Portia Grant Is An Employee Who Is Paid Monthly

Holbox

Mar 28, 2025 · 6 min read

Table of Contents

- Portia Grant Is An Employee Who Is Paid Monthly

- Table of Contents

- Portia Grant: A Case Study in Monthly Payroll Processing

- Understanding the Components of Portia's Monthly Paycheck

- 1. Gross Pay: The Foundation

- 2. Deductions: Reducing the Take-Home Pay

- Calculating Portia's Net Pay: The Final Figure

- Payroll Processing: A Step-by-Step Guide for Portia's Employer

- 1. Data Collection: Gathering the Necessary Information

- 2. Payroll Calculation: Determining the Amounts

- 3. Payroll Processing: Generating Payment

- 4. Record Keeping: Maintaining Accurate Records

- 5. Compliance: Adhering to Legal Requirements

- Potential Payroll Issues and Their Resolution

- The Importance of Accurate and Timely Payroll

- Utilizing Payroll Software for Efficiency

- Conclusion: Portia's Paycheck and the Bigger Picture

- Latest Posts

- Latest Posts

- Related Post

Portia Grant: A Case Study in Monthly Payroll Processing

Portia Grant, a fictional employee, serves as an excellent case study to explore the intricacies of monthly payroll processing. This comprehensive guide will delve into the various aspects involved, from calculating gross pay to handling deductions and ensuring compliance with relevant regulations. Understanding these processes is crucial for both employers and employees alike. We’ll unpack the complexities of Portia’s monthly paycheck, illustrating the steps involved in a clear and concise manner.

Understanding the Components of Portia's Monthly Paycheck

Portia’s monthly paycheck, like any other, is composed of several key components. Let's break them down:

1. Gross Pay: The Foundation

Portia's gross pay represents the total amount she earns before any deductions. This is calculated based on her salary (if she's a salaried employee) or her hourly rate multiplied by the number of hours worked (if she's an hourly employee). For the purpose of this case study, let's assume Portia is a salaried employee with a monthly salary of $4,000. Therefore, her gross pay for the month is $4,000.

2. Deductions: Reducing the Take-Home Pay

Several deductions can reduce Portia's gross pay to arrive at her net pay (also known as take-home pay). These deductions often include:

-

Federal Income Tax: A significant deduction based on Portia's income level, filing status (single, married, etc.), and the applicable tax brackets defined by the Internal Revenue Service (IRS). The amount withheld is calculated using payroll software or tax tables.

-

State Income Tax (if applicable): Similar to federal income tax, but dependent on Portia's state of residence and its specific tax laws. Some states don't have income tax.

-

Social Security Tax (FICA): This tax contributes to Social Security and Medicare benefits. Both the employer and employee contribute a percentage of Portia's earnings.

-

Medicare Tax (FICA): Another component of FICA, contributing to the Medicare healthcare program. Like Social Security tax, both employer and employee contribute.

-

Other Deductions: This category encompasses various deductions Portia might elect, such as:

-

Health Insurance Premiums: If Portia participates in her employer's health insurance plan, her monthly premium will be deducted.

-

Retirement Plan Contributions: Portia might contribute to a 401(k) or other retirement plan, reducing her taxable income and saving for the future.

-

Dental and Vision Insurance Premiums: Additional insurance coverage, often offered as optional benefits.

-

Life Insurance Premiums: Premiums for life insurance policies offered through the employer.

-

Union Dues (if applicable): If Portia belongs to a labor union, dues will be deducted from her paycheck.

-

Garnishment: In certain situations, a court order may require a portion of Portia's wages to be garnished for debt repayment.

-

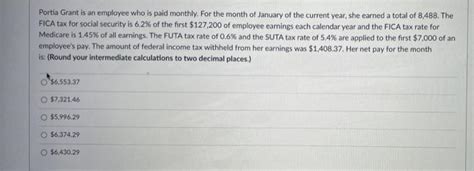

Calculating Portia's Net Pay: The Final Figure

Once all deductions are calculated and subtracted from Portia's gross pay, the remaining amount is her net pay. This is the actual amount she receives in her bank account or paycheck. Let's illustrate with an example:

Example:

- Gross Pay: $4,000

- Federal Income Tax: $600

- State Income Tax: $200

- Social Security Tax: $248

- Medicare Tax: $58

- Health Insurance Premiums: $100

- 401(k) Contributions: $200

Net Pay Calculation:

$4,000 (Gross Pay) - $600 (Federal Tax) - $200 (State Tax) - $248 (Social Security) - $58 (Medicare) - $100 (Health Insurance) - $200 (401k) = $1,594 (Net Pay)

In this scenario, Portia's net pay would be $1,594. This amount is what she actually receives.

