How Is The Economic Surplus Generated By A Decision Calculated

Holbox

Mar 19, 2025 · 6 min read

Table of Contents

How is the Economic Surplus Generated by a Decision Calculated?

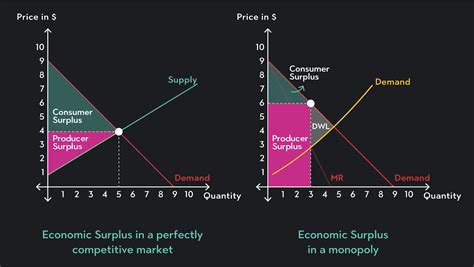

Understanding economic surplus is crucial for making sound economic decisions, whether you're a consumer, a business, or a government. Economic surplus, also known as total welfare, represents the total benefit society receives from a particular economic activity. It's the difference between the total benefit received and the total cost incurred. Calculating this surplus requires understanding several key concepts and applying them to different scenarios. This article will delve into the intricacies of calculating economic surplus, examining different approaches and considering various factors that can influence its value.

Defining Economic Surplus: Consumer and Producer Surplus

Economic surplus is the sum of consumer surplus and producer surplus. Let's break down each component:

Consumer Surplus

Consumer surplus measures the difference between what consumers are willing to pay for a good or service and what they actually pay. It represents the net benefit consumers receive from purchasing a good or service at a given market price. Imagine a consumer who would be willing to pay $100 for a new phone but finds it on sale for $75. Their consumer surplus is $25 ($100 - $75). This surplus represents the added value the consumer receives beyond the price they paid.

Producer Surplus

Producer surplus, conversely, represents the difference between the price producers receive for a good or service and the minimum price they would be willing to accept to supply it. It reflects the profit earned by producers after accounting for their costs. A producer who can sell a product for $50 but would be willing to sell it for $30 earns a producer surplus of $20 ($50 - $30). This surplus shows the profit margin the producer enjoys.

Calculating Economic Surplus: A Simple Example

Let's consider a simple market for apples. Suppose the market price is $2 per apple. We have the following demand and supply schedules:

| Price ($) | Quantity Demanded | Quantity Supplied |

|---|---|---|

| 3 | 10 | 20 |

| 2 | 20 | 20 |

| 1 | 30 | 10 |

At the market price of $2, 20 apples are traded. To calculate the economic surplus:

-

Consumer Surplus: We need to find the area of the triangle representing consumer surplus. The base of the triangle is the quantity traded (20 apples). The height is the difference between the maximum price consumers are willing to pay (which we can infer from the demand curve, $3) and the market price ($2). Therefore, the height is $1. The area of the triangle (consumer surplus) is (1/2) * base * height = (1/2) * 20 * $1 = $10.

-

Producer Surplus: Similarly, we find the area of the triangle representing producer surplus. The base is the quantity traded (20 apples). The height is the difference between the market price ($2) and the minimum price producers are willing to accept (which we can infer from the supply curve, $1). The height is $1. The area of the triangle (producer surplus) is (1/2) * 20 * $1 = $10.

-

Total Economic Surplus: The total economic surplus is the sum of consumer and producer surplus: $10 + $10 = $20. This represents the total benefit society receives from the apple market at the given price.

Beyond Simple Markets: More Complex Calculations

The simple example above assumes linear supply and demand curves. However, in reality, these curves can be non-linear, making calculations more complex. We might need to employ integral calculus to accurately determine the areas under the curves.

Factors Affecting Economic Surplus

Several factors can influence the level of economic surplus generated by a decision:

-

Market Efficiency: Efficient markets, where supply and demand are balanced, generally lead to higher economic surplus. Government interventions, such as price ceilings or floors, can distort the market and reduce the surplus.

-

Externalities: Externalities are costs or benefits that affect parties not directly involved in a transaction. Negative externalities (like pollution) reduce the total surplus, while positive externalities (like education) increase it.

-

Information Asymmetry: When one party has more information than the other, it can lead to inefficient outcomes and lower economic surplus. For example, if a seller knows a product is defective but the buyer doesn't, the buyer might overpay, reducing their consumer surplus.

-

Transaction Costs: Costs associated with making a transaction (e.g., search costs, negotiation costs) can also affect the economic surplus. Higher transaction costs tend to reduce the surplus.

-

Market Power: Firms with market power (monopolies, oligopolies) can restrict output and charge higher prices, leading to a lower economic surplus compared to a perfectly competitive market.

Applications of Economic Surplus Analysis

Economic surplus analysis has broad applications in various fields:

-

Public Policy: Governments use it to evaluate the impact of policies on social welfare. For instance, they might assess the effects of a carbon tax on environmental protection and economic efficiency.

-

Cost-Benefit Analysis: Economic surplus analysis forms the foundation of cost-benefit analysis, used to determine whether a project (e.g., building a new road, implementing a new regulation) is worthwhile.

-

Business Decision-Making: Firms can use it to analyze the profitability of different investment strategies or pricing decisions.

-

Environmental Economics: It plays a significant role in assessing the value of environmental goods and services. For instance, it helps to determine the economic benefits of preserving a rainforest.

Advanced Techniques for Calculating Economic Surplus

For complex scenarios, more advanced techniques are often necessary:

-

Discrete Choice Models: These models are used when consumers choose among multiple options, such as different transportation modes or brands of a product.

-

Hedonic Pricing Models: These are used to estimate the value of goods or services that have multiple attributes, such as a house (location, size, amenities).

-

Contingent Valuation: This method involves asking individuals how much they would be willing to pay for a good or service, such as cleaner air.

-

Revealed Preference Methods: These rely on observed market behavior to infer the value of goods or services.

Conclusion

Calculating economic surplus is essential for understanding the overall welfare impact of economic decisions. While simple markets allow for straightforward calculation using geometric representations, more complex scenarios may require sophisticated mathematical techniques. Understanding the components of consumer and producer surplus, along with the factors influencing them, empowers individuals, businesses, and policymakers to make informed decisions that maximize societal benefits. By recognizing the limitations of simple models and employing more advanced techniques when necessary, a comprehensive and accurate assessment of economic surplus can be achieved, ultimately leading to better resource allocation and improved societal welfare. Further research into dynamic models and incorporating factors such as risk and uncertainty can lead to even more refined and robust methods for analyzing economic surplus in the future.

Latest Posts

Latest Posts

-

Social Support Can Lead To All Of The Following Except

Mar 19, 2025

-

What Is The Difference Between Tuff And Tough

Mar 19, 2025

-

Based On This Model Households Earn Income When

Mar 19, 2025

-

Which Of The Following Incorporates Best Practices In Email Design

Mar 19, 2025

-

How Are Profits Used In A For Profit Health Care Organization

Mar 19, 2025

Related Post

Thank you for visiting our website which covers about How Is The Economic Surplus Generated By A Decision Calculated . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.