The Invisible Hand Concept Suggests That

Holbox

Mar 19, 2025 · 7 min read

Table of Contents

The Invisible Hand: How Self-Interest Drives Societal Benefit

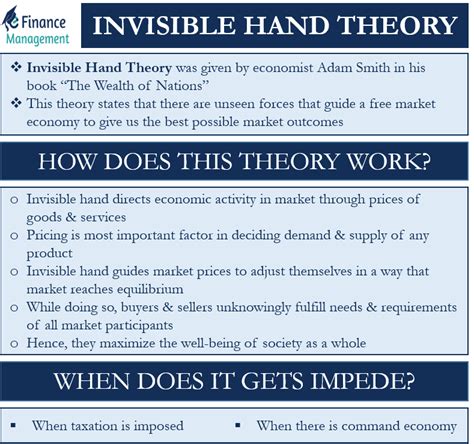

The concept of the "invisible hand" is arguably one of the most influential and debated ideas in economics. First introduced by Adam Smith in his seminal work, The Wealth of Nations (1776), it suggests that individuals acting in their own self-interest, within a free market, can unintentionally create positive outcomes for society as a whole. This seemingly paradoxical notion has sparked centuries of discussion, with proponents emphasizing its efficiency and critics highlighting its potential for inequality and market failures. This article will delve deep into the invisible hand concept, exploring its mechanics, implications, and limitations.

Understanding the Invisible Hand: A Deeper Dive

Smith's invisible hand wasn't a literal entity; rather, it's a metaphor for the unintended social benefits arising from individual pursuit of self-interest. Imagine a baker, for example. The baker doesn't bake bread out of altruism; they do it to make a profit. They invest their time, energy, and resources to produce bread because it's in their self-interest to do so. However, in the process of seeking their own gain, they also satisfy the consumer demand for bread. This seemingly simple act, repeated millions of times across an economy, creates a complex web of production and consumption that efficiently allocates resources and benefits the entire society.

The Mechanics of the Invisible Hand

The invisible hand operates through several key mechanisms:

-

Price Signals: Prices act as signals in the market. When demand for a good increases, the price rises, incentivizing producers to increase supply. Conversely, when supply exceeds demand, prices fall, signaling producers to reduce output. This dynamic price adjustment mechanism guides resources towards where they are most needed.

-

Competition: Competition among producers forces them to become more efficient and innovative. To survive, businesses must offer goods and services of comparable quality at competitive prices. This constant pressure to improve benefits consumers through lower prices, better quality, and a wider variety of choices.

-

Self-Interest as a Motivator: The invisible hand relies on self-interest as a powerful motivator. Individuals are incentivized to work hard, innovate, and invest their resources because they stand to gain personally. This self-interest, when channeled through market mechanisms, drives economic growth and prosperity.

-

Specialization and Division of Labor: The invisible hand facilitates specialization and division of labor. By focusing on specific tasks or industries, individuals become more efficient and productive. This specialization leads to increased output and overall economic growth.

The Benefits of the Invisible Hand: A Flourishing Market

The invisible hand, when functioning effectively, can lead to a number of significant benefits:

-

Increased Efficiency: By allowing prices to adjust freely and competition to thrive, the invisible hand encourages efficient resource allocation. Resources are channeled towards the production of goods and services that consumers value most.

-

Economic Growth: The pursuit of self-interest, coupled with competition and innovation, stimulates economic growth. New businesses emerge, existing businesses expand, and overall productivity increases.

-

Consumer Sovereignty: Consumers, through their purchasing decisions, dictate what is produced and at what price. This consumer sovereignty ensures that businesses respond to the needs and wants of the marketplace.

-

Innovation and Technological Advancement: The competitive pressure to gain market share encourages businesses to innovate and develop new technologies. This continuous drive for improvement leads to technological progress that benefits society as a whole.

Limitations and Criticisms of the Invisible Hand: Where it Falls Short

While the invisible hand has demonstrably positive effects, it's crucial to acknowledge its limitations and the situations where it fails to deliver optimal societal outcomes.

-

Market Failures: The invisible hand operates most effectively in perfectly competitive markets. However, real-world markets often deviate from this ideal. Market failures, such as monopolies, externalities (e.g., pollution), and information asymmetry, can lead to inefficient resource allocation and suboptimal outcomes.

