The Following Costs Were Incurred In May

Holbox

Mar 28, 2025 · 5 min read

Table of Contents

- The Following Costs Were Incurred In May

- Table of Contents

- The Following Costs Were Incurred in May: A Comprehensive Guide to Cost Accounting and Analysis

- Categorizing Costs Incurred in May

- 1. Direct Costs:

- 2. Indirect Costs (Overhead Costs):

- 3. Fixed Costs:

- 4. Variable Costs:

- 5. Semi-Variable Costs:

- Analyzing Costs Incurred in May: Methods and Tools

- 1. Cost Accounting Systems:

- 2. Break-Even Analysis:

- 3. Cost-Volume-Profit (CVP) Analysis:

- 4. Variance Analysis:

- 5. Activity-Based Costing (ABC):

- Utilizing Cost Information for Improved Profitability

- Beyond May: Continuous Monitoring and Improvement

- Conclusion: Mastering Cost Analysis for Business Success

- Latest Posts

- Latest Posts

- Related Post

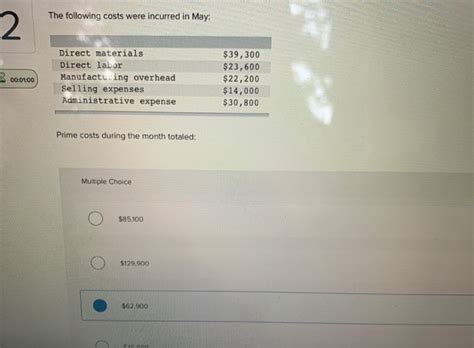

The Following Costs Were Incurred in May: A Comprehensive Guide to Cost Accounting and Analysis

Understanding your business's financial health requires a deep dive into your expenses. Simply knowing that "costs were incurred in May" is insufficient. This article delves into the intricacies of cost accounting, focusing on how to analyze and categorize costs incurred in a given month—May, in this case—to make informed business decisions. We'll explore various cost categories, methods of analysis, and how to utilize this information for improved profitability.

Categorizing Costs Incurred in May

Before we analyze specific costs, it's crucial to understand the different categories they can fall into. This categorization is fundamental for effective cost accounting and management.

1. Direct Costs:

Direct costs are directly attributable to the production of goods or services. These costs are easily traceable to specific products or projects. In May, examples could include:

- Direct Materials: Raw materials used in production. For a bakery, this would be flour, sugar, eggs, etc. Quantify exactly how much of each material was used in May.

- Direct Labor: Wages paid to employees directly involved in production. This includes bakers' salaries and wages, not administrative staff. Detailed payroll records from May are essential here.

2. Indirect Costs (Overhead Costs):

Indirect costs, also known as overhead costs, are not directly traceable to a specific product or service. They support the production process but aren't directly involved in creating the goods. May's indirect costs might include:

- Rent: The cost of renting the factory or office space.

- Utilities: Electricity, gas, and water bills.

- Depreciation: The reduction in value of assets over time (e.g., machinery). Accurately calculate depreciation using a consistent method.

- Insurance: Premiums paid for business insurance.

- Maintenance and Repairs: Costs of maintaining equipment and facilities.

- Salaries of Support Staff: Wages for administrative staff, sales personnel, and other support roles.

3. Fixed Costs:

Fixed costs remain relatively constant regardless of the production volume. These costs are incurred even if there's no production. Examples from May include:

- Rent (as above): Rent is usually a fixed monthly expense.

- Salaries of Administrative Staff (as above): Their salaries are generally fixed unless there are changes in employment.

- Insurance Premiums (as above): These are usually paid on a fixed schedule.

4. Variable Costs:

Variable costs fluctuate directly with the production volume. Higher production leads to higher variable costs, and vice versa. In May, examples include:

- Direct Materials (partially): The more goods produced, the more raw materials are consumed.

- Direct Labor (partially): Overtime pay or additional labor hired due to increased production.

