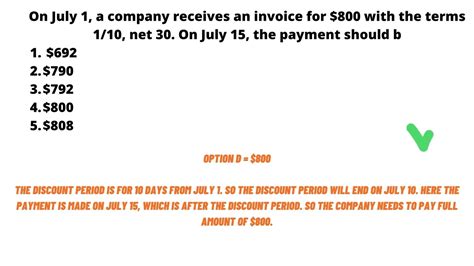

On July 1st A Company Receives An Invoice For $800

Holbox

Mar 17, 2025 · 5 min read

Table of Contents

On July 1st, a Company Receives an Invoice for $800: A Comprehensive Guide to Invoice Processing and Financial Management

On July 1st, a seemingly simple event occurs: a company receives an invoice for $800. While seemingly insignificant on its own, this single invoice represents a crucial element within a larger ecosystem of financial management. This comprehensive guide will dissect the implications of this invoice, exploring various aspects from initial receipt to final payment, touching upon best practices in invoice processing, financial record-keeping, and strategic financial planning.

Understanding the Invoice: Beyond the Numbers

The $800 invoice isn't just a piece of paper; it's a legally binding document outlining a transaction. Understanding its components is critical. A typical invoice includes:

- Invoice Number: A unique identifier for easy tracking and referencing.

- Invoice Date: The date the invoice was issued. Crucial for tracking payment due dates.

- Due Date: The date by which payment is expected. Late payments can incur penalties.

- Vendor/Supplier Information: Details identifying the entity issuing the invoice (name, address, contact information).

- Company Information: Details of the company receiving the invoice.

- Description of Goods or Services: A detailed breakdown of what was provided. This is crucial for reconciliation and auditing.

- Quantity and Unit Price: Specifies the quantity of goods or services provided and the price per unit.

- Total Amount Due: The sum total of the invoice. In this case, $800.

- Payment Terms: Specifies the acceptable payment methods (check, credit card, wire transfer, etc.) and any discounts offered for early payment.

The Importance of Accurate Invoicing: Accurate invoices are essential for both the buyer and the seller. For the buyer, accurate invoices ensure they are only paying for what they received. For the seller, accurate invoices are vital for accurate revenue recognition and financial reporting. Discrepancies can lead to disputes, delays, and financial losses.

Processing the Invoice: A Step-by-Step Guide

Efficient invoice processing is key to maintaining sound financial health. Here's a step-by-step guide:

1. Receiving and Reviewing: Upon receipt, the invoice should be immediately reviewed for accuracy. Verify the quantities, prices, and descriptions against purchase orders or contracts. Note any discrepancies.

2. Coding the Invoice: Each invoice needs to be coded appropriately for accounting purposes. This involves assigning the invoice to specific general ledger accounts. Proper coding ensures accurate financial reporting and simplifies year-end processes.

3. Data Entry: Input the invoice details into the company's accounting system. This could be an accounting software package, a spreadsheet, or a dedicated invoice processing system. Accuracy is paramount at this stage.

4. Approval Process: Depending on the company's policies, the invoice may need to go through an approval process before payment. This might involve multiple levels of authorization, particularly for larger amounts.

5. Payment Processing: Once approved, the invoice is ready for payment. The chosen payment method should be used, ensuring adherence to the payment terms specified in the invoice.

6. Record Keeping: Maintain a detailed record of all invoices received, including copies of the invoices, payment confirmations, and any related correspondence. This is critical for auditing and financial reporting.

Financial Implications and Strategic Considerations

The $800 invoice has broader financial implications beyond the immediate payment.

1. Cash Flow Management: The invoice impacts the company's cash flow. The company needs to ensure it has sufficient funds available to meet the payment due date. This necessitates careful cash flow forecasting and budgeting.

2. Accounts Payable: The invoice becomes an item in the company's accounts payable (A/P). Effective A/P management involves timely processing of invoices and maintaining a clear record of outstanding payments.

3. Expense Tracking: The invoice represents an expense for the company. Tracking expenses accurately is crucial for budgeting, financial reporting, and identifying potential areas for cost savings.

4. Budgeting and Forecasting: The invoice should be incorporated into the company's budget and financial forecasts. This helps ensure the company has sufficient resources to meet its obligations and achieve its financial goals.

5. Tax Implications: Depending on the nature of the goods or services purchased, the invoice may have tax implications. Understanding and properly recording applicable sales taxes, VAT, or other taxes is vital for compliance.

6. Vendor Relationships: Prompt and accurate payment of invoices contributes to positive vendor relationships. Good vendor relationships can lead to better pricing, improved service, and stronger collaborations.

Technology and Automation: Streamlining Invoice Processing

Technology plays a crucial role in streamlining invoice processing. Several tools and systems can automate various aspects of invoice handling, improving efficiency and reducing errors.

- Invoice Processing Software: Many software packages automate invoice entry, data extraction, and workflow management.

- Optical Character Recognition (OCR): OCR technology extracts data from invoices automatically, reducing manual data entry.

- Automated Payment Systems: Automated payment systems streamline payment processing, reducing manual effort and minimizing errors.

- Cloud-Based Solutions: Cloud-based solutions offer accessibility, scalability, and enhanced collaboration.

Best Practices for Effective Invoice Management

Effective invoice management requires a combination of processes, technology, and best practices.

- Centralized Invoice Processing: Establish a centralized system for handling invoices, ensuring consistency and reducing redundancy.

- Clear Invoice Approval Workflow: Implement a clear and efficient approval workflow to expedite the payment process.

- Regular Reconciliation: Regularly reconcile invoices with purchase orders and payment records to identify any discrepancies.

- Establish Payment Terms: Clearly define payment terms with vendors to avoid confusion and payment delays.

- Utilize Invoice Automation Software: Leverage technology to automate manual tasks and improve efficiency.

- Maintain Accurate Records: Maintain detailed and accurate records of all invoices, payments, and related documents.

- Regular Training: Provide regular training to employees involved in invoice processing to ensure they are using best practices.

The Long-Term Perspective: $800 and the Bigger Picture

While the $800 invoice represents a small transaction in isolation, its implications extend far beyond the immediate payment. Effective handling of this single invoice demonstrates a commitment to sound financial management, impacting cash flow, budgeting, vendor relationships, and ultimately, the long-term success of the company. It highlights the importance of attention to detail, efficient processes, and the strategic use of technology in maintaining financial health. The consistent and effective management of invoices, both large and small, builds a strong foundation for sustainable growth and financial stability. Ignoring or mishandling these seemingly minor details can lead to larger, more significant problems down the line. The $800 invoice, therefore, serves as a microcosm of the larger financial landscape, reminding us of the importance of diligent financial management in every aspect of business operation. The proactive approach to invoice processing showcased here is a key component of achieving long-term financial success.

Latest Posts

Latest Posts

-

Which Of The Following Questions Cannot Be Answered By Science

Mar 19, 2025

-

The Overhead Variance Is The Difference Between

Mar 19, 2025

-

What Is The Formula Mass Of Mg No3 2

Mar 19, 2025

-

Hipaa And Ferpa Prevent A Professionally Mandated Reporter

Mar 19, 2025

-

Which Statement Regarding Free Radicals Is False

Mar 19, 2025

Related Post

Thank you for visiting our website which covers about On July 1st A Company Receives An Invoice For $800 . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.