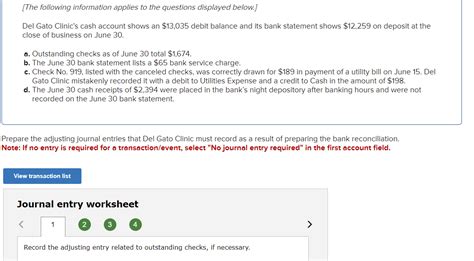

Record The Adjusting Entry Related To Outstanding Checks If Necessary

Holbox

Mar 23, 2025 · 6 min read

Table of Contents

- Record The Adjusting Entry Related To Outstanding Checks If Necessary

- Table of Contents

- Recording Adjusting Entries for Outstanding Checks: A Comprehensive Guide

- What are Outstanding Checks?

- Why are Adjusting Entries Necessary for Outstanding Checks?

- The Bank Reconciliation Process and Outstanding Checks

- Recording the Adjusting Entry: A Step-by-Step Guide

- Handling Outstanding Checks Over Time

- Common Errors and Pitfalls in Handling Outstanding Checks

- Advanced Scenarios and Considerations

- The Importance of Accurate Record Keeping

- Conclusion

- Latest Posts

- Latest Posts

- Related Post

Recording Adjusting Entries for Outstanding Checks: A Comprehensive Guide

Understanding and correctly recording adjusting entries, especially those related to outstanding checks, is crucial for maintaining accurate financial records. This comprehensive guide will delve into the intricacies of outstanding checks, their impact on bank reconciliation, and the precise steps involved in creating the necessary adjusting journal entries. We'll cover various scenarios and provide practical examples to solidify your understanding.

What are Outstanding Checks?

Outstanding checks represent checks issued by a company but haven't yet been cashed or processed by the bank. These checks are recorded in the company's books but haven't yet been deducted from the bank statement balance. This discrepancy arises because there's a time lag between issuing a check and the bank actually clearing it.

Key Characteristics of Outstanding Checks:

- Issued but not yet cashed: The crucial element is that the payee hasn't presented the check for payment.

- Recorded in company books: The company's accounting system reflects the issuance of these checks.

- Not reflected on bank statement: The bank hasn't yet processed these checks, so they don't appear on the bank statement.

- Cause of bank reconciliation differences: They are a major reason why the company's cash balance and the bank's cash balance often differ.

Why are Adjusting Entries Necessary for Outstanding Checks?

The primary reason for creating adjusting entries for outstanding checks is to ensure that the company's financial records accurately reflect the true cash balance. Failing to account for outstanding checks leads to an inaccurate representation of cash on hand. This inaccuracy can have severe implications, including:

- Inaccurate financial statements: The balance sheet will show an inflated cash balance if outstanding checks aren't considered.

- Misleading financial analysis: Incorrect cash figures can distort key financial ratios and analyses, hindering sound decision-making.

- Poor cash flow management: Without a clear picture of actual cash available, effective cash flow management becomes challenging.

- Auditing issues: Auditors scrutinize bank reconciliations meticulously, and failing to account for outstanding checks can raise serious concerns.

The Bank Reconciliation Process and Outstanding Checks

The bank reconciliation process is the key to identifying and addressing discrepancies between the company's cash balance and the bank's cash balance. Outstanding checks are a critical component of this process.

Steps in Bank Reconciliation:

- Obtain bank statement: Acquire the latest bank statement from the financial institution.

- Compare bank statement with company records: Carefully compare the bank statement transactions with the company's cash transactions.

- Identify outstanding checks: This involves comparing the checks issued by the company with those processed by the bank. Any checks issued but not yet cleared are identified as outstanding checks.

- Prepare bank reconciliation: A bank reconciliation statement is prepared to reconcile the differences between the company's cash book balance and the bank statement balance. This includes adjustments for outstanding checks, deposits in transit, bank charges, NSF checks, and other adjustments.

- Make adjusting entries: Once the discrepancies are identified, appropriate adjusting journal entries are made to correct the company's accounting records.

Recording the Adjusting Entry: A Step-by-Step Guide

The adjusting entry for outstanding checks reduces the cash balance shown in the company’s books. This is because the checks have been written but not yet cashed, meaning the company still shows a higher cash balance than is actually available.

