The Federal Reserve Sells Government Securities To __________.

Holbox

Mar 18, 2025 · 5 min read

Table of Contents

The Federal Reserve Sells Government Securities to Contract the Money Supply

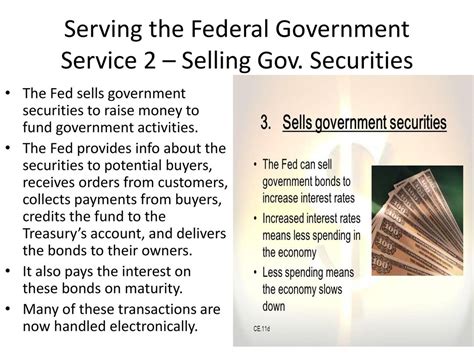

The Federal Reserve (also known as the Fed), the central bank of the United States, employs various monetary policy tools to influence the nation's economy. One crucial tool is the buying and selling of government securities, also known as open market operations. When the Fed sells government securities, its primary goal is to contract the money supply. This action has significant ripple effects throughout the financial system and the broader economy. Understanding why and how this happens is crucial to grasping the intricacies of monetary policy.

Why the Fed Sells Government Securities

The Fed's decision to sell government securities is not arbitrary. It's a deliberate strategy undertaken to achieve specific macroeconomic goals. The most common reason is to combat inflation. When the money supply expands too rapidly, it can lead to a rise in prices, eroding purchasing power. By reducing the money supply, the Fed aims to cool down an overheating economy and curb inflationary pressures.

Here's a breakdown of the situations that might prompt the Fed to sell government securities:

1. High Inflation Rates:

When inflation persistently exceeds the Fed's target rate (generally around 2%), it indicates an overheated economy. Excess money circulating in the system fuels demand, driving up prices. Selling securities removes money from circulation, reducing the overall money supply and consequently dampening demand-pull inflation.

2. Rapid Economic Growth:

While economic growth is generally desirable, excessively rapid growth can be unsustainable. This rapid expansion can lead to inflationary pressures, resource shortages, and asset bubbles. The Fed might intervene by selling securities to slow down the pace of economic growth and prevent an eventual economic downturn.

3. Asset Bubbles:

Rapidly rising asset prices (like stocks or real estate) can indicate an unsustainable boom fueled by excessive credit and speculation. The Fed might sell securities to tighten credit conditions, making it more expensive to borrow money and thus cooling down speculative activity and preventing a potential asset bubble burst.

4. Maintaining Price Stability:

The Fed's primary mandate is to maintain price stability. This involves keeping inflation within a target range. Selling government securities is a crucial tool to achieve this goal, ensuring the long-term health and stability of the economy.

How Selling Government Securities Contracts the Money Supply

The mechanism by which selling government securities contracts the money supply is relatively straightforward but involves several steps:

1. The Sale:

The Fed sells government securities (Treasury bonds, notes, and bills) to commercial banks and other financial institutions. These institutions purchase these securities using funds from their reserves.

2. Reduced Reserves:

When banks buy securities from the Fed, they transfer funds from their reserve accounts at the Fed to the Fed's account. This reduces the amount of reserves that banks hold. Reserves are the cash that banks hold to meet their obligations and maintain liquidity.

3. Reduced Lending Capacity:

With fewer reserves, banks have less money available to lend to businesses and consumers. This reduction in lending capacity restricts the flow of credit throughout the economy.

4. Higher Interest Rates:

The decreased supply of loanable funds leads to an increase in interest rates. Higher interest rates make borrowing more expensive, discouraging businesses from investing and consumers from spending.

5. Decreased Money Supply:

The combined effects of reduced lending and higher interest rates lead to a contraction in the money supply. Less money is available for circulation, dampening economic activity and ultimately helping to control inflation.

6. The Multiplier Effect:

The impact of the Fed's actions is amplified through the money multiplier effect. A reduction in reserves by the Fed leads to a proportionally larger reduction in the overall money supply. The extent of this multiplier effect depends on various factors, including the reserve requirement ratio.

The Impact on Different Sectors

The impact of the Fed selling government securities is far-reaching and affects various sectors of the economy:

1. Businesses:

Higher interest rates increase the cost of borrowing for businesses, making investments less attractive. This can lead to reduced capital expenditures, slower hiring, and potentially lower economic growth.

2. Consumers:

Consumers are also impacted by higher interest rates. Borrowing for purchases like homes or cars becomes more expensive, reducing consumer spending. This can affect various sectors like real estate and the automotive industry.

3. Financial Markets:

The sale of government securities can affect the bond market. Increased supply of bonds can push down bond prices, while interest rates rise. This can lead to volatility in the financial markets.

4. International Trade:

Higher interest rates in the US can attract foreign investment, strengthening the dollar. This can impact the country's international trade balance, making imports cheaper and exports more expensive.

Potential Risks and Considerations

While selling government securities is a powerful tool, it's not without potential drawbacks:

1. Economic Slowdown:

Aggressive contractionary monetary policy can lead to a significant economic slowdown or even a recession if not carefully managed. The Fed needs to strike a balance between controlling inflation and preventing economic hardship.

2. Unemployment:

Reduced economic activity due to tighter monetary policy can lead to job losses and increased unemployment. The Fed needs to consider the social costs of its actions.

3. Deflation:

While combating inflation is the primary goal, overly aggressive contractionary policy can lead to deflation (a sustained decline in the general price level). Deflation can be just as harmful to the economy as inflation, as it can discourage spending and investment.

Conclusion: A Delicate Balancing Act

The Federal Reserve's decision to sell government securities is a crucial part of its monetary policy toolkit. This action aims to contract the money supply, primarily to combat inflation and maintain price stability. However, it's a complex process with significant impacts on various sectors of the economy. The Fed must carefully weigh the benefits and risks, aiming for a delicate balance between controlling inflation and maintaining economic growth and employment. The effectiveness of this policy depends on various factors, including the state of the economy, the intensity of inflationary pressures, and the responsiveness of businesses and consumers to changes in interest rates. Ultimately, the Fed's goal is to promote a stable and healthy economy for the benefit of all Americans. Understanding this intricate interplay of monetary policy is vital for anyone seeking to comprehend the workings of the US economy.

Latest Posts

Latest Posts

-

Copy And Paste Or Type Your Submission Right Here

Mar 18, 2025

-

Social Media Marketing Goals Must Be Flexible Because

Mar 18, 2025

-

In Hypothesis Testing If The Null Hypothesis Is Rejected

Mar 18, 2025

-

Draw The Product Of The Reaction Shown Below

Mar 18, 2025

-

Use Retrosynthetic Analysis To Suggest A Way

Mar 18, 2025

Related Post

Thank you for visiting our website which covers about The Federal Reserve Sells Government Securities To __________. . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.