Meller Purchases Inventory On Account. As A Results Meller's

Holbox

Mar 21, 2025 · 6 min read

Table of Contents

- Meller Purchases Inventory On Account. As A Results Meller's

- Table of Contents

- Meller Purchases Inventory on Account: A Comprehensive Analysis of the Resulting Accounting Entries and Financial Statement Impacts

- Understanding the Transaction: Meller Purchases Inventory on Account

- Accounting for the Transaction: The Journal Entry

- Impact on Financial Statements

- Balance Sheet

- Income Statement

- Statement of Cash Flows

- Variations and Complexities

- Purchase Discounts

- Freight Costs

- Returns and Allowances

- Damaged or Obsolete Inventory

- Importance of Accurate Accounting for Inventory

- Conclusion

- Latest Posts

- Latest Posts

- Related Post

Meller Purchases Inventory on Account: A Comprehensive Analysis of the Resulting Accounting Entries and Financial Statement Impacts

Meller's purchase of inventory on account represents a common business transaction with significant implications for the company's financial statements. Understanding the accounting treatment of this transaction is crucial for accurate financial reporting and effective business management. This article will delve into the details of this transaction, exploring its impact on the accounting equation, the preparation of journal entries, and the subsequent effects on the balance sheet, income statement, and statement of cash flows. We'll also examine potential variations and complexities associated with this seemingly simple transaction.

Understanding the Transaction: Meller Purchases Inventory on Account

When Meller purchases inventory on account, it means the company acquires goods for resale without making an immediate cash payment. Instead, Meller incurs an account payable, a short-term liability representing the company's obligation to pay the supplier at a later date. This credit arrangement allows Meller to maintain inventory levels without tying up significant cash resources, facilitating smoother business operations.

Key Aspects of the Transaction:

- Inventory: This represents the goods Meller purchases for the purpose of resale. The cost of these goods is a crucial element in determining the company's cost of goods sold (COGS) and ultimately its profitability.

- Account Payable: This is a liability account that reflects Meller's obligation to pay the supplier for the inventory purchased. It increases the company's short-term debt.

- Credit Terms: The agreement between Meller and the supplier will stipulate credit terms, typically specifying the payment due date (e.g., net 30, meaning payment is due within 30 days). These terms are crucial for managing cash flow and ensuring timely payments.

Accounting for the Transaction: The Journal Entry

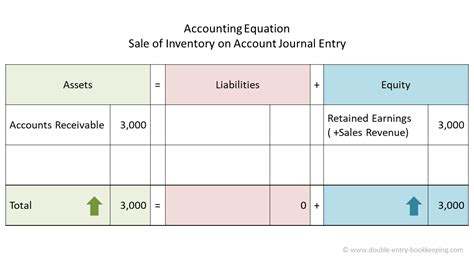

The core accounting principle guiding the recording of this transaction is the double-entry bookkeeping system. This system requires that every transaction impacts at least two accounts, ensuring the accounting equation (Assets = Liabilities + Equity) remains balanced.

The journal entry to record Meller's purchase of inventory on account is as follows:

| Date | Account Name | Debit | Credit |

|---|---|---|---|

| [Date] | Inventory | [Cost] | |

| Accounts Payable | [Cost] | ||

| To record purchase of inventory on account |

Explanation:

- Debit to Inventory: The debit increases the inventory account, reflecting the increase in Meller's assets due to the acquisition of goods.

- Credit to Accounts Payable: The credit increases the accounts payable account, reflecting the increase in Meller's liabilities due to the unpaid obligation to the supplier.

The debit and credit amounts are equal, maintaining the balance of the accounting equation. The cost of inventory is the amount that Meller agreed to pay for the goods. This will typically include the purchase price of the inventory, any taxes levied, and freight-in costs (if Meller pays them and the costs are considered part of the inventory's acquisition cost).

Impact on Financial Statements

This seemingly simple transaction has ramifications across all three primary financial statements:

Balance Sheet

The purchase of inventory on account directly affects the balance sheet by increasing two accounts:

- Inventory (Asset): The inventory account increases, reflecting the added value of goods available for sale. This boosts the company's total assets.

- Accounts Payable (Liability): The accounts payable account increases, representing the increased short-term debt owed to the supplier. This increases the company's total liabilities.

