oligopoly decides to lower its prices. This isn't simply a matter of attracting more customers; it's a direct challenge to its competitors. They'll likely respond, perhaps by lowering their prices as well, initiating a price war. Conversely, if a firm decides to increase its output, it could flood the market, driving down prices for everyone. This is the essence of interdependence: one firm's actions directly influence the choices and outcomes of its rivals.

Key Factors Driving Mutual Interdependence

Several factors contribute to the high degree of interdependence seen in oligopolistic markets:

1. High Barriers to Entry

High barriers to entry, such as significant capital requirements, economies of scale, patents, or government regulations, prevent new firms from easily entering the market. This reinforces the dominance of existing firms and intensifies the competition between them. Since there are few potential entrants, existing firms are more focused on outmaneuvering each other rather than worrying about new competitors.

2. Product Differentiation and Branding

Oligopolies often involve products that are differentiated, either through branding, quality, features, or marketing. This differentiation allows firms to exert some control over pricing, but it also heightens the interdependence. A competitor's advertising campaign, new product launch, or change in pricing strategy can directly impact the demand for a firm's own product.

3. Strategic Interactions and Game Theory

The interaction between oligopolists is often analyzed using game theory. This approach highlights how firms make decisions based on anticipating the reactions of their competitors. The classic example is the Prisoner's Dilemma, which illustrates how even when cooperation would be mutually beneficial, firms might end up in a less favorable outcome due to the fear of being exploited by their rivals. This fear of being undercut or outmaneuvered is a constant driver of interdependent decision-making.

4. Information Sharing and Signaling

Although not always explicit collusion, oligopolistic firms often engage in subtle forms of information sharing. This might involve monitoring each other's pricing strategies, advertising campaigns, or production levels. Price leadership, where one firm sets the price and others follow, is a clear example of implicit coordination born from interdependence. Actions are also used as signals. For instance, a price cut might signal a firm's intention to gain market share, prompting retaliatory action from competitors.

Manifestations of Mutual Interdependence: Pricing Strategies and Models

The mutual interdependence of oligopolies leads to several distinct pricing strategies and models:

1. Price Leadership

As mentioned earlier, one firm, often the largest or most efficient, acts as a price leader. It sets the price, and other firms follow, either implicitly or explicitly. This isn't necessarily collusive; it's a practical response to the risk of price wars. If a firm deviates, it risks losing market share or triggering a price war that hurts everyone.

2. Price Wars

When firms aggressively compete on price, often triggered by a price cut by one firm, a price war can erupt. This destructive competition can drive prices down to very low levels, squeezing profit margins for all participants. Price wars are a dramatic illustration of the destructive potential of unchecked interdependence.

3. Kinked Demand Curve

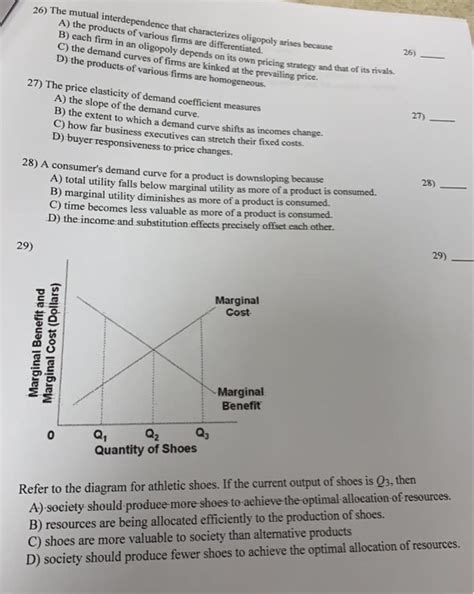

The kinked demand curve model suggests that oligopolists are reluctant to raise prices for fear that competitors won't follow, leading to lost market share. However, they're also hesitant to lower prices because competitors are likely to retaliate, triggering a price war. This leads to a relatively stable price range, but it also limits price flexibility as a competitive tool.

4. Cartels and Collusion

While illegal in most jurisdictions, cartels represent a more explicit form of collusion where firms agree to coordinate their pricing and output decisions. Cartels aim to maximize joint profits by restricting output and raising prices. However, the inherent instability of cartels – the temptation to cheat and gain individual advantage – highlights the inherent difficulties in sustaining cooperation even when it appears mutually beneficial.

Beyond Pricing: Non-Price Competition

Mutual interdependence in oligopolies extends beyond pricing. Firms often engage in intense non-price competition:

1. Product Differentiation

Creating unique product features, branding, and marketing to distinguish themselves from competitors is a vital strategy. This allows firms to compete on aspects other than price, mitigating the risks of price wars.

2. Advertising and Marketing

Advertising and marketing campaigns are often used to create brand loyalty and build market share. This competitive aspect further intensifies the interdependence, as firms react and respond to each other's marketing efforts.

3. Innovation and Research and Development (R&D)

Investing in R&D to develop new products and technologies can be a powerful way to gain a competitive edge and differentiate a firm from its rivals. The resulting innovation race amongst firms showcases the dynamic nature of their mutual interdependence.

4. Strategic Alliances and Mergers and Acquisitions (M&A)

Firms might form strategic alliances to share resources or technologies, or pursue M&A activity to consolidate market power and reduce the number of competitors. These strategic moves are carefully considered in the context of the overall competitive landscape and demonstrate the deeply interwoven nature of the relationships.

The Long-Term Implications: Stability and Innovation

The constant interplay of mutual interdependence in oligopolistic markets has profound implications for both market stability and innovation.

On one hand, the awareness of mutual reliance can lead to a degree of price stability and reduced risk of ruinous price wars. Firms might be more cautious in their actions, leading to a more predictable market environment.

On the other hand, the intense competition fostered by interdependence can drive innovation. Firms are constantly seeking ways to differentiate their products, improve efficiency, and gain a competitive edge. This can lead to faster technological advancements and improved products for consumers.

However, this innovative drive can also be hampered by the fear of aggressive responses from competitors, or the prioritization of market share protection over bold innovation. The balancing act between stability and innovation is a constant challenge for oligopolists.

Conclusion: A Complex and Dynamic Landscape

The mutual interdependence that characterizes oligopoly arises from the inherent nature of a market dominated by a few powerful players. High barriers to entry, product differentiation, and the need for strategic interactions create a complex and dynamic environment where each firm's actions directly affect its rivals. Understanding the factors driving this interdependence and the resulting pricing strategies and competitive tactics is key to comprehending the complexities of oligopolistic markets, both their potential for stability and their capacity for innovation and disruption. The constant game of strategy and counter-strategy shapes not only the fortunes of individual firms but also the overall market dynamics and the experience of consumers.

Latest Posts

Latest Posts

-

When Major Changes Are Initiated In Organizations

Mar 16, 2025

-

Consider The Cyclohexane Framework In A Chair Conformation

Mar 16, 2025

-

The Account Allowance For Uncollectible Accounts Is Classified As

Mar 16, 2025

-

Studying Marketing Should Help You To Blank

Mar 16, 2025

-

Licensed Defensive Driving Instructors Are Available To Help You

Mar 16, 2025

Related Post

Thank you for visiting our website which covers about The Mutual Interdependence That Characterizes Oligopoly Arises Because . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.