Receivables Not Expected To Be Collected Should

Holbox

Mar 20, 2025 · 6 min read

Table of Contents

Receivables Not Expected to Be Collected: A Comprehensive Guide

Businesses, regardless of size or industry, face the challenge of managing accounts receivable. A significant portion of this management involves dealing with receivables that are unlikely to be collected. Understanding how to identify, account for, and ultimately write off these bad debts is crucial for maintaining accurate financial reporting and overall business health. This comprehensive guide delves into the intricacies of receivables not expected to be collected, providing a clear understanding of the process and its implications.

Identifying Receivables at Risk

The first step in managing receivables not expected to be collected is accurate identification. This process requires careful analysis and a robust system for tracking customer payments. Several factors indicate a high likelihood of non-payment:

Past Due Invoices:

The most obvious indicator. Invoices significantly past their due date, especially those that have gone through multiple reminders without response, are strong candidates for non-collection. Establishing clear payment terms and following a consistent collection process is critical in minimizing the number of past-due invoices.

Customer Financial Distress:

Analyzing a customer's financial stability is paramount. Signs of financial trouble, such as public filings for bankruptcy, significant changes in credit rating, or persistent late payments across multiple vendors, signal a high risk of non-payment. Regularly monitoring customer creditworthiness using external resources and internal data is essential.

Changes in Customer Circumstances:

Unforeseen events like business closures, changes in ownership, or major legal issues can severely impact a customer's ability to pay. Maintaining up-to-date customer information and proactively monitoring industry news can help anticipate these changes.

Lack of Communication:

Repeated attempts to contact a customer without response strongly suggests the receivable is at risk. A robust communication strategy, including phone calls, emails, and potentially formal letters, is crucial. This strategy should be documented and followed consistently for every potentially problematic account.

Significant Disputes:

Large disputes over the quality of goods or services provided can lead to delayed or non-payment. Clear contracts, thorough documentation, and a readily available dispute resolution process are vital. Addressing disputes promptly and professionally can sometimes salvage the receivable.

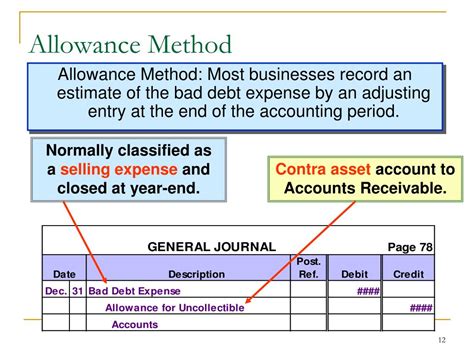

Accounting for Doubtful Accounts

Once receivables are identified as potentially uncollectible, they must be accounted for properly. This typically involves creating a reserve for doubtful accounts, a contra-asset account that reduces the value of accounts receivable on the balance sheet. This reserve reflects the estimated portion of accounts receivable that will likely not be collected.

Methods for Estimating Bad Debts:

Several methods are commonly used to estimate the amount to set aside for doubtful accounts:

-

Percentage of Sales Method: This method estimates bad debts as a percentage of credit sales for a specific period. This approach is simple but may not accurately reflect the specific risks associated with individual accounts.

-

Percentage of Receivables Method: This method estimates bad debts as a percentage of outstanding accounts receivable at the end of a period. This method is more directly linked to the actual receivables but may not account for changes in credit risk over time.

-

Aging of Receivables Method: This is a more sophisticated method that analyzes accounts receivable based on their age. Older receivables are generally considered riskier and assigned a higher percentage of uncollectibility. This method provides a more granular and accurate estimate of bad debts.

The choice of method depends on the company's specific circumstances and industry practices. Larger companies with more complex receivable portfolios may benefit from using the aging method, while smaller businesses might find the percentage of sales method sufficient. Regardless of the method chosen, the estimate should be reviewed and adjusted regularly to reflect changes in credit risk.