The net effect on the balance sheet's fundamental equation remains balanced, as the increase in assets is offset by an equal increase in liabilities.

Income Statement

The impact on the income statement is indirect and becomes apparent only when Meller sells the inventory. The cost of the inventory acquired on account will eventually be recognized as cost of goods sold (COGS) when the goods are sold. This reduces the company's gross profit (Revenue - COGS) and ultimately affects net income.

The specific timing of COGS recognition depends on the inventory costing method used by Meller (e.g., FIFO, LIFO, weighted-average). This choice will influence how the cost of inventory is allocated to the cost of goods sold and the ending inventory balance.

Statement of Cash Flows

The purchase of inventory on account does not directly impact the cash flow statement at the time of purchase. Since no cash changed hands, the transaction does not affect the operating, investing, or financing activities sections of the statement. However, when Meller pays its accounts payable in the future, the cash outflow will be reflected in the operating activities section of the statement of cash flows.

Variations and Complexities

The basic scenario described above represents a simplified view. Several variations and complexities can add layers of nuance to the accounting treatment:

Purchase Discounts

Suppliers often offer purchase discounts to encourage prompt payment. For example, terms like "2/10, net 30" mean that Meller can deduct 2% from the invoice amount if it pays within 10 days; otherwise, the full amount is due within 30 days. If Meller takes advantage of the discount, the accounting entries will need to reflect this reduction in the payable amount.

Freight Costs

The accounting treatment of freight costs depends on the agreement between Meller and the supplier. If Meller pays the freight costs, they are often included in the cost of inventory (debiting inventory and crediting cash or accounts payable). If the supplier pays the freight, these costs are already included in the invoice, and no separate entry is needed beyond the basic inventory and accounts payable entry.

Returns and Allowances

If Meller returns some of the inventory or receives an allowance (price reduction) from the supplier due to damaged goods, further adjustments are necessary. These adjustments will involve debiting accounts payable and crediting inventory for the returned goods or allowance amount.

Damaged or Obsolete Inventory

If the inventory is damaged or becomes obsolete before it can be sold, Meller must write down the value of the inventory to reflect its reduced value. This will result in a debit to cost of goods sold and a credit to inventory. This reduction lowers the reported asset value and affects the cost of goods sold on the income statement.

Importance of Accurate Accounting for Inventory

Precisely accounting for inventory purchases on account is critical for several reasons:

- Accurate Financial Reporting: Accurate records ensure the financial statements fairly represent Meller's financial position and performance. Inaccurate inventory accounting can lead to misleading financial reports, impacting investor and creditor decisions.

- Inventory Management: Effective tracking of inventory helps Meller maintain appropriate inventory levels, reducing costs associated with overstocking or stockouts.

- Tax Compliance: Accurate inventory records are crucial for complying with tax regulations, ensuring accurate reporting of cost of goods sold and avoiding potential tax penalties.

- Creditworthiness: Timely and accurate payment of accounts payable demonstrates Meller's creditworthiness and maintains a positive relationship with suppliers.

Conclusion

Meller's purchase of inventory on account, while seemingly a straightforward transaction, has far-reaching implications for the company's financial reporting and management. Understanding the accounting treatment, including the journal entries, impacts on financial statements, and potential complexities, is vital for accurate financial statements, efficient inventory management, and sound business decision-making. Attention to detail and the use of consistent accounting methods ensure reliable information for internal and external stakeholders. By accurately reflecting these transactions, Meller gains valuable insights into its financial health and can make informed decisions to optimize its operations and profitability. Moreover, maintaining strong relationships with suppliers through timely payments strengthens the business's overall financial standing and credibility.

Latest Posts

Latest Posts

-

When Servers Or Sellers Break State County

Mar 28, 2025

-

A Company Sells 10 000 Shares Of Previously

Mar 28, 2025

-

Another Term For Equilibrium Price Is

Mar 28, 2025

-

The Optimum Level Of Inspection Is Where The

Mar 28, 2025

-

Identify The Three Costs Of Fdi To A Home Country

Mar 28, 2025

Related Post

Thank you for visiting our website which covers about Meller Purchases Inventory On Account. As A Results Meller's . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.