The Following Items Are Reported On A Company's Balance Sheet

Holbox

Mar 29, 2025 · 7 min read

Table of Contents

- The Following Items Are Reported On A Company's Balance Sheet

- Table of Contents

- Understanding a Company's Balance Sheet: A Deep Dive into Reported Items

- The Fundamental Accounting Equation: The Foundation of the Balance Sheet

- Assets: What a Company Owns

- Current Assets: Short-Term Resources

- Non-Current Assets: Long-Term Investments

- Liabilities: What a Company Owes

- Current Liabilities: Short-Term Obligations

- Non-Current Liabilities: Long-Term Obligations

- Equity: Owners' Investment

- Analyzing the Balance Sheet: Key Ratios and Indicators

- Conclusion: A Holistic View of Financial Health

- Latest Posts

- Latest Posts

- Related Post

Understanding a Company's Balance Sheet: A Deep Dive into Reported Items

The balance sheet, a cornerstone of financial statements, offers a snapshot of a company's financial health at a specific point in time. Unlike the income statement, which tracks performance over a period, the balance sheet presents a static view of assets, liabilities, and equity. Understanding the items reported on a balance sheet is crucial for investors, creditors, and anyone analyzing a company's financial standing. This comprehensive guide will delve into the various components, explaining their significance and how they interact to paint a complete picture of the company's financial position.

The Fundamental Accounting Equation: The Foundation of the Balance Sheet

Before diving into specific items, it's crucial to grasp the fundamental accounting equation: Assets = Liabilities + Equity. This equation underpins the entire balance sheet. It signifies that everything a company owns (assets) is financed either by what it owes to others (liabilities) or by the owners' investment (equity). This equation must always balance; any discrepancy indicates an error in the financial reporting.

Assets: What a Company Owns

Assets represent a company's resources that have economic value and are expected to provide future benefits. They are categorized into current assets and non-current (or long-term) assets based on their liquidity – how quickly they can be converted into cash.

Current Assets: Short-Term Resources

Current assets are expected to be converted into cash or used up within one year or the company's operating cycle, whichever is longer. These include:

-

Cash and Cash Equivalents: This represents the most liquid asset, including readily available cash, bank balances, and short-term, highly liquid investments like treasury bills. Its significance lies in a company's immediate liquidity and ability to meet short-term obligations.

-

Accounts Receivable: This represents money owed to the company by its customers for goods or services sold on credit. Analyzing the aging of accounts receivable – how long it takes customers to pay – is crucial to assess the creditworthiness of the company's clients and the potential for bad debts. A high percentage of overdue receivables signals potential financial problems.

-

Inventory: This includes raw materials, work-in-progress, and finished goods held for sale. The valuation of inventory is critical; different methods (FIFO, LIFO, weighted average) can significantly impact the reported value and profitability. High inventory levels might indicate weak sales or potential obsolescence.

-

Prepaid Expenses: These are expenses paid in advance, such as rent, insurance, or subscriptions. They are considered assets because they represent future benefits.

Non-Current Assets: Long-Term Investments

Non-current assets are long-term resources that are not expected to be converted into cash within one year. These include:

-

Property, Plant, and Equipment (PP&E): This encompasses tangible assets used in the company's operations, such as land, buildings, machinery, and equipment. These assets are usually depreciated over their useful lives, reflecting their gradual decline in value. The depreciation method used affects the reported value and profitability.

-

Intangible Assets: These are non-physical assets with economic value, such as patents, copyrights, trademarks, and goodwill. Intangible assets are often amortized over their useful lives, similar to depreciation for tangible assets. Goodwill represents the excess of the purchase price of a company over the fair value of its identifiable net assets.

-

Long-Term Investments: These include investments in other companies' securities or long-term projects that are not expected to be liquidated within one year. These investments can generate income or provide strategic advantages.

-

Goodwill: This is an intangible asset that represents the excess of the purchase price of a business over the fair value of its identifiable net assets. It reflects the value of intangible assets such as brand reputation, customer relationships, and management expertise.

Liabilities: What a Company Owes

Liabilities represent a company's obligations to others, requiring future outflow of economic benefits. Similar to assets, they are categorized into current and non-current liabilities based on their maturity.