Writing Off Bad Debts

After making reasonable efforts to collect a receivable and concluding it's unlikely to be collected, the account must be written off. This involves formally removing the receivable from the balance sheet. The write-off reduces both accounts receivable and the allowance for doubtful accounts, resulting in no net change to the company's overall net assets.

The Write-Off Process:

The specific steps involved in writing off bad debts vary depending on the accounting system used. However, the general process includes:

-

Documentation: Thoroughly document the reasons for writing off the receivable, including all collection attempts and communication with the customer.

-

Journal Entry: A journal entry is recorded to remove the receivable from the books. This typically involves debiting the allowance for doubtful accounts and crediting accounts receivable.

-

Internal Controls: Implement strong internal controls to prevent fraudulent write-offs. This includes multiple approvals for write-offs and regular audits of the accounts receivable process.

-

Reporting: The write-off should be properly reported in the financial statements. The amount of bad debt expense is reported on the income statement, while the net accounts receivable (accounts receivable less allowance for doubtful accounts) is reported on the balance sheet.

Minimizing Bad Debts: Proactive Strategies

Preventing bad debts is far more effective and cost-efficient than dealing with them after they occur. Proactive strategies play a crucial role in minimizing the risk of non-payment:

Creditworthiness Assessment:

Implementing a rigorous credit check process for new customers is essential. This involves reviewing credit reports, financial statements, and conducting reference checks. Setting clear credit limits based on assessed risk is also crucial.

Strong Contracts and Payment Terms:

Clearly defined contracts with specific payment terms, including due dates, late payment penalties, and dispute resolution mechanisms, minimize ambiguities and encourage timely payment. Legal review of contracts can ensure they are enforceable.

Efficient Invoice Processing:

Accurate and timely invoice processing is crucial. Invoices should be clear, concise, and delivered promptly. Automation can streamline this process and reduce errors.

Effective Collection Procedures:

A well-defined collection policy, including timely reminders, escalation procedures, and multiple communication channels, increases the likelihood of collecting outstanding payments. Using collection agencies as a last resort can also be effective.

Regular Monitoring and Analysis:

Regular monitoring of accounts receivable and key metrics, such as Days Sales Outstanding (DSO), provides early warnings of potential problems. Analyzing trends and identifying high-risk customers allows for proactive intervention.

The Impact of Bad Debts on Financial Statements

Bad debts have a direct impact on a company's financial statements:

-

Income Statement: The write-off of bad debts increases bad debt expense, reducing net income.

-

Balance Sheet: The write-off reduces accounts receivable and the allowance for doubtful accounts. The net effect on total assets is zero.

-

Cash Flow Statement: While the write-off doesn't directly impact cash flow, the inability to collect receivables negatively affects cash flow from operating activities.

Accurate accounting for bad debts is essential for presenting a true and fair view of a company's financial position and performance. Misrepresenting bad debts can have serious consequences, including misleading investors and creditors.

Conclusion: A Proactive Approach is Key

Managing receivables, particularly those not expected to be collected, is a critical aspect of financial management. While writing off bad debts is sometimes unavoidable, a proactive approach that emphasizes creditworthiness assessment, robust contracts, efficient invoice processing, and effective collection procedures is significantly more effective. By implementing these strategies, businesses can minimize bad debt expense, improve cash flow, and maintain accurate financial reporting. Regularly reviewing and refining these processes ensures ongoing effectiveness and adaptability to changing market conditions. Remember, proactive management is not just about minimizing losses; it's about maximizing the potential for successful revenue collection and overall business success.

Latest Posts

Latest Posts

-

Match Each Example With The Business Trend It Illustrates

Mar 20, 2025

-

Which Of The Following Cross Couplings Of An Enolate

Mar 20, 2025

-

Suppose T And Z Are Random Variables

Mar 20, 2025

-

Blood Clotting Is An Example Of How Multiple Choice Question

Mar 20, 2025

-

Matching 11 1 Key Terms And Descriptions

Mar 20, 2025

Related Post

Thank you for visiting our website which covers about Receivables Not Expected To Be Collected Should . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.