Identify The Three Costs Of Fdi To A Home Country.

Holbox

Mar 28, 2025 · 7 min read

Table of Contents

- Identify The Three Costs Of Fdi To A Home Country.

- Table of Contents

- Identifying the Three Costs of FDI to a Home Country

- 1. The Brain Drain Effect: Loss of Skilled Labor

- Mechanisms of Brain Drain due to FDI

- Mitigating the Brain Drain

- 2. Loss of Domestic Investment: Crowding Out Effect

- Mechanisms of Crowding Out Domestic Investment

- Mitigating the Crowding Out Effect

- 3. Risk of Capital Flight: Instability and Vulnerability

- Mechanisms of Capital Flight Linked to FDI

- Mitigating the Risk of Capital Flight

- Conclusion: Balancing the Benefits and Costs of FDI

- Latest Posts

- Latest Posts

- Related Post

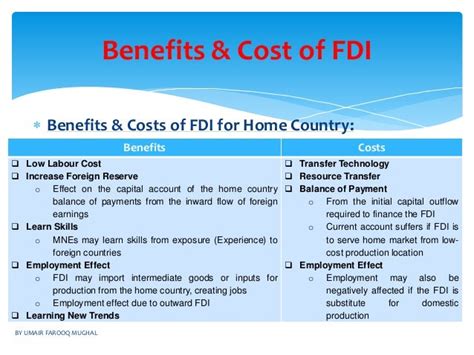

Identifying the Three Costs of FDI to a Home Country

Foreign Direct Investment (FDI) presents a complex economic phenomenon, offering both significant benefits and potential drawbacks to the home country where the investment originates. While the advantages, such as increased exports and job creation in related industries, are often emphasized, a balanced perspective requires careful consideration of the costs. This article delves into three key costs associated with FDI outflow from a home country perspective: the brain drain effect, the potential loss of domestic investment, and the risk of capital flight. We will explore each cost in detail, examining its underlying mechanisms and the potential policy responses aimed at mitigating its negative impact.

1. The Brain Drain Effect: Loss of Skilled Labor

One significant cost of FDI for the home country is the potential for brain drain. This refers to the emigration of highly skilled workers, researchers, and entrepreneurs to foreign countries where they may find better opportunities, higher salaries, or more advanced research facilities. This outflow of talent can significantly hamper the home country's innovation capacity, productivity, and long-term economic growth.

Mechanisms of Brain Drain due to FDI

The link between FDI and brain drain is multifaceted. FDI often involves the establishment of multinational corporations (MNCs) that actively recruit top talent from the home country. These MNCs may offer attractive compensation packages, superior working conditions, and opportunities for career advancement that are not readily available domestically. This creates a competitive pull, drawing skilled individuals away from the home country.

Furthermore, the establishment of foreign subsidiaries or joint ventures can create a perception of greater career opportunities abroad, motivating skilled individuals to seek employment opportunities in foreign markets. This effect is particularly pronounced in developing countries where domestic job markets may be less developed and offer fewer incentives for retaining skilled labor. The creation of international research collaborations, another facet of FDI, can also lead to the transfer of knowledge and expertise abroad, potentially accelerating the brain drain.

Mitigating the Brain Drain

Addressing the brain drain requires a multi-pronged approach. Governments can invest in strengthening domestic educational institutions and research facilities to make them more competitive and attractive to skilled workers. Creating a more favorable business environment, with reduced bureaucratic hurdles and robust intellectual property protection, can encourage the creation of high-paying jobs within the home country, reducing the incentive to seek opportunities abroad.

Furthermore, governments can implement policies that incentivize the return of skilled emigrants, such as offering tax breaks, grants, or other forms of financial assistance. Promoting the establishment of diaspora networks can also play a crucial role. These networks can facilitate the transfer of knowledge and skills back to the home country, fostering innovation and economic growth. Additionally, policies focusing on improving quality of life, including better healthcare and education systems, can improve the overall attractiveness of the home country.

2. Loss of Domestic Investment: Crowding Out Effect

A second potential cost associated with FDI is the crowding out effect on domestic investment. This occurs when significant FDI inflows lead to a reduction in investment by domestic firms. Several mechanisms can contribute to this effect.

Mechanisms of Crowding Out Domestic Investment

One mechanism is the competition for capital. A surge in FDI can increase the demand for capital, driving up interest rates. This higher cost of borrowing can make it more difficult and expensive for domestic firms to secure financing for their investment projects, leading to a reduction in domestic investment.

Another mechanism is the diversion of resources. FDI often attracts significant resources, including skilled labor, land, and infrastructure, which can be diverted from domestic firms. This resource scarcity can further constrain domestic investment, hindering the growth of home country businesses.

Moreover, large multinational corporations, often associated with FDI, may benefit from economies of scale and access to cheaper resources, giving them a significant competitive advantage over domestic firms. This may lead to a decrease in market share for domestic businesses, resulting in reduced investment opportunities.

Mitigating the Crowding Out Effect

To mitigate the crowding-out effect, governments can focus on promoting domestic savings through policies that encourage higher household savings rates and pension fund contributions. Diversifying the sources of investment finance, such as fostering the development of a robust capital market, can also lessen the dependency on FDI and decrease the impact of its fluctuations on domestic investment.

Governments can also implement targeted policies that support domestic small and medium-sized enterprises (SMEs). This can include providing access to financing, offering training and mentorship programs, and creating favorable regulatory environments to help them compete with foreign investors. Promoting strategic partnerships between domestic and foreign firms can facilitate technology transfer and knowledge sharing, enabling domestic companies to compete more effectively and reduce their dependence on external funding.

3. Risk of Capital Flight: Instability and Vulnerability

A third significant cost of FDI is the potential for capital flight. This refers to the rapid outflow of capital from a country, typically driven by fears of economic or political instability. While not directly caused by FDI, a substantial reliance on FDI can exacerbate the risk and impact of capital flight.

Mechanisms of Capital Flight Linked to FDI

A heavily FDI-dependent economy might become vulnerable to sudden shifts in global investor sentiment. If investors perceive a change in the home country's economic or political climate as unfavorable, they may quickly withdraw their investments, leading to a significant capital outflow. This is especially true if the FDI is concentrated in a few key sectors or industries, making the economy more vulnerable to shocks in those specific areas.

Moreover, if the FDI is largely short-term portfolio investment rather than long-term direct investment, it's more susceptible to rapid withdrawal. This can create instability and contribute to economic volatility. Furthermore, if the FDI is heavily reliant on foreign currency borrowing, a sudden depreciation of the home country’s currency can make it difficult to repay those debts, potentially prompting further capital flight.

Mitigating the Risk of Capital Flight

To mitigate the risk of capital flight, governments can focus on building a strong macroeconomic foundation. This includes maintaining fiscal discipline, managing inflation effectively, and fostering sound monetary policies. Diversifying the economy and reducing its reliance on a few key industries can enhance resilience to external shocks.

Strengthening institutions, ensuring transparency and predictability in policymaking, and promoting good governance are crucial for building investor confidence. This can help to attract long-term, stable investment and reduce the susceptibility to sudden capital outflows. Furthermore, the development of a deep and liquid domestic capital market can provide alternative sources of funding, reducing reliance on foreign capital and enhancing the ability to withstand periods of capital flight.

Conclusion: Balancing the Benefits and Costs of FDI

Foreign Direct Investment presents a double-edged sword for the home country. While offering significant potential benefits, it also carries considerable risks. The brain drain effect, the crowding-out of domestic investment, and the risk of capital flight represent three key costs that require careful consideration. Effectively managing these risks involves a comprehensive strategy that includes:

- Investing in human capital: Improving education and research infrastructure to retain and attract skilled workers.

- Promoting domestic investment: Creating a business-friendly environment and supporting SMEs to compete effectively.

- Strengthening macroeconomic stability: Implementing sound fiscal and monetary policies to reduce vulnerability to external shocks.

- Diversifying the economy: Reducing reliance on specific sectors or industries to increase resilience.

- Improving governance: Building strong institutions and fostering transparency to enhance investor confidence.

By proactively addressing these issues, home countries can maximize the benefits of FDI while mitigating its potential negative consequences, ensuring sustainable and inclusive economic growth. The optimal approach requires a nuanced understanding of the specific context and the careful balancing of potentially competing policy objectives.

Latest Posts

Latest Posts

-

The White Smoke Produced From Reaction A 1

Apr 01, 2025

-

How Did The Attackers Finally Steal The Account Data

Apr 01, 2025

-

Match The Step In The Control Process With Its Description

Apr 01, 2025

-

Draw The Major Product Of The Reaction Shown

Apr 01, 2025

-

Which Of The Following Is True Of Nalmefene

Apr 01, 2025

Related Post

Thank you for visiting our website which covers about Identify The Three Costs Of Fdi To A Home Country. . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.