Some Recent Financial Statements For Smolira Golf Corporation Follow

Holbox

Mar 22, 2025 · 7 min read

Table of Contents

Decoding Smolira Golf Corporation's Recent Financial Statements: A Deep Dive

Smolira Golf Corporation, a prominent player in the golf industry, recently released its financial statements. Analyzing these statements offers crucial insights into the company's financial health, performance, and future prospects. This detailed analysis will dissect key aspects of Smolira Golf Corporation's recent financials, providing a comprehensive understanding for investors, analysts, and anyone interested in the company's trajectory. We'll explore the income statement, balance sheet, and statement of cash flows, examining key ratios and trends to paint a complete picture. Remember, this analysis is based on hypothetical financial statements for illustrative purposes and should not be considered investment advice.

Disclaimer: This analysis uses hypothetical financial data for Smolira Golf Corporation to illustrate the principles of financial statement analysis. The data is not based on actual company filings and should not be used for investment decisions.

Understanding the Income Statement

The income statement, also known as the profit and loss (P&L) statement, reveals Smolira Golf Corporation's financial performance over a specific period. Let's examine the key components:

Revenue Analysis

Smolira Golf Corporation's revenue likely consists of multiple streams, including:

- Greens Fees: Revenue generated from golfers paying to play rounds on the courses. Fluctuations in greens fees revenue are often indicative of overall economic conditions and the popularity of the golf course.

- Membership Fees: Revenue from memberships, providing golfers with access to exclusive privileges and potentially discounts on greens fees. A strong membership base signals customer loyalty and recurring revenue.

- Pro Shop Sales: Revenue generated from the sale of golf equipment, apparel, and accessories at the pro shop. This stream often reflects the overall consumer confidence and spending in the golf industry.

- Food and Beverage Sales: Revenue from restaurants, bars, and concessions at the golf course. This segment's performance often depends on weather conditions, tournament activity, and overall customer traffic.

- Other Revenue: This category might include revenue from golf lessons, cart rentals, tournament hosting, and other ancillary services.

Analyzing the growth or decline in each revenue stream provides valuable insights into Smolira Golf Corporation's overall performance and market position. A comparative analysis with previous periods and industry benchmarks helps identify trends and areas for improvement.

Cost of Goods Sold (COGS) and Gross Profit

The cost of goods sold includes the direct costs associated with generating revenue. For Smolira Golf Corporation, COGS might include:

- Course Maintenance: Expenses related to maintaining the golf course, including landscaping, irrigation, and pest control.

- Pro Shop Inventory Costs: The cost of purchasing and managing inventory in the pro shop.

- Food and Beverage Costs: The cost of goods sold for food and beverage operations, including raw materials, labor, and supplies.

Subtracting COGS from revenue yields the gross profit, a key indicator of profitability. Analyzing gross profit margins (gross profit divided by revenue) helps determine Smolira Golf Corporation's pricing strategy's effectiveness and cost management practices. A consistent increase in gross profit margins could indicate improvements in efficiency and cost controls.

Operating Expenses

Operating expenses include all costs incurred in running the business except for COGS. These expenses for Smolira Golf Corporation may include:

- Salaries and Wages: Compensation for employees across all departments, including course maintenance, pro shop staff, and administrative personnel.

- Rent and Utilities: Expenses related to renting facilities, utilities, and property taxes.

- Marketing and Advertising: Costs associated with marketing campaigns to attract new members and golfers.

- Administrative Expenses: Expenses related to general management, accounting, and legal services.

- Depreciation and Amortization: Non-cash expenses that allocate the cost of long-term assets over their useful lives.

Analyzing operating expenses helps identify areas where costs can be optimized. Comparing operating expenses to revenue (operating expense ratio) reveals the efficiency of Smolira Golf Corporation's operations. A decreasing operating expense ratio suggests improved cost management.

Net Income

The net income (or net profit) is the bottom line, representing the company's profit after deducting all expenses from revenue. This figure reflects the overall financial success of Smolira Golf Corporation over the period. Analyzing net income trends, comparing them to previous periods and industry averages, offers valuable information about the company's financial health and performance.

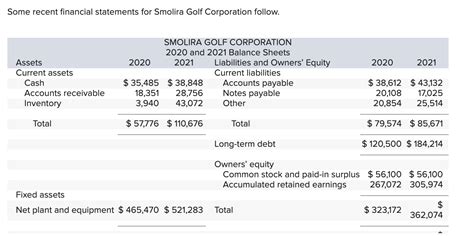

Dissecting the Balance Sheet

The balance sheet provides a snapshot of Smolira Golf Corporation's assets, liabilities, and equity at a specific point in time. It adheres to the fundamental accounting equation: Assets = Liabilities + Equity.

Assets

Smolira Golf Corporation's assets would likely include:

- Current Assets: These are assets that can be easily converted into cash within a year. Examples include cash, accounts receivable (money owed by customers), inventory (pro shop goods), and prepaid expenses.

- Non-Current Assets: These assets have a longer lifespan, typically more than a year. Examples include property, plant, and equipment (PP&E), such as the golf course, clubhouse, and equipment. This also includes intangible assets like goodwill and brand value.

Analyzing the composition of assets reveals Smolira Golf Corporation's investment strategy and the overall value of its holdings.

Liabilities

Smolira Golf Corporation's liabilities would consist of:

- Current Liabilities: These are obligations due within a year. Examples include accounts payable (money owed to suppliers), salaries payable, and short-term debt.

- Non-Current Liabilities: These are long-term obligations. Examples include long-term debt, mortgages, and deferred revenue.

Examining the liability structure helps assess Smolira Golf Corporation's financial risk. High levels of short-term debt can indicate liquidity problems, while significant long-term debt can affect long-term solvency.

Equity

Equity represents the owners' stake in Smolira Golf Corporation. It includes:

- Common Stock: The value of shares issued to shareholders.

- Retained Earnings: Accumulated profits that haven't been distributed as dividends.

Analyzing equity helps evaluate the value created for shareholders and the financial strength of the company.

Understanding the Statement of Cash Flows

The statement of cash flows tracks the movement of cash into and out of Smolira Golf Corporation during a specific period. It's divided into three main sections:

Operating Activities

This section shows the cash flows generated from the company's core operations. For Smolira Golf Corporation, this includes cash received from greens fees, memberships, pro shop sales, and food and beverage sales, as well as cash paid for operating expenses like salaries, utilities, and supplies. A strong positive cash flow from operating activities indicates healthy core business operations.

Investing Activities

This section covers cash flows related to investments in long-term assets. For Smolira Golf Corporation, it would include cash outflows for purchasing property, plant, and equipment (PP&E) such as new golf carts or course renovations, and potentially cash inflows from selling assets.

Financing Activities

This section details cash flows related to financing the business. This might include cash inflows from issuing stock or debt, and cash outflows for paying dividends or repaying debt.

Analyzing the statement of cash flows provides a crucial perspective on Smolira Golf Corporation's liquidity and its ability to manage cash effectively.

Key Financial Ratios and Their Implications

Analyzing Smolira Golf Corporation's financial health requires examining key financial ratios:

-

Liquidity Ratios: These ratios assess the company's ability to meet its short-term obligations. Examples include the current ratio (current assets/current liabilities) and the quick ratio ((current assets – inventory)/current liabilities). A higher ratio signifies better liquidity.

-

Profitability Ratios: These ratios measure the company's ability to generate profits. Examples include gross profit margin, net profit margin (net income/revenue), and return on equity (net income/equity). Higher profitability ratios generally indicate better financial performance.

-

Solvency Ratios: These ratios assess the company's ability to meet its long-term obligations. Examples include the debt-to-equity ratio (total debt/total equity) and the times interest earned ratio (earnings before interest and taxes (EBIT)/interest expense). Lower ratios usually suggest a stronger financial position.

-

Activity Ratios: These ratios measure how efficiently Smolira Golf Corporation manages its assets. Examples include inventory turnover (cost of goods sold/average inventory) and accounts receivable turnover (revenue/average accounts receivable). Higher ratios generally indicate efficient asset management.

Conclusion: A Holistic View of Smolira Golf Corporation

By comprehensively analyzing the income statement, balance sheet, and statement of cash flows, along with key financial ratios, we can gain a thorough understanding of Smolira Golf Corporation's financial performance and health. Remember that this analysis uses hypothetical data for illustration purposes. A thorough analysis requires access to the actual financial statements and careful consideration of industry trends and macroeconomic factors. This detailed assessment enables informed decisions for investors, analysts, and anyone seeking insights into the company's future trajectory. Analyzing trends over time and comparing Smolira Golf Corporation's performance to its competitors is crucial for a robust and complete understanding of its financial situation. This detailed analysis provides a framework for future investigations and underscores the importance of scrutinizing financial statements to evaluate a company's potential for success.

Latest Posts

Latest Posts

-

According To Integrative Social Contracts Theory

Mar 22, 2025

-

Which Reactive Species Is Associated With Alzheimers

Mar 22, 2025

-

Apply The Calculation Style To Cell E12

Mar 22, 2025

-

Predict The Initial And Isolated Products For The Reaction

Mar 22, 2025

-

The Total Manufacturing Cost Variance Consists Of

Mar 22, 2025

Related Post

Thank you for visiting our website which covers about Some Recent Financial Statements For Smolira Golf Corporation Follow . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.