Payroll Processing: A Step-by-Step Guide for Portia's Employer

Portia's employer follows a systematic process to generate her monthly paycheck:

1. Data Collection: Gathering the Necessary Information

This initial step involves collecting crucial data about Portia and her employment:

- Personal Information: Name, address, Social Security number, and banking details.

- Employment Information: Job title, salary or hourly rate, start date, and any changes in pay or work schedule.

- Deduction Information: Details about Portia's tax withholdings, insurance premiums, and other deductions.

2. Payroll Calculation: Determining the Amounts

This stage involves calculating Portia's gross pay, deductions, and net pay using payroll software or manual calculations (though software is far more common and efficient). The accuracy of this step is critical to avoid discrepancies and legal issues.

3. Payroll Processing: Generating Payment

The employer then processes Portia's paycheck using their chosen payroll system. This might involve direct deposit to Portia's bank account or issuing a physical check. Many employers utilize online payroll services for efficiency and accuracy.

4. Record Keeping: Maintaining Accurate Records

Maintaining detailed payroll records is vital for tax purposes and compliance with labor laws. Employers must keep accurate records of Portia's earnings, deductions, and payments for a specific period (usually several years). This often involves electronic records and secure storage.

5. Compliance: Adhering to Legal Requirements

Employers must comply with various federal, state, and local regulations regarding payroll. This includes:

- Federal and State Tax Laws: Accurate withholding of taxes and timely remittance to the relevant tax authorities.

- Labor Laws: Adherence to minimum wage laws, overtime pay regulations, and other relevant employment standards.

- Data Security: Protecting Portia's sensitive personal and financial information from unauthorized access.

Potential Payroll Issues and Their Resolution

While monthly payroll processing strives for accuracy, issues can arise. Let's consider some scenarios involving Portia:

-

Incorrect Deductions: If Portia notices incorrect deductions from her paycheck (e.g., wrong amount of tax withheld), she should promptly contact her employer's payroll department to rectify the error. The employer should investigate and issue a corrected paycheck.

-

Late Payment: If Portia's payment is consistently late, she should inquire with her employer about the reason for the delay. Late payment can be a breach of employment contract in some cases.

-

Payroll Errors: Various errors can occur during payroll processing, such as miscalculation of gross pay or incorrect deductions. Addressing these errors swiftly is crucial for maintaining a positive employer-employee relationship.

-

Garnishment Issues: If Portia is experiencing wage garnishment, she needs to understand the legal basis for the garnishment and explore potential options for addressing the debt.

The Importance of Accurate and Timely Payroll

Accurate and timely payroll is essential for both the employer and the employee. For Portia, it ensures she receives the correct amount of compensation for her work. For Portia's employer, it ensures compliance with labor laws, avoids potential legal issues, and maintains a positive working environment. Efficient payroll processing is vital for smooth business operations and employee satisfaction.

Utilizing Payroll Software for Efficiency

Modern payroll processing relies heavily on payroll software. Such software streamlines the process, reduces errors, and enhances efficiency. Features typically include:

- Automated Calculations: Automatic calculations of gross pay, deductions, and net pay, minimizing manual errors.

- Direct Deposit: Efficient and secure direct deposit of funds into Portia's bank account.

- Tax Compliance: Assistance with adhering to federal and state tax laws.

- Record Keeping: Organized and secure storage of payroll records.

- Reporting: Generation of various payroll reports for management and tax purposes.

Conclusion: Portia's Paycheck and the Bigger Picture

Portia Grant's monthly paycheck is more than just a payment; it represents a complex process involving various legal, financial, and administrative aspects. Understanding the components of her paycheck, the payroll processing steps, and potential issues involved provides valuable insights for both employers and employees. Accurate and timely payroll is crucial for maintaining a positive work environment, ensuring compliance with regulations, and fostering strong employer-employee relationships. The use of efficient payroll software further streamlines the process and minimizes the risk of errors. Portia's case serves as a microcosm of the larger payroll landscape, highlighting the importance of detailed and meticulous payroll management.

Latest Posts

Latest Posts

-

The Traditional Method Of Maintaining Product Quality Has Been The

Mar 31, 2025

-

Use The Drop Down Menus To Complete The Statements

Mar 31, 2025

-

Schizophrenia Is Considered A Disorder

Mar 31, 2025

-

Who Do Legitimate Sharepoint Documents Come From

Mar 31, 2025

-

Select The Four Principles That Underlie The Strategic Marketing Process

Mar 31, 2025

Related Post

Thank you for visiting our website which covers about Portia Grant Is An Employee Who Is Paid Monthly . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.