-

Income Inequality: Critics argue that the invisible hand can exacerbate income inequality. Those with more resources may accumulate more wealth, leading to a widening gap between the rich and the poor. This can result in social unrest and instability.

-

Public Goods: The invisible hand is less effective in providing public goods, such as national defense or clean air. These goods are often non-excludable (difficult to prevent people from consuming them even if they don't pay) and non-rivalrous (one person's consumption doesn't diminish another's), making it difficult for private markets to provide them efficiently.

-

Information Asymmetry: The invisible hand assumes perfect information – that buyers and sellers have equal access to all relevant information. However, in reality, information is often asymmetrically distributed, leading to market inefficiencies. For instance, a used car seller might possess more information about a car's condition than the buyer, potentially leading to an unfair transaction.

-

Externalities: Externalities are the costs or benefits of a transaction that are borne by a third party not directly involved in the transaction. For example, a factory polluting a river imposes a negative externality on the community living downstream. The invisible hand doesn't account for these external costs or benefits, leading to market inefficiencies and potentially harming the environment and public health.

The Role of Government Intervention: Balancing the Market

Given the limitations of the invisible hand, many economists advocate for a role for government intervention in the economy. Government intervention isn't necessarily antithetical to the concept of the invisible hand; rather, it can be seen as a mechanism to correct market failures and ensure that the market functions more effectively.

Governments can play several crucial roles:

-

Regulation: Governments can regulate markets to prevent monopolies, control pollution, and ensure consumer safety. This regulation can create a fairer and more efficient market environment.

-

Provision of Public Goods: Governments are responsible for providing public goods that private markets are unable or unwilling to provide. This includes national defense, infrastructure, education, and healthcare.

-

Social Safety Nets: Governments can implement social safety nets, such as unemployment insurance and welfare programs, to alleviate income inequality and provide support for those in need.

-

Enforcement of Contracts: Governments provide the legal framework for enforcing contracts, which is crucial for the smooth functioning of markets. This ensures that businesses and individuals can trust each other and engage in transactions with confidence.

The Invisible Hand in the 21st Century: Adapting to Modern Challenges

The invisible hand remains a powerful and relevant concept in the 21st century, even as the global economy has become increasingly complex and interconnected. However, its application must be nuanced to account for contemporary challenges such as:

-

Globalization: Globalization has intensified competition and increased the interconnectedness of markets. This requires a more sophisticated understanding of the invisible hand's effects across national borders.

-

Technological Disruption: Rapid technological advancements are constantly reshaping industries and creating new market dynamics. Understanding how the invisible hand operates in the face of these disruptions is critical.

-

Climate Change: Climate change presents a significant market failure, requiring government intervention and international cooperation to address its negative externalities.

-

Data Privacy and Cybersecurity: The digital economy poses unique challenges to the invisible hand, raising concerns about data privacy, cybersecurity, and the potential for market manipulation.

Conclusion: A Balanced Perspective

The invisible hand is a powerful metaphor that highlights the remarkable ability of free markets to generate societal benefits through the pursuit of individual self-interest. However, it's not a panacea. Market failures, income inequality, and the need for public goods necessitate government intervention to correct inefficiencies and ensure a more equitable and sustainable outcome. A balanced perspective, acknowledging both the strengths and limitations of the invisible hand, is essential for navigating the complexities of the modern global economy. The challenge lies in finding the optimal balance between free markets and government intervention – a delicate dance that requires constant adaptation and ongoing debate. The invisible hand, while a potent force, needs a visible guiding hand to ensure its benefits are widely shared and its limitations addressed.

Latest Posts

Latest Posts

-

How Is The Economic Surplus Generated By A Decision Calculated

Mar 19, 2025

-

Add Curved Arrows To Draw Step 1 Of The Mechanism

Mar 19, 2025

-

Microsoft Office 2016 A Skills Approach

Mar 19, 2025

-

A Nurse Is Caring For A Client Who Has Osteoporosis

Mar 19, 2025

-

In Which Situation Is A Combining Vowel Never Used

Mar 19, 2025

Related Post

Thank you for visiting our website which covers about The Invisible Hand Concept Suggests That . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.