The Book Value Of A Plant Asset Is

Holbox

Mar 27, 2025 · 7 min read

Table of Contents

- The Book Value Of A Plant Asset Is

- Table of Contents

- The Book Value of a Plant Asset: A Comprehensive Guide

- What is a Plant Asset?

- Understanding Depreciation and its Impact on Book Value

- Calculating the Book Value of a Plant Asset

- The Significance of Book Value in Financial Reporting

- Book Value vs. Market Value: Key Differences

- Analyzing Book Value Trends Over Time

- Impact of Different Accounting Standards on Book Value

- The Role of Book Value in Business Decisions

- Conclusion: The Importance of Accurate Book Value Reporting

- Latest Posts

- Latest Posts

- Related Post

The Book Value of a Plant Asset: A Comprehensive Guide

Understanding the book value of a plant asset is crucial for accurate financial reporting and effective business management. This comprehensive guide will delve into the intricacies of plant asset book value, exploring its calculation, implications, and significance in various financial contexts. We'll also touch upon related concepts like depreciation and its impact on book value, providing a holistic understanding of this vital financial metric.

What is a Plant Asset?

Before diving into book value, let's define what constitutes a plant asset. Plant assets, also known as fixed assets or property, plant, and equipment (PP&E), are long-term tangible assets used in the operations of a business. These assets are not intended for sale in the ordinary course of business and provide benefits for multiple accounting periods. Examples include:

- Buildings: Offices, factories, warehouses.

- Machinery and Equipment: Production equipment, computers, vehicles.

- Land: Land used for operations, not for resale.

- Furniture and Fixtures: Desks, chairs, shelving.

These assets are crucial for a company's operations and contribute significantly to its overall value. However, their value diminishes over time due to wear and tear, obsolescence, and other factors. This is where depreciation comes into play.

Understanding Depreciation and its Impact on Book Value

Depreciation is the systematic allocation of the cost of a plant asset over its useful life. It reflects the decline in the asset's value due to usage, age, and obsolescence. Several depreciation methods exist, each impacting the book value differently:

-

Straight-Line Depreciation: This is the simplest method, allocating an equal amount of depreciation expense each year. The formula is: (Cost - Salvage Value) / Useful Life. Salvage Value is the estimated value of the asset at the end of its useful life, and Useful Life is the estimated period the asset will be used.

-

Declining Balance Depreciation: This method accelerates depreciation, recognizing higher expense in the early years of the asset's life. A fixed depreciation rate is applied to the asset's net book value (cost less accumulated depreciation) each year.

-

Units of Production Depreciation: This method allocates depreciation based on the asset's actual usage. The formula is: ((Cost - Salvage Value) / Total Units to be Produced) * Units Produced During the Year.

-

Sum-of-the-Years' Digits Depreciation: This accelerated depreciation method uses a fraction based on the sum of the years' digits in the asset's useful life.

The choice of depreciation method significantly impacts the reported book value. Accelerated methods like declining balance result in a lower book value in the early years compared to the straight-line method. The selection of the appropriate method depends on the nature of the asset and the company's accounting policies. Consistency in applying the chosen method is paramount for reliable financial reporting.

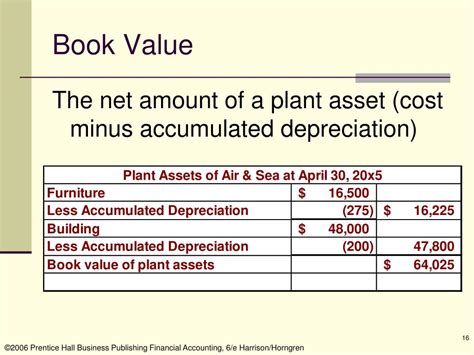

Calculating the Book Value of a Plant Asset

The book value of a plant asset represents its net carrying amount on the balance sheet. It is calculated as:

Book Value = Cost - Accumulated Depreciation

-

Cost: This encompasses all expenditures directly attributable to acquiring and preparing the asset for its intended use. This includes purchase price, transportation costs, installation costs, and any necessary modifications.

-

Accumulated Depreciation: This is the total depreciation expense recognized on the asset since its acquisition. It's a contra-asset account, reducing the asset's reported value.

