On July 1 A Company Receives An Invoice

Holbox

Mar 26, 2025 · 5 min read

Table of Contents

- On July 1 A Company Receives An Invoice

- Table of Contents

- On July 1st, a Company Receives an Invoice: A Comprehensive Guide to Invoice Processing and Management

- Understanding the Invoice: Deconstructing the Document

- Streamlining the Invoice Processing Workflow: A Step-by-Step Guide

- Minimizing Invoice Processing Errors and Disputes: Proactive Strategies

- Leveraging Technology for Enhanced Invoice Management: Software and Automation

- The Importance of Timely Invoice Payment: Maintaining Positive Vendor Relationships

- Beyond Payment: Analyzing Invoice Data for Business Insights

- Conclusion: Mastering Invoice Processing for Financial Health and Growth

- Latest Posts

- Latest Posts

- Related Post

On July 1st, a Company Receives an Invoice: A Comprehensive Guide to Invoice Processing and Management

Receiving an invoice on July 1st, or any day for that matter, initiates a crucial process for any business. Proper invoice handling is not just about paying bills; it's a cornerstone of efficient financial management, strong vendor relationships, and maintaining a healthy bottom line. This comprehensive guide delves into every aspect of invoice processing, from initial receipt to final payment, offering strategies for optimization and highlighting potential pitfalls to avoid.

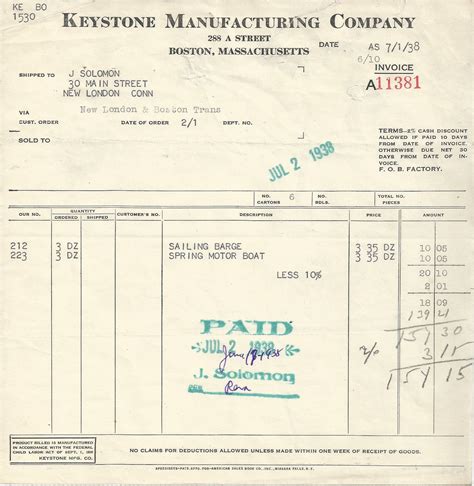

Understanding the Invoice: Deconstructing the Document

Before diving into the processing steps, it's essential to understand the components of an invoice. A typical invoice includes:

- Invoice Number: A unique identifier for the specific invoice.

- Invoice Date: The date the invoice was issued. Note the difference between the invoice date and the due date.

- Vendor Information: The name, address, and contact details of the supplier.

- Client Information: The name, address, and contact details of the company receiving the invoice.

- Description of Goods or Services: A detailed breakdown of the items or services provided.

- Quantity and Unit Price: The number of units and the cost per unit for each item.

- Subtotal: The total cost of goods or services before taxes and other charges.

- Taxes: Applicable sales tax or other taxes.

- Total Amount Due: The final amount payable, including all taxes and charges.

- Payment Terms: The payment due date and accepted payment methods.

Identifying Potential Issues: Carefully review each component. Discrepancies like incorrect quantities, pricing errors, or missing items require immediate clarification with the vendor. Don't hesitate to contact the supplier if anything seems amiss. Early identification saves time and prevents potential payment disputes later.

Streamlining the Invoice Processing Workflow: A Step-by-Step Guide

Efficient invoice processing requires a structured workflow. Here's a step-by-step guide to optimize the process:

1. Invoice Receipt and Data Entry:

- Centralized Inbox: Establish a centralized system for receiving invoices, whether physical mail, email, or online portals. This prevents invoices from getting lost and ensures timely processing.

- Automated Data Entry: Consider using invoice processing software or optical character recognition (OCR) technology to automate data entry. This significantly reduces manual effort and minimizes errors.

- Data Validation: After data entry, meticulously verify all details against purchase orders or contracts to ensure accuracy.

2. Invoice Approval:

- Workflow Automation: Implement a workflow system that routes invoices to the appropriate approvers based on pre-defined rules and spending limits. This streamlines the approval process and avoids bottlenecks.

- Clear Approval Process: Establish clear guidelines and responsibilities for invoice approvals, including designated approvers and escalation paths for exceptions.

3. Matching Invoices to Purchase Orders (POs):

- Three-Way Matching: Implement a three-way matching process, comparing the invoice to the purchase order and receiving report. This ensures that the goods or services received match what was ordered and invoiced.

- Automated Matching: Utilize software that can automatically match invoices to POs, reducing manual effort and improving accuracy.

4. Payment Processing:

- Automated Payments: Explore automated payment systems like electronic funds transfer (EFT) or online payment platforms to streamline payments and reduce processing time.

- Payment Reconciliation: Reconcile payments with invoices to ensure accuracy and track outstanding balances.

5. Invoice Archiving:

- Secure Storage: Store invoices securely, either physically or electronically, ensuring compliance with relevant regulations and easy retrieval when needed.

- Digital Archiving: Opt for digital archiving systems that provide secure, searchable storage and comply with audit requirements.

Minimizing Invoice Processing Errors and Disputes: Proactive Strategies

Errors and disputes can disrupt cash flow and damage vendor relationships. Proactive strategies are crucial:

- Clear Communication: Maintain open communication with vendors to address any discrepancies promptly.

- Regular Audits: Conduct regular audits of invoice processing procedures to identify areas for improvement and prevent errors.

- Vendor Relationship Management: Cultivate strong relationships with vendors to facilitate smooth communication and resolution of any issues.

- Robust Internal Controls: Implement strong internal controls to prevent fraud and ensure accuracy in invoice processing.

- Dispute Resolution Process: Establish a clear process for handling invoice disputes, including escalation procedures and mediation options.

Leveraging Technology for Enhanced Invoice Management: Software and Automation

Technology plays a vital role in modern invoice management. Several software solutions can streamline the entire process:

- Enterprise Resource Planning (ERP) Systems: ERP systems integrate various business functions, including invoice processing, providing a centralized platform for managing all aspects of the process.

- Accounts Payable (AP) Automation Software: Specialized AP automation software automates invoice processing tasks, reducing manual effort and improving accuracy.

- Invoice Processing Platforms: Cloud-based invoice processing platforms offer scalability, accessibility, and collaboration features.

- Optical Character Recognition (OCR) Software: OCR technology can extract data from invoices automatically, reducing manual data entry.

The Importance of Timely Invoice Payment: Maintaining Positive Vendor Relationships

Timely invoice payments are crucial for maintaining positive relationships with vendors. Late payments can damage your reputation, lead to penalties, and even jeopardize future business opportunities. Establish a clear payment schedule, automate payments where possible, and communicate promptly with vendors if any delays are anticipated. A strong payment history fosters trust and encourages favorable terms in future transactions.

Beyond Payment: Analyzing Invoice Data for Business Insights

Beyond simply processing invoices, the data they contain offers valuable insights into your business spending. Analyzing invoice data can reveal:

- Spending Trends: Identify trends in spending patterns to optimize purchasing decisions.

- Cost Savings Opportunities: Analyze invoices to identify areas where cost savings are possible.

- Supplier Performance: Evaluate supplier performance based on invoice data, including delivery times and accuracy.

- Budgeting and Forecasting: Use invoice data to improve budgeting and forecasting accuracy.

Conclusion: Mastering Invoice Processing for Financial Health and Growth

Effective invoice processing is a critical function for every business, regardless of size. By implementing the strategies and utilizing the technology outlined in this guide, companies can streamline their processes, minimize errors and disputes, and leverage invoice data for valuable business insights. A well-managed invoice processing system ensures smooth cash flow, strengthens vendor relationships, and contributes significantly to overall financial health and sustainable growth. Remember, an invoice received on July 1st is not just a piece of paper; it's an opportunity to optimize your financial operations and build a more robust and efficient business. Don't underestimate the power of a well-organized and efficient invoice management system – it's a cornerstone of sustainable success.

Latest Posts

Latest Posts

-

Peptidoglycan Is A Unique Macromolecule Found In Bacterial

Mar 30, 2025

-

Select The Five Major Mechanisms Of Antimicrobial Resistance

Mar 30, 2025

-

Correctly Label The Following Functional Regions Of The Cerebral Cortex

Mar 30, 2025

-

Your Pc Screen Looks Like This

Mar 30, 2025

-

Label The Structures Of A Motor Multipolar Neuron

Mar 30, 2025

Related Post

Thank you for visiting our website which covers about On July 1 A Company Receives An Invoice . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.