Refers To A Company's Ability To Generate An Adequate Return.

Holbox

Mar 14, 2025 · 6 min read

Table of Contents

Return on Investment (ROI): A Comprehensive Guide to Measuring Company Performance

Return on investment (ROI) is a crucial metric that measures the profitability of an investment relative to its cost. For companies, understanding and maximizing ROI is paramount for sustained growth and competitiveness. This comprehensive guide delves into the intricacies of ROI, exploring its calculation, variations, limitations, and its critical role in strategic decision-making.

Understanding ROI: Beyond the Numbers

At its core, ROI answers a simple yet powerful question: For every dollar invested, how much profit did the company generate? While the calculation is straightforward, interpreting and applying ROI requires a deeper understanding of its context and implications. A high ROI suggests efficient resource allocation and a profitable venture, while a low or negative ROI indicates potential areas for improvement or a need for strategic realignment.

Key Components of ROI Calculation

The fundamental formula for calculating ROI is:

ROI = (Net Profit / Cost of Investment) x 100%

Let's break down each component:

-

Net Profit: This represents the overall profit generated from the investment after deducting all expenses. This includes both direct costs (materials, labor) and indirect costs (overhead, marketing). It's crucial to use consistent accounting practices to ensure accuracy.

-

Cost of Investment: This refers to the total amount invested in the project or initiative. This includes all capital expenditures, operating expenses, and any other relevant costs associated with the investment. Again, accuracy and consistency are paramount.

Example Calculation

Let's say a company invests $100,000 in a new marketing campaign. The campaign generates $150,000 in additional revenue, with associated expenses of $30,000.

- Net Profit: $150,000 (Revenue) - $30,000 (Expenses) = $120,000

- ROI: ($120,000 / $100,000) x 100% = 120%

This indicates that for every dollar invested, the company generated $1.20 in profit, representing a strong return on the marketing investment.

Variations and Applications of ROI

While the basic ROI formula is widely applicable, several variations exist to cater to specific situations and industries.

Return on Equity (ROE)

ROE measures a company's profitability relative to shareholder equity. It's a critical indicator of how effectively a company uses shareholder investments to generate profit.

ROE = (Net Income / Shareholder Equity) x 100%

ROE is especially valuable for investors assessing the financial health and potential returns of publicly traded companies. A consistently high ROE suggests strong management and efficient capital allocation.

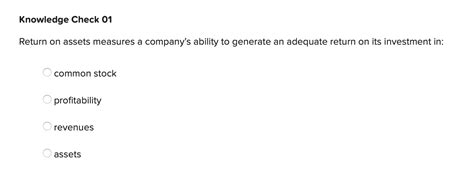

Return on Assets (ROA)

ROA measures how effectively a company uses its assets to generate earnings. It provides insights into a company's operational efficiency and its ability to generate profits from its resources.

ROA = (Net Income / Total Assets) x 100%

ROA is valuable for comparing companies within the same industry, as it provides a standardized measure of profitability relative to asset size.

Return on Capital Employed (ROCE)

ROCE is similar to ROA but focuses on the capital employed by the company, which is the sum of equity and debt financing. This provides a broader view of profitability, considering both equity and debt financing.

ROCE = (EBIT / Capital Employed) x 100%

Where EBIT (Earnings Before Interest and Taxes) reflects the company's operating profitability before the impact of financing. ROCE is particularly relevant for companies with significant debt financing.

Beyond the Numbers: Interpreting ROI in Context

While the numerical value of ROI is important, its interpretation requires considering several contextual factors.

Industry Benchmarks

Comparing a company's ROI to industry averages provides a valuable perspective on its performance relative to its competitors. An ROI above the industry average suggests a competitive advantage, while a lower ROI might indicate areas for improvement or strategic reassessment.

Time Horizon

The time horizon for ROI calculation significantly impacts its interpretation. A long-term investment may have a lower ROI in the short term but a higher return over the long run. Conversely, a short-term investment might yield high returns initially but lower returns in the long run.

Risk Tolerance

Higher-risk investments often come with the potential for higher returns, but also a greater chance of loss. Companies must consider their risk tolerance when assessing the viability of investments with varying ROI potential.

Qualitative Factors

ROI calculations primarily focus on quantitative data. However, qualitative factors like brand reputation, employee morale, and customer satisfaction also significantly influence a company's long-term success. These qualitative factors should be considered alongside ROI.

Limitations of ROI

Despite its widespread use, ROI has limitations:

-

Ignoring Time Value of Money: The basic ROI formula doesn't account for the time value of money. A dollar received today is worth more than a dollar received in the future due to its potential earning capacity. Discounted Cash Flow (DCF) analysis is often used to address this limitation.

-

Difficulty in Quantifying Intangible Benefits: ROI struggles to capture the value of intangible benefits, such as improved brand reputation or increased employee morale. These factors can significantly contribute to a company's long-term success but are difficult to quantify in monetary terms.

-

Data Accuracy and Consistency: Accurate ROI calculation depends on reliable and consistent data. Inaccurate or inconsistent data can lead to misleading results and flawed decision-making.

-

Oversimplification: ROI can oversimplify complex investment scenarios, neglecting nuances and unforeseen circumstances that may significantly impact the outcome.

Maximizing ROI: Strategic Implications

Maximizing ROI requires a strategic approach encompassing several key areas:

-

Strategic Planning: A well-defined strategic plan is crucial for aligning investments with overall business objectives, ensuring that resources are allocated efficiently to achieve desired outcomes.

-

Efficient Resource Allocation: Optimizing resource allocation involves identifying and prioritizing investments with the highest potential ROI. This may involve using advanced analytical techniques to identify opportunities for improvement.

-

Continuous Monitoring and Evaluation: Regular monitoring and evaluation of investment performance are essential for identifying areas for improvement and making timely adjustments to maximize returns. This includes tracking key performance indicators (KPIs) and conducting periodic reviews.

-

Innovation and Technology: Embracing innovation and leveraging technology can significantly enhance efficiency and profitability, ultimately contributing to a higher ROI. This includes exploring new technologies and business models that may lead to higher returns.

Conclusion: ROI as a Guiding Star

Return on investment is a multifaceted metric that provides valuable insights into a company's financial performance and efficiency. While the calculation itself is relatively straightforward, its effective interpretation and application require a deeper understanding of its context, limitations, and strategic implications. By focusing on strategic planning, efficient resource allocation, continuous monitoring, and embracing innovation, companies can maximize their ROI and achieve sustained growth and profitability. A well-rounded understanding and implementation of ROI analysis can be a crucial factor in a company’s long-term success and competitive advantage in the market. Remember, maximizing ROI isn't just about numbers; it's about making informed decisions that drive value creation and sustainable growth.

Latest Posts

Latest Posts

-

Question Pine Draw The Skeletal Structure Of The Alkane Given

Mar 14, 2025

-

Match The Term And The Definition

Mar 14, 2025

-

Glimpse Is To Stare As Sprinkle Is To

Mar 14, 2025

-

Flexible Manufacturing Systems Can Be Extended

Mar 14, 2025

-

Locate The Centroid Y Of The Area

Mar 14, 2025

Related Post

Thank you for visiting our website which covers about Refers To A Company's Ability To Generate An Adequate Return. . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.