For example, if a company purchased a machine for $100,000, with a salvage value of $10,000 and a useful life of 10 years, using straight-line depreciation, the annual depreciation expense would be $9,000 (($100,000 - $10,000) / 10). After 5 years, the accumulated depreciation would be $45,000 ($9,000 * 5), and the book value would be $55,000 ($100,000 - $45,000).

The Significance of Book Value in Financial Reporting

The book value of plant assets is a crucial component of a company's financial statements. It's reported on the balance sheet as part of the company's total assets. This value provides insights into:

-

Company's Financial Health: A company with a high book value of plant assets might indicate significant investments in its operations, potentially signifying future growth potential. However, an excessively high book value could also suggest overinvestment or obsolete assets.

-

Tax Implications: Depreciation expense directly impacts a company's taxable income, reducing tax liability. The choice of depreciation method influences the timing and amount of tax savings.

-

Creditworthiness: Lenders often consider the book value of plant assets when assessing a company's creditworthiness. A higher book value can strengthen a company's borrowing capacity.

-

Mergers and Acquisitions: Book value plays a role in determining the fair market value of a company during mergers and acquisitions. However, it's important to note that book value often differs significantly from market value.

-

Asset Impairment: If the book value of a plant asset exceeds its recoverable amount (the higher of its fair value less costs to sell and its value in use), an impairment loss must be recognized. This adjustment reflects the decline in the asset's value below its carrying amount.

Book Value vs. Market Value: Key Differences

It's essential to distinguish between book value and market value. Book value reflects the asset's value according to the company's accounting records, while market value represents the price the asset would fetch in a current market transaction. These values often diverge significantly.

Market value is influenced by factors not considered in book value calculations, such as:

- Market Demand: The current demand for similar assets.

- Technological Advancements: The obsolescence of older assets.

- Inflation: Changes in the overall price level.

- Economic Conditions: The overall state of the economy.

Book value is a historical cost-based measure, while market value is forward-looking and reflects current market conditions.

Analyzing Book Value Trends Over Time

Analyzing changes in book value over time provides valuable insights into a company's investment strategies and asset management practices. A declining book value may indicate significant depreciation or asset disposals. Conversely, an increasing book value could signal ongoing capital expenditures and expansion.

Analyzing trends alongside other financial metrics, like revenue growth and profitability, offers a more comprehensive understanding of a company's financial performance.

Impact of Different Accounting Standards on Book Value

Different accounting standards, such as Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS), have varying requirements for asset valuation and depreciation methods. These variations can lead to differences in the reported book value of plant assets across companies following different standards. Understanding these differences is crucial when comparing the financial performance of companies using different accounting frameworks.

The Role of Book Value in Business Decisions

Book value plays a vital role in various business decisions, including:

-

Capital Budgeting: When evaluating potential investments in new plant assets, companies often consider the asset's projected book value and its impact on future profitability.

-

Asset Replacement Decisions: The book value of existing assets is compared to the cost of replacement when deciding whether to replace or continue using existing equipment.

-

Financial Planning: Accurate book values are crucial for developing realistic financial plans and projections.

-

Performance Evaluation: Managers often use book value as a metric when evaluating the performance of different departments or business units.

Conclusion: The Importance of Accurate Book Value Reporting

The book value of a plant asset is a fundamental element of financial reporting and business decision-making. Accurate calculation and consistent application of depreciation methods are crucial for presenting a reliable picture of a company's financial health. Understanding the nuances of book value, its relationship with market value, and its impact on various financial statements empowers businesses to make informed decisions and maintain a strong financial position. Regular review and analysis of plant asset book values are essential for effective asset management and long-term financial success. Ignoring the significance of accurate book value reporting can lead to misinformed decisions and potentially detrimental consequences for the company's financial stability.

Latest Posts

Latest Posts

-

Identify The Four Postulates Of Natural Selection

Mar 31, 2025

-

Select The Action For Which The Featured Muscle Is Responsible

Mar 31, 2025

-

Label The Components Of A Synapse

Mar 31, 2025

-

Cost Accounting Systems Are Used To

Mar 31, 2025

-

Under Accrual Basis Accounting Companies Typically Report Expenses

Mar 31, 2025

Related Post

Thank you for visiting our website which covers about The Book Value Of A Plant Asset Is . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.