- Utilities (partially): Higher production often leads to increased energy consumption.

5. Semi-Variable Costs:

Semi-variable costs have both fixed and variable components. A portion of the cost remains constant, while another part changes with the production volume. An example from May could be:

- Telephone Bills: There's a fixed monthly charge, plus variable charges based on usage.

Analyzing Costs Incurred in May: Methods and Tools

Analyzing the costs incurred in May requires a systematic approach. Several methods can be used to gain valuable insights:

1. Cost Accounting Systems:

Implementing a robust cost accounting system is vital. This involves meticulously tracking and recording all costs, categorizing them as discussed above, and using appropriate software for analysis and reporting.

2. Break-Even Analysis:

This helps determine the production volume at which total revenue equals total costs (the break-even point). Analyzing May's costs in conjunction with revenue from the same period allows for a detailed break-even analysis. This helps determine profitability at various production levels and can be a key tool for pricing decisions.

3. Cost-Volume-Profit (CVP) Analysis:

CVP analysis examines the relationship between costs, volume, and profit. By analyzing May's data, you can predict profit levels at different sales volumes and identify potential areas for improvement.

4. Variance Analysis:

This involves comparing actual costs incurred in May against budgeted or planned costs. Significant variances highlight potential inefficiencies or unexpected expenses that need attention. For example, a large variance in direct materials cost may indicate a need to negotiate better prices with suppliers or improve inventory management.

5. Activity-Based Costing (ABC):

ABC assigns costs to activities and then to products based on their consumption of those activities. This is particularly useful for businesses with multiple products or services where traditional cost allocation methods might be inaccurate.

Utilizing Cost Information for Improved Profitability

The analysis of costs incurred in May provides valuable insights for improving profitability:

- Cost Reduction: Identify areas where costs can be reduced without compromising quality or production. For example, negotiating better prices with suppliers, improving energy efficiency, or streamlining operations.

- Pricing Strategies: Understanding cost structures allows for more informed pricing decisions. You can determine the minimum price needed to cover costs and achieve a desired profit margin.

- Process Improvement: Analyze variances to pinpoint bottlenecks or inefficiencies in the production process. This allows for targeted improvements that reduce costs and enhance productivity.

- Inventory Management: Careful analysis of direct materials costs can highlight areas where inventory management can be improved, minimizing waste and storage costs.

- Investment Decisions: Cost analysis helps inform decisions regarding investments in new equipment, technology, or other capital expenditures.

Beyond May: Continuous Monitoring and Improvement

Analyzing costs incurred in May is just one step. Continuous monitoring and analysis of costs throughout the year are essential for sound financial management. Regular cost reports, coupled with periodic reviews and adjustments to budgeting and forecasting, ensure a proactive approach to cost control. Consider implementing a monthly or quarterly cost review process to ensure your business remains financially healthy and profitable.

Conclusion: Mastering Cost Analysis for Business Success

Understanding and analyzing costs incurred, such as those from May, is not merely an accounting exercise; it's a crucial aspect of running a successful business. By implementing the methods and strategies discussed in this article, you can gain valuable insights into your business's financial health, make informed decisions, and ultimately improve profitability. Remember that effective cost management is an ongoing process requiring vigilance, analysis, and a commitment to continuous improvement. The information gathered from analyzing your May expenses will serve as a foundation for future financial planning and success. Regularly reviewing and adapting your cost analysis strategies will help you navigate market changes and maintain a competitive edge.

Latest Posts

Latest Posts

-

Select The Graph That Is Positively Skewed

Mar 31, 2025

-

Label The Structures Of The Pelvis

Mar 31, 2025

-

Water Held Behind A Dam Would Best Reflect

Mar 31, 2025

-

Per Company Policy Tools With A Purchase

Mar 31, 2025

-

When Should You Introduce Distractor Trials

Mar 31, 2025

Related Post

Thank you for visiting our website which covers about The Following Costs Were Incurred In May . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.