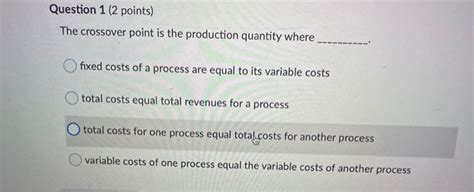

The Crossover Point Is That Production Quantity Where __________.

Holbox

Mar 20, 2025 · 6 min read

Table of Contents

The Crossover Point: Where Fixed Costs Meet Variable Costs

The crossover point, also known as the break-even point, is that production quantity where total revenue equals total costs. This means that at the crossover point, a company is neither making a profit nor incurring a loss; it's simply covering all its expenses. Understanding this crucial point is vital for any business, large or small, as it provides a benchmark against which to measure performance and plan for future growth. This article delves deep into the concept of the crossover point, exploring its calculation, its significance in different business contexts, and the factors that can influence its location.

Understanding Fixed and Variable Costs

Before we dissect the crossover point, it's essential to understand the two primary cost categories involved: fixed costs and variable costs.

Fixed Costs: The Unwavering Expenses

Fixed costs remain constant regardless of the production volume. These are the overhead expenses that a business must pay, irrespective of whether it produces one unit or a thousand. Examples include:

- Rent: Monthly rent for office space or factory premises.

- Salaries: Fixed salaries paid to employees.

- Insurance premiums: Annual or monthly premiums for business insurance.

- Depreciation: The reduction in the value of assets over time.

- Loan payments: Regular repayments on business loans.

These costs are usually incurred even before the production process begins, representing a significant financial commitment for the business.

Variable Costs: The Fluctuating Expenses

Variable costs, on the other hand, fluctuate directly with the production volume. The more units produced, the higher the variable costs. Examples include:

- Raw materials: The cost of materials directly used in production.

- Direct labor: Wages paid to production workers based on output.

- Utilities: Electricity, water, and gas consumption directly related to production.

- Packaging: Cost of materials used to package the finished product.

- Freight and shipping: Costs associated with transporting the finished goods.

These costs are directly tied to the production process and increase proportionally with the level of output.

Calculating the Crossover Point

The crossover point can be calculated using several methods, but the most common involve considering both fixed and variable costs alongside the selling price of the product or service. Here's a breakdown of the calculation:

1. The Basic Formula:

The simplest formula to calculate the crossover point is:

Crossover Point (in units) = Fixed Costs / (Selling Price per Unit - Variable Cost per Unit)

This formula assumes a linear relationship between production volume and both revenue and variable costs.

2. Example:

Let's imagine a company produces widgets. Their fixed costs are $10,000 per month. The variable cost per widget is $5, and the selling price per widget is $10.

Using the formula:

Crossover Point = $10,000 / ($10 - $5) = 2,000 units

This means the company needs to produce and sell 2,000 widgets to cover all its costs and reach the crossover point.

3. Considering Revenue:

The crossover point can also be expressed in terms of revenue instead of units. To calculate this, simply multiply the crossover point in units by the selling price per unit.

In our example:

Crossover Point (in revenue) = 2,000 units * $10/unit = $20,000

This means the company needs to generate $20,000 in revenue to break even.

4. Beyond Simple Linearity:

The formulas above assume a perfectly linear relationship between costs and production. In reality, this is rarely the case. Economies of scale might reduce variable costs per unit at higher production levels, while fixed costs might increase with expansion (e.g., needing a larger facility). These non-linear relationships require more sophisticated modeling techniques, often involving spreadsheets or specialized software.

The Significance of the Crossover Point

The crossover point is a crucial metric for several reasons:

-

Financial Planning: It helps businesses determine the minimum sales volume required to avoid losses. This information is vital for securing financing, setting realistic sales targets, and making informed investment decisions.

-

Pricing Strategies: The crossover point analysis can inform pricing strategies. By understanding the costs involved, businesses can set prices that ensure profitability even at lower sales volumes.

-

Production Planning: It assists in production planning by determining the optimal production levels to achieve profitability.

-

Risk Assessment: By analyzing the crossover point, businesses can assess the financial risks associated with different production levels and market conditions. A high crossover point might indicate a higher risk of losses, especially during periods of low demand.

-

Performance Evaluation: The crossover point serves as a benchmark for evaluating business performance. If the actual sales volume consistently surpasses the crossover point, the business is profitable. Conversely, consistently falling short indicates the need for adjustments to costs or pricing.

Factors Influencing the Crossover Point

Several factors can influence the location of the crossover point:

-

Fixed Costs: Higher fixed costs naturally lead to a higher crossover point, requiring higher sales volume to break even.

-

Variable Costs: Lower variable costs per unit result in a lower crossover point, making it easier to achieve profitability.

-

Selling Price: A higher selling price reduces the number of units needed to reach the crossover point, while a lower selling price increases it.

-

Production Efficiency: Improved production efficiency can lower variable costs, thereby reducing the crossover point.

-

Economic Conditions: External economic factors like inflation, recession, or changes in consumer spending can impact both costs and sales volume, influencing the crossover point.

-

Marketing and Sales Efforts: Effective marketing and sales strategies can increase sales volume, bringing the business closer to, or exceeding, the crossover point more quickly.

The Crossover Point in Different Business Contexts

The importance and application of the crossover point vary across different business sectors and models.

Manufacturing Businesses:

For manufacturers, the crossover point is crucial for determining the optimal production volume to balance costs and revenue. Analyzing the crossover point allows them to optimize their production processes and pricing strategies to maximize profitability.

Service Businesses:

Service businesses also utilize the crossover point, but the calculation might involve different cost structures. Instead of raw materials, variable costs might include labor hours, supplies, and travel expenses.

Retail Businesses:

Retailers use the crossover point to determine the necessary sales volume to cover rent, utilities, staffing costs, and the cost of goods sold. This helps them to optimize inventory management and pricing decisions.

Beyond the Crossover Point: Profit Maximization

While achieving the crossover point is essential for survival, it's just the starting point. The ultimate goal for any business is profit maximization. This involves not only reaching the crossover point but also exceeding it significantly. Analyzing factors beyond the crossover point, such as:

- Demand elasticity: How sensitive demand is to price changes.

- Market competition: The pricing strategies of competitors.

- Customer lifetime value: The total revenue generated from a single customer over their relationship with the business.

These factors help businesses develop strategies to optimize revenue and profit margins while still maintaining a healthy margin of safety beyond the crossover point.

Conclusion

The crossover point, or break-even point, is a fundamental concept in business management. Understanding how to calculate and interpret the crossover point allows businesses to make informed decisions regarding production, pricing, and financial planning. While achieving this point is critical for survival, it serves as a stepping stone toward the ultimate goal of long-term profitability and sustainable growth. By constantly monitoring and analyzing factors that influence the crossover point, businesses can adapt to changing market conditions and optimize their operations for maximum success. Furthermore, integrating the crossover point analysis into broader business planning processes, encompassing market research, competitive analysis, and financial forecasting, ensures a more robust and resilient business model. A deep understanding of this concept isn't merely about avoiding losses; it's about strategic decision-making that paves the way for consistent profitability and growth.

Latest Posts

Latest Posts

-

List The Following Events In The Correct Order

Mar 21, 2025

-

A Service Sink Should Be Used To

Mar 21, 2025

-

In Each Reaction Box Place The Best Reagent And Conditions

Mar 21, 2025

-

Using Models To Predict Molecular Structure Lab

Mar 21, 2025

-

Based On The Cell Values In Cells B77

Mar 21, 2025

Related Post

Thank you for visiting our website which covers about The Crossover Point Is That Production Quantity Where __________. . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.