The adjusting entry always involves:

- Debit to Outstanding Checks: This account is a temporary contra-asset account that offsets the cash balance. The debit reduces the cash balance to reflect the checks that haven't cleared the bank.

- Credit to Cash: This reduces the cash balance in the general ledger to align with the actual available cash after accounting for outstanding checks.

Example:

Let's assume that at the end of the month, the company's bank reconciliation reveals outstanding checks totaling $5,000. The adjusting entry would be:

| Account Name | Debit | Credit |

|---|---|---|

| Outstanding Checks | $5,000 | |

| Cash | $5,000 | |

| To record outstanding checks |

This entry decreases the cash balance by $5,000, bringing it in line with the actual available cash after accounting for the outstanding checks.

Handling Outstanding Checks Over Time

Outstanding checks aren't static; they change over time. Checks issued in previous periods might clear in the current period, while new checks are continuously issued. This necessitates regular monitoring and adjustment.

Reconciliation Frequency:

The frequency of bank reconciliation is critical. Monthly reconciliation is generally recommended, but more frequent reconciliations might be necessary for businesses with high transaction volumes.

Tracking Outstanding Checks:

Maintaining a detailed record of outstanding checks is essential. This usually involves a dedicated spreadsheet or software to track check numbers, amounts, and dates issued.

Clearing of Outstanding Checks:

When an outstanding check clears the bank, it's removed from the outstanding check register. A reversing entry is then typically made to clear the outstanding checks account. This reverses the initial adjusting entry, thereby restoring the true cash balance. The entry to clear the outstanding check would look like this:

| Account Name | Debit | Credit |

|---|---|---|

| Cash | $5,000 | |

| Outstanding Checks | $5,000 | |

| To clear outstanding checks |

Common Errors and Pitfalls in Handling Outstanding Checks

Several common errors can occur when dealing with outstanding checks. Understanding these errors helps prevent inaccuracies in financial reporting.

- Double counting: Accurately tracking and accounting for outstanding checks is crucial. Double-counting outstanding checks is a common mistake that leads to an understated cash balance.

- Omitting outstanding checks: Failing to identify and account for all outstanding checks results in an overstated cash balance, misrepresenting the true financial position.

- Incorrect calculation: Errors in calculating the total amount of outstanding checks directly affect the accuracy of the adjusting entry and the bank reconciliation.

- Timing discrepancies: Ensure that the bank statement and the company's records cover the same period. Timing mismatches can lead to inaccuracies in identifying outstanding checks.

Advanced Scenarios and Considerations

The handling of outstanding checks becomes more complex in certain situations:

- Multiple bank accounts: Businesses with multiple bank accounts must reconcile each account separately, meticulously tracking outstanding checks for each.

- Large volumes of transactions: For businesses processing a large number of checks, automated reconciliation software can significantly enhance accuracy and efficiency.

- International transactions: International transactions often involve longer clearing times, requiring more careful monitoring of outstanding checks.

The Importance of Accurate Record Keeping

The accuracy of your financial records is paramount. The correct recording of adjusting entries for outstanding checks directly contributes to the reliability of your financial statements, improving your decision-making, and upholding your organization's financial integrity. Regular reconciliation and diligent attention to detail are key to success.

Conclusion

Accurately recording adjusting entries for outstanding checks is a non-negotiable aspect of sound financial management. Understanding the process, potential pitfalls, and advanced scenarios will equip you to maintain accurate financial records, improve cash flow management, and contribute to informed business decisions. Remember, consistency and attention to detail are essential for a smooth and accurate bank reconciliation process. Through diligent monitoring and the careful application of the principles outlined above, you can ensure the integrity of your financial reporting and avoid potentially costly mistakes.

Latest Posts

Latest Posts

-

How Can The Problem Statement Be Improved

Mar 27, 2025

-

Research On Animal Subjects Has Demonstrated That

Mar 27, 2025

-

Classify The Myograms Based On Frequency Of Stimulation

Mar 27, 2025

-

Universities That Actively Recruit Foreign Students

Mar 27, 2025

-

Construct A 95 Confidence Interval For The Population Mean

Mar 27, 2025

Related Post

Thank you for visiting our website which covers about Record The Adjusting Entry Related To Outstanding Checks If Necessary . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.