Liquidity Has Two Dimensions Which Are The Ability To

Holbox

Mar 18, 2025 · 5 min read

Table of Contents

Liquidity: The Two Dimensions of Financial Flexibility

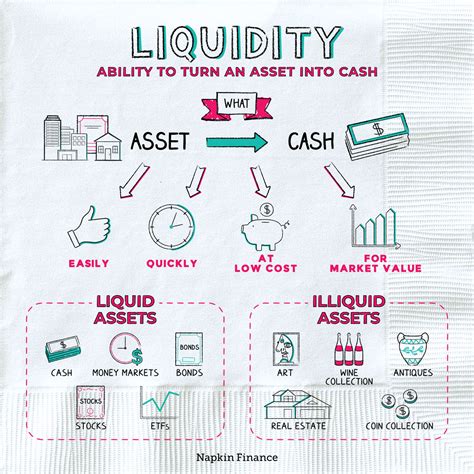

Liquidity, a cornerstone of financial health for individuals, businesses, and even entire economies, isn't a single, monolithic concept. Instead, it possesses two crucial dimensions: the ability to convert assets into cash quickly and efficiently, and the ability to meet short-term obligations without incurring undue costs or disruptions. Understanding both facets is critical for making informed financial decisions and navigating the complexities of the market. This article delves deep into each dimension, exploring their implications and offering practical strategies for enhancing liquidity across diverse contexts.

Dimension 1: Speed and Efficiency of Asset Conversion

This dimension focuses on the ease and speed with which an asset can be transformed into cash. A highly liquid asset is one that can be sold quickly without significant loss of value. Conversely, an illiquid asset requires more time and effort to sell, often resulting in a price discount to attract a buyer.

Identifying Highly Liquid Assets

Several asset classes are known for their high liquidity:

-

Cash and Cash Equivalents: This is the epitome of liquidity. Cash is instantly available, while cash equivalents (like money market funds or treasury bills) are easily convertible into cash with minimal risk.

-

Marketable Securities: Stocks and bonds traded on established exchanges offer relatively high liquidity. The volume of trading ensures buyers are readily available, allowing for relatively quick sales. However, market fluctuations can impact the price received.

-

Short-Term Debt Instruments: These include commercial paper and certificates of deposit (CDs) with shorter maturities. These instruments are generally easier to sell than longer-term debt.

Understanding Illiquid Assets

On the other hand, illiquid assets pose challenges when quick access to cash is needed:

-

Real Estate: Selling property typically takes considerable time, involving marketing, viewings, negotiations, and legal processes. The price obtained might also be lower than the desired value.

-

Private Equity and Venture Capital: Investing in private companies carries an inherent lack of liquidity. There's no readily available market to sell your shares, and exit strategies often involve lengthy processes.

-

Collectibles (Art, Antiques): These assets can be highly valuable but difficult to liquidate quickly. Finding a buyer willing to pay the desired price can take time, and the valuation process can be subjective.

Strategies for Enhancing Liquidity in Asset Conversion

To improve your ability to convert assets into cash swiftly, consider these strategies:

-

Diversify Your Portfolio: Don't put all your eggs in one basket. Spread your investments across various asset classes, balancing liquid and illiquid assets based on your risk tolerance and financial goals.

-

Maintain an Emergency Fund: Having a readily accessible cash reserve cushions you against unexpected expenses or market downturns, reducing the need to quickly sell illiquid assets.

-

Regularly Monitor Your Investments: Stay informed about market conditions and the liquidity of your assets. This allows you to react proactively to potential challenges and make adjustments as needed.

-

Consider Liquidity Ratios: For businesses, monitoring liquidity ratios (like the current ratio and quick ratio) provides valuable insight into the ability to meet short-term obligations using readily available assets.

Dimension 2: Meeting Short-Term Obligations

The second dimension of liquidity concerns the ability to fulfill immediate financial commitments without significant strain or disruption. This involves managing cash flow effectively and ensuring sufficient funds are available to cover expenses such as salaries, rent, loan payments, and supplier invoices.

Identifying Sources of Liquidity for Obligation Fulfillment

Several avenues can provide the necessary funds:

-

Cash on Hand: Having sufficient cash reserves is fundamental to covering short-term liabilities.

-

Lines of Credit: These provide readily accessible funds when needed, offering flexibility in managing unexpected expenses.

-

Short-Term Loans: These loans offer temporary financing for specific needs. However, interest costs should be carefully considered.

-

Accounts Receivable: For businesses, efficiently collecting payments from customers is crucial for maintaining liquidity.

-

Inventory Management: Effective inventory control minimizes storage costs and ensures sufficient stock to meet demand, preventing disruptions to cash flow.

Understanding the Risks of Insufficient Liquidity

A lack of liquidity can have severe repercussions:

-

Missed Payments: Failure to meet obligations can damage credit ratings, making it difficult to secure future financing.

-

Business Disruptions: For businesses, liquidity shortfalls can halt operations, leading to lost revenue and potential bankruptcy.

-

Financial Stress: Individuals facing liquidity issues may experience significant financial stress, potentially affecting their mental and physical well-being.

-

Lost Opportunities: Insufficient liquidity can prevent businesses from taking advantage of profitable opportunities due to a lack of readily available capital.

Strategies for Enhancing Liquidity in Meeting Obligations

Building and maintaining sufficient liquidity to meet short-term obligations demands proactive management:

-

Cash Flow Forecasting: Predicting future cash inflows and outflows helps identify potential liquidity gaps and allows for proactive planning.

-

Effective Debt Management: Maintaining manageable debt levels reduces the strain on cash flow and improves overall financial flexibility.

-

Negotiate Favorable Payment Terms: With suppliers and customers, negotiating longer payment terms can improve cash flow management.

-

Implement Cost-Cutting Measures: Identifying and eliminating unnecessary expenses frees up cash for essential obligations.

-

Explore Alternative Financing Options: Investigate various financing options to find the best fit for your specific needs and risk tolerance.

The Interplay Between the Two Dimensions

While distinct, these two dimensions of liquidity are intrinsically linked. The ability to convert assets into cash quickly and efficiently directly impacts the ability to meet short-term obligations. For example, a business with highly liquid assets can quickly sell them to cover unexpected expenses, ensuring operational continuity. Conversely, a business reliant on illiquid assets might face difficulties meeting urgent financial commitments, even if the overall value of its assets is substantial.

Conclusion: Liquidity – A Dynamic Balancing Act

Liquidity isn't a static state but a dynamic balance between the speed of asset conversion and the ability to meet short-term commitments. Maintaining sufficient liquidity requires a proactive and multi-faceted approach, encompassing careful asset management, efