Manufacuring Overhead Cost Incurred For The Month Are

Holbox

Mar 22, 2025 · 6 min read

Table of Contents

Manufacturing Overhead Costs Incurred for the Month: A Comprehensive Guide

Manufacturing overhead costs represent all indirect costs incurred during the production process. Understanding and effectively managing these costs is crucial for maintaining profitability and competitiveness in any manufacturing business. This comprehensive guide delves into the various types of manufacturing overhead, methods for calculating and allocating them, and strategies for controlling and reducing them.

What are Manufacturing Overhead Costs?

Manufacturing overhead, also known as factory overhead or indirect costs, encompasses all costs related to production except direct materials and direct labor. These are the costs that are difficult or impossible to directly trace to a specific product. Think of them as the costs of running the factory itself.

Key Characteristics of Manufacturing Overhead:

- Indirect Costs: They cannot be directly linked to a particular product or unit.

- Necessary for Production: They are essential for the manufacturing process to occur.

- Varied Nature: They include a wide range of expenses, from utilities to depreciation.

Types of Manufacturing Overhead Costs

Manufacturing overhead costs are broadly categorized, allowing for better tracking and analysis. Common categories include:

1. Indirect Materials:

These are materials used in the production process that are not easily traceable to individual products. Examples include:

- Cleaning supplies: Used to maintain a clean and safe working environment.

- Lubricants: Essential for maintaining machinery.

- Small tools and fasteners: Used in the production process but not a significant part of the finished product.

2. Indirect Labor:

This includes the wages and salaries of employees who are not directly involved in the production of goods. Examples include:

- Supervisors: Overseeing the production process.

- Maintenance personnel: Maintaining and repairing machinery.

- Quality control inspectors: Ensuring the quality of the finished products.

- Security guards: Protecting the factory and its assets.

3. Factory Overhead:

This is a broad category encompassing various costs associated with running the factory. These can include:

- Rent or mortgage payments: For the factory building.

- Utilities: Electricity, gas, and water.

- Depreciation: On factory equipment and buildings.

- Insurance: Property and liability insurance.

- Property taxes: On the factory building and land.

- Factory supplies: Consumables used in the factory, like stationery and cleaning supplies.

- Repairs and maintenance: For factory equipment.

Calculating Manufacturing Overhead Costs

Accurately calculating manufacturing overhead is critical for accurate costing and pricing. There are several methods:

1. Actual Costing:

This method uses the actual manufacturing overhead costs incurred during the period. While seemingly straightforward, it's susceptible to fluctuations and inaccuracies, especially with variations in production volume.

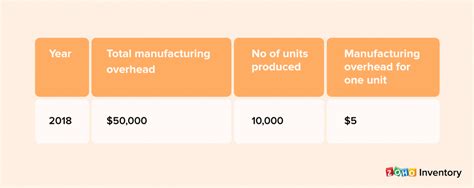

Formula: Total Actual Manufacturing Overhead Costs / Total Number of Units Produced

This method provides a cost per unit but can be unreliable due to its dependence on actual costs which may fluctuate significantly throughout the year.

2. Normal Costing:

This approach uses a predetermined overhead rate based on budgeted overhead costs and an estimated activity base (e.g., machine hours, direct labor hours). It offers greater stability and predictability than actual costing.

Steps:

- Estimate total manufacturing overhead costs for the period. This involves forecasting all indirect costs.

- Select an appropriate activity base. This should be a factor that strongly correlates with overhead costs. Common choices include direct labor hours, machine hours, or units produced.

- Calculate the predetermined overhead rate. This is done by dividing the estimated total manufacturing overhead costs by the estimated activity base.

Formula: Predetermined Overhead Rate = Estimated Total Manufacturing Overhead Costs / Estimated Activity Base

- Apply the predetermined overhead rate to the actual activity level. This allocates manufacturing overhead costs to the products produced.

Formula: Applied Manufacturing Overhead = Predetermined Overhead Rate x Actual Activity Base

Normal costing provides a more consistent and predictable cost per unit, which is vital for pricing decisions and budgeting.

3. Standard Costing:

This sophisticated method involves setting predetermined standards for all manufacturing costs, including overhead. Deviations from these standards are analyzed to identify areas for improvement and cost reduction. Standard costing is often used in conjunction with variance analysis to pinpoint inefficiencies and improve operational performance.

Allocating Manufacturing Overhead Costs

Once calculated, manufacturing overhead costs need to be allocated to individual products or production departments. Accurate allocation is crucial for determining product costs and profitability. Common allocation methods include:

1. Direct Labor Hours:

This method allocates overhead costs based on the number of direct labor hours used in production. It's simple to implement but may not be accurate if overhead costs aren't directly proportional to labor hours.

2. Machine Hours:

This method uses machine hours as the allocation base. It's suitable for automated production environments where machine hours are a significant driver of overhead costs.

3. Activity-Based Costing (ABC):

ABC is a more sophisticated method that assigns overhead costs based on the activities that consume resources. It identifies cost drivers for each activity and allocates costs accordingly. ABC provides a more accurate allocation of overhead costs, particularly in complex manufacturing environments with diverse products and processes.

Controlling and Reducing Manufacturing Overhead Costs

Controlling and reducing manufacturing overhead is crucial for profitability. Strategies include:

- Improved Inventory Management: Reducing inventory levels minimizes storage costs and reduces the risk of obsolescence. Just-in-time (JIT) inventory systems can be particularly effective.

- Process Improvement: Streamlining processes and eliminating waste can significantly reduce overhead costs. Lean manufacturing principles are valuable tools for this.

- Technology Upgrades: Investing in automation and advanced manufacturing technologies can increase efficiency and reduce labor costs.

- Energy Efficiency: Implementing energy-saving measures can lower utility costs.

- Negotiation with Suppliers: Securing favorable pricing from suppliers can reduce the cost of indirect materials.

- Regular Maintenance: Preventative maintenance on equipment minimizes costly repairs and downtime.

- Effective Planning and Budgeting: Careful planning and budgeting helps to control costs and identify potential problem areas.

Analyzing Manufacturing Overhead Variances

Analyzing variances between actual and budgeted overhead costs helps in identifying areas for improvement. Common variances include:

- Spending Variance: The difference between actual and budgeted overhead costs.

- Volume Variance: The difference between the budgeted overhead cost at the actual activity level and the budgeted overhead cost at the budgeted activity level.

- Efficiency Variance: This variance measures the difference between the actual and standard quantity of the allocation base used for a given level of production.

Importance of Accurate Manufacturing Overhead Calculation

Accurate calculation and allocation of manufacturing overhead are critical for several reasons:

- Accurate Product Costing: This is essential for setting prices that ensure profitability. Underestimating overhead costs can lead to underpricing and lost profits. Overestimating can lead to overpricing and lost market share.

- Performance Evaluation: Analyzing overhead costs helps identify areas of inefficiency and improve operational performance.

- Decision-Making: Accurate cost data supports informed decision-making regarding production volumes, pricing strategies, and investment decisions.

- Compliance: Accurate cost accounting is necessary for meeting regulatory requirements and reporting obligations.

Conclusion

Manufacturing overhead costs represent a significant portion of total production costs. Effective management of these costs requires a thorough understanding of their nature, methods for calculation and allocation, and strategies for controlling and reducing them. By implementing appropriate costing methods, analyzing variances, and employing cost-reduction strategies, manufacturers can enhance profitability and maintain a competitive advantage in the market. Regular monitoring and analysis of overhead costs are crucial for long-term success. The choice of costing method (actual, normal, or standard) will depend on the specific needs and complexity of the manufacturing operation, with standard costing offering the most comprehensive control and analysis capabilities. Remember that consistent review and adaptation of your overhead management strategies are key to maintaining efficiency and profitability in the dynamic manufacturing landscape.

Latest Posts

Latest Posts

-

The Price Of Related Outputs Affect Supply

Mar 22, 2025

-

Draw The Structure Of An Eight Carbon Alkene

Mar 22, 2025

-

Assume That The Function F Is A One To One Function

Mar 22, 2025

-

When I Look Back On The Decisions I Ve Made

Mar 22, 2025

-

Consider A Binomial Experiment With And

Mar 22, 2025

Related Post

Thank you for visiting our website which covers about Manufacuring Overhead Cost Incurred For The Month Are . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.