Prepare An Income Statement For The Year Ended December 31

Holbox

Mar 19, 2025 · 7 min read

Table of Contents

Preparing an Income Statement for the Year Ended December 31

The income statement, also known as the profit and loss (P&L) statement, is a crucial financial statement that summarizes a company's revenues, costs, and expenses over a specific period, typically a year. Preparing an accurate and comprehensive income statement is essential for understanding a company's financial health, making informed business decisions, and complying with accounting standards. This guide will walk you through the process of preparing an income statement for the year ended December 31st, covering key components, common methods, and important considerations.

Understanding the Components of an Income Statement

Before diving into the preparation, it's crucial to understand the fundamental elements that constitute an income statement. These components work together to paint a clear picture of a company's profitability.

1. Revenue: The Top Line

Revenue, also known as sales or turnover, represents the total income generated from the company's primary operations during the reporting period. This includes sales of goods, services rendered, and any other income directly related to the business's core activities.

- Example: For a retail store, revenue would encompass all sales of merchandise. For a service-based business like a consulting firm, revenue would be the fees charged for services provided.

2. Cost of Goods Sold (COGS): Direct Costs of Production

COGS represents the direct costs associated with producing the goods or services sold during the reporting period. This includes the cost of raw materials, direct labor, and manufacturing overhead directly attributable to the production process.

- Example: For a bakery, COGS would include the cost of flour, sugar, eggs, and the wages of bakers directly involved in producing the bread.

3. Gross Profit: Revenue Minus COGS

Gross profit is the difference between revenue and the cost of goods sold. It represents the profit generated from the core business operations before considering operating expenses. A high gross profit margin (gross profit divided by revenue) indicates efficient cost management and potentially strong pricing power.

- Formula: Gross Profit = Revenue - Cost of Goods Sold

4. Operating Expenses: Costs of Running the Business

Operating expenses encompass all costs incurred in running the business, excluding COGS. These expenses can be categorized broadly into selling, general, and administrative expenses.

- Selling Expenses: Costs associated with marketing, sales, and distribution of goods or services. (e.g., advertising, sales commissions, shipping costs)

- General and Administrative Expenses: Costs related to overall management and administration of the business. (e.g., rent, utilities, salaries of administrative staff, insurance)

- Research and Development Expenses: Costs incurred in developing new products or improving existing ones.

5. Operating Income (EBIT): Profit from Core Operations

Operating income, also known as earnings before interest and taxes (EBIT), represents the profit generated from the company's core operations after deducting operating expenses. It provides a measure of profitability exclusive of financing and tax implications.

- Formula: Operating Income (EBIT) = Gross Profit - Operating Expenses

6. Interest Expense: Cost of Borrowing

Interest expense reflects the cost of borrowing money, such as loans or debt financing. This expense is deducted from operating income to arrive at earnings before taxes (EBT).

7. Earnings Before Taxes (EBT): Profit Before Taxes

Earnings before taxes represent the company's profit before deducting income taxes.

- Formula: Earnings Before Taxes (EBT) = Operating Income - Interest Expense

8. Income Tax Expense: Taxes on Profit

Income tax expense is the amount of taxes owed on the company's taxable income. This is calculated based on applicable tax laws and rates.

9. Net Income (Net Profit): The Bottom Line

Net income, also known as net profit, is the company's final profit after deducting all expenses, including taxes. It represents the overall profitability of the business during the reporting period. This is the most important figure on the income statement.

- Formula: Net Income = Earnings Before Taxes (EBT) - Income Tax Expense

Methods for Preparing an Income Statement

There are several common formats used for preparing an income statement. The most prevalent are the single-step and multi-step income statements.

1. Single-Step Income Statement

The single-step income statement presents a simple format where all revenues are grouped together, and all expenses are subtracted to arrive at net income. It's straightforward and easy to understand.

Example:

Company Name Income Statement For the Year Ended December 31, 20XX

| Revenue | $XXX,XXX |

|---|---|

| Total Revenue | $XXX,XXX |

| Expenses: | |

| Cost of Goods Sold | $XXX,XXX |

| Operating Expenses | $XXX,XXX |

| Interest Expense | $XXX,XXX |

| Income Tax Expense | $XXX,XXX |

| Total Expenses | $XXX,XXX |

| Net Income | $XXX,XXX |

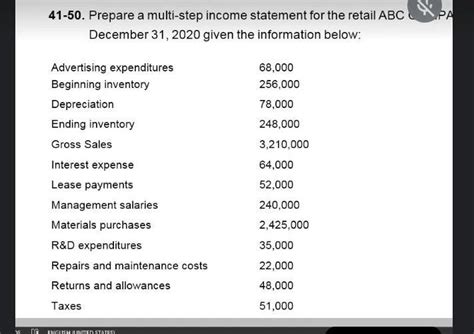

2. Multi-Step Income Statement

The multi-step income statement provides a more detailed breakdown of revenues and expenses. It presents intermediate profit figures like gross profit and operating income, offering a more comprehensive view of a company's profitability at different stages.

Example:

Company Name Income Statement For the Year Ended December 31, 20XX

| Revenue | $XXX,XXX |

|---|---|

| Cost of Goods Sold | $XXX,XXX |

| Gross Profit | $XXX,XXX |

| Operating Expenses: | |

| Selling Expenses | $XXX,XXX |

| General and Administrative Expenses | $XXX,XXX |

| Research and Development Expenses | $XXX,XXX |

| Total Operating Expenses | $XXX,XXX |

| Operating Income (EBIT) | $XXX,XXX |

| Interest Expense | $XXX,XXX |

| Earnings Before Taxes (EBT) | $XXX,XXX |

| Income Tax Expense | $XXX,XXX |

| Net Income | $XXX,XXX |

Important Considerations When Preparing an Income Statement

Several crucial factors need consideration to ensure the accuracy and reliability of your income statement:

-

Accrual Accounting: Income statements should be prepared using accrual accounting, recording revenues when earned and expenses when incurred, regardless of when cash changes hands. This provides a more accurate reflection of a company's financial performance.

-

Matching Principle: Expenses should be matched to the revenues they helped generate. For instance, the cost of goods sold should be matched with the revenue from the sale of those goods.

-

Consistency: Use the same accounting methods and principles consistently from period to period for better comparability. Changes in accounting methods should be disclosed.

-

Materiality: Only items that are significant enough to affect users' decisions need to be disclosed separately. Minor items can be aggregated.

-

Professional Judgement: Preparing financial statements often involves professional judgment. If uncertain about certain transactions, consult with an accountant or financial professional.

-

GAAP Compliance (Generally Accepted Accounting Principles): In the United States, financial statements must comply with GAAP. Other countries have their own accounting standards, such as IFRS (International Financial Reporting Standards). Adherence to these standards is crucial for credibility and comparability.

-

Data Accuracy: Accurate and reliable source data is fundamental. This necessitates a robust accounting system and meticulous record-keeping.

Analyzing the Income Statement

Once the income statement is prepared, it's crucial to analyze it to extract meaningful insights. This involves calculating key ratios and comparing performance over time or against industry benchmarks. Some key ratios include:

- Gross Profit Margin: Gross Profit / Revenue

- Operating Profit Margin: Operating Income / Revenue

- Net Profit Margin: Net Income / Revenue

- Return on Assets (ROA): Net Income / Total Assets

- Return on Equity (ROE): Net Income / Shareholders' Equity

By analyzing these ratios and comparing them to previous periods or industry averages, you can assess the company’s profitability, efficiency, and overall financial health.

Conclusion

Preparing an accurate and comprehensive income statement is a critical aspect of financial reporting. By understanding the components, choosing the appropriate format, and adhering to accounting principles, businesses can gain valuable insights into their financial performance and make informed decisions for future growth and success. Remember that seeking professional advice from a qualified accountant is always recommended, especially for complex financial situations. Thorough understanding and consistent application of these principles will lead to more reliable financial reporting and better business decisions.

Latest Posts

Latest Posts

-

Which Statement Is An Accurate Summary Of Meiosis

Mar 19, 2025

-

Absolute Advantage Is Found By Comparing Different Producers

Mar 19, 2025

-

At A Team Meeting The Restaurant Manager

Mar 19, 2025

-

All Of The Following Are Heart Valves Except

Mar 19, 2025

-

Draw The Correct Organic Product Of The Oxidation Reaction Shown

Mar 19, 2025

Related Post

Thank you for visiting our website which covers about Prepare An Income Statement For The Year Ended December 31 . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.