Current Liabilities: Short-Term Obligations

Current liabilities are obligations due within one year or the operating cycle. These include:

-

Accounts Payable: This represents money owed to suppliers for goods or services purchased on credit. Monitoring accounts payable helps assess the company's payment practices and relationships with suppliers.

-

Short-Term Debt: This includes loans and other obligations due within one year. This shows the company's reliance on short-term financing and its ability to manage its short-term debt obligations.

-

Salaries Payable: This represents the wages and salaries owed to employees for work performed but not yet paid.

-

Interest Payable: This represents interest accrued but not yet paid on loans or other debt instruments.

-

Taxes Payable: This represents taxes owed to government agencies.

Non-Current Liabilities: Long-Term Obligations

Non-current liabilities are obligations due beyond one year. These include:

-

Long-Term Debt: This includes loans, bonds, and other debt instruments with maturities exceeding one year. This reflects the company's capital structure and its long-term financing strategy. The terms of the debt – interest rates, maturity dates, and covenants – are important factors to consider.

-

Deferred Revenue: This represents payments received for goods or services that have not yet been delivered or performed. It's a liability because the company owes the performance of these services or delivery of goods.

-

Pension Liabilities: These represent obligations to employees for future pension benefits. The calculation of pension liabilities can be complex and depends on various actuarial assumptions.

Equity: Owners' Investment

Equity represents the owners' residual interest in the company's assets after deducting its liabilities. It signifies the net worth of the company. Key components of equity include:

-

Common Stock: This represents the ownership stake held by shareholders. The number of outstanding shares and their par value are reported.

-

Retained Earnings: This represents the accumulated profits of the company that have not been distributed as dividends. It reflects the company's profitability and reinvestment strategy.

-

Treasury Stock: This represents shares of the company's own stock that have been repurchased from the market. Treasury stock reduces the number of outstanding shares.

-

Other Comprehensive Income (OCI): This includes gains and losses that are not included in net income, such as unrealized gains or losses on certain investments.

Analyzing the Balance Sheet: Key Ratios and Indicators

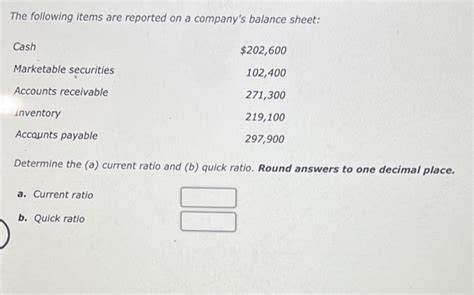

Analyzing a company's balance sheet involves comparing various items and calculating key ratios to assess its financial health. Some important ratios include:

-

Current Ratio: This assesses a company's short-term liquidity by comparing current assets to current liabilities. A higher ratio generally indicates better short-term liquidity.

-

Quick Ratio (Acid-Test Ratio): Similar to the current ratio, but excludes inventory from current assets, providing a more conservative measure of short-term liquidity.

-

Debt-to-Equity Ratio: This measures the proportion of a company's financing that comes from debt versus equity. A higher ratio suggests higher financial risk.

-

Working Capital: This represents the difference between current assets and current liabilities. Positive working capital generally indicates sufficient resources to meet short-term obligations.

Conclusion: A Holistic View of Financial Health

The balance sheet, though a static representation, provides crucial insights into a company's financial health. By carefully examining the assets, liabilities, and equity, along with calculating key ratios, investors, creditors, and analysts can gain a comprehensive understanding of the company's financial position, its liquidity, its solvency, and its overall financial strength. Understanding the interplay between these components allows for informed decisions regarding investment, lending, or other business relationships. Regularly reviewing the balance sheet, alongside other financial statements, is vital for effective financial analysis and decision-making. Remember that the balance sheet is only one piece of the puzzle; it should always be considered in conjunction with the income statement and cash flow statement for a complete picture of the company's financial performance and health.

Latest Posts

Latest Posts

-

Overhead May Be Applied Based On

Apr 02, 2025

-

Knowledge Courage Patience And Honesty Are Examples Of

Apr 02, 2025

-

What Is The Function Of The Highlighted Organelle

Apr 02, 2025

-

Which Method Or Operator Can Be Used To Concatenate Lists

Apr 02, 2025

-

Which Of The Following Is Not A Component Ingredient Rok

Apr 02, 2025

Related Post

Thank you for visiting our website which covers about The Following Items Are Reported On A Company's Balance Sheet . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.