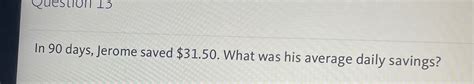

Sain 90 Days Jerome Save 31.5 What Was His Daily

Holbox

Mar 15, 2025 · 5 min read

Table of Contents

Decoding Jerome's Savings: A Deep Dive into Daily Habits & Financial Strategies

Saving $31,500 in just 90 days is a phenomenal achievement. It represents exceptional discipline, a well-defined plan, and likely, some significant sources of income. Let's dissect this remarkable feat, exploring the potential daily habits and financial strategies that could have contributed to Jerome's success. We'll examine realistic scenarios, considering different income streams and lifestyle choices, to paint a comprehensive picture. Understanding Jerome's journey can provide valuable insights for anyone aiming to accelerate their savings goals.

Understanding the Magnitude of the Achievement

A daily savings target of $350 ($31,500 / 90 days) is incredibly ambitious. It implies a high income level, significant expense reduction, or a combination of both. Let’s delve into various possibilities:

Scenario 1: High Income, Moderate Expenses

This scenario assumes Jerome earned a substantial income, allowing him to save a large portion without drastically altering his lifestyle. Let's consider examples:

-

High-Income Professions: Professions like investment banking, surgery, or tech leadership frequently offer salaries exceeding $500,000 annually. If Jerome fell into this category, saving $350 daily would represent a smaller percentage of his overall income.

-

Significant Bonuses or Windfalls: The $31,500 could represent a bonus, inheritance, or proceeds from a profitable investment, supplemented by regular savings from his usual income. This scenario explains a large lump sum accumulation within a short timeframe.

-

Multiple Income Streams: Jerome may have multiple sources of income – a primary job combined with freelance work, rental income, or investments generating significant returns. This diversification reduces reliance on a single income source and allows for higher savings potential.

Daily Habits in this Scenario:

-

Budgeting and Tracking: Meticulous budgeting and expense tracking are crucial. Jerome would likely use budgeting apps or spreadsheets to monitor his spending closely and identify areas for potential optimization.

-

Automated Savings: Automating savings transfers directly from his checking account to a high-yield savings account or investment account removes the temptation to spend the money and ensures consistent savings.

-

Mindful Spending: While not dramatically altering his lifestyle, Jerome would consciously choose to avoid unnecessary expenses, focusing on needs over wants. This could involve strategic choices in dining, entertainment, and transportation.

Scenario 2: Moderate Income, Extreme Expense Reduction

This scenario posits that Jerome started with a moderate income and significantly reduced his expenses to achieve this high savings rate. This demands exceptional discipline and lifestyle adjustments:

-

Minimizing Housing Costs: Moving to a cheaper rental, taking on a roommate, or even temporarily moving back home could significantly reduce housing expenses.

-

Eliminating Non-Essential Expenses: Substantial savings would necessitate cutting non-essential spending. This includes dining out, entertainment, travel, subscriptions, and other discretionary expenses.

-

Strategic Debt Management: Jerome might have aggressively paid down high-interest debts to reduce financial burdens and free up more money for savings. This demonstrates financial prudence and proactive debt management.

Daily Habits in this Scenario:

-

Extreme Frugality: This scenario requires an extreme focus on frugality. Jerome likely prepared meals at home, avoided impulse purchases, and explored budget-friendly alternatives for leisure activities.

-

Prioritization of Needs over Wants: A strict prioritization of essential expenses ensures only necessities are purchased, delaying or foregoing any non-essential purchases.

-

Constant Evaluation and Adjustment: Regularly reviewing expenses and adjusting the budget is crucial. Jerome would adapt his strategy based on changing circumstances and identify new opportunities for cost savings.

Scenario 3: A Combination of Strategies

The most realistic scenario likely involves a blend of both high income and significant expense reduction. This approach offers a more sustainable and less extreme route to achieving substantial savings.

Daily Habits in this Scenario:

-

Balanced Lifestyle: This approach allows for some flexibility and enjoyment without sacrificing significant savings. A balanced approach enables long-term sustainability.

-

Strategic Spending: Mindful spending habits are crucial. Jerome would be strategic about his purchases, looking for deals and prioritizing value.

-

Consistent Goal Setting and Review: Regular reviews of progress are crucial for maintaining motivation and adjusting the strategy as needed. Consistent monitoring ensures the target remains achievable.

Beyond the Numbers: The Psychological Factors

Jerome's success is not solely about numbers; it's about a strong mindset:

-

Clear Goals and Motivation: A clear, compelling reason for saving $31,500 likely drove his commitment. This could range from a down payment on a house to funding a business venture.

-

Self-Discipline and Perseverance: Achieving this level of savings requires immense self-discipline and the persistence to stick to the plan, even during challenging times.

-

Financial Literacy: A solid understanding of personal finance principles, including budgeting, investing, and debt management, significantly improves the chances of success.

Lessons Learned and Practical Applications

Jerome's story offers invaluable lessons for everyone seeking financial independence:

-

Set Realistic Goals: While his savings rate is exceptional, setting realistic goals based on your income and expenses is crucial.

-

Create a Detailed Budget: A thorough budget helps you track income and expenses, identifying areas where you can cut back.

-

Automate Savings: Automating savings transfers makes it easier to save consistently without having to actively manage it each month.

-

Build Multiple Income Streams: Diversifying income increases your financial security and boosts savings potential.

-

Seek Professional Advice: If needed, seek advice from a financial advisor to create a personalized savings plan tailored to your circumstances.

Conclusion:

Jerome's $31,500 savings in 90 days is an extraordinary achievement, likely resulting from a combination of high income, significant expense reduction, and exceptional discipline. By analyzing the various scenarios and their corresponding daily habits, we gain a deeper understanding of the dedication and strategic planning required to achieve such ambitious financial goals. While his level of savings might be exceptional, the underlying principles – budgeting, mindful spending, and consistent effort – are applicable to everyone seeking to improve their financial well-being. Remember, financial success is a journey, not a sprint, and consistent, informed actions are key to achieving long-term financial security.

Latest Posts

Latest Posts

-

Measured Progress Maryland Mathematics Performance Task Unstructured Answers

Mar 15, 2025

-

Lysosomes Are Membrane Bound Vesicles That Arise From The

Mar 15, 2025

-

What Intoxications Signs Is John Showing

Mar 15, 2025

-

Common Mistakes Made When Managing Current Cash Needs Include

Mar 15, 2025

-

The Amount Of Current Assets Minus Current Liabilities Is Called

Mar 15, 2025

Related Post

Thank you for visiting our website which covers about Sain 90 Days Jerome Save 31.5 What Was His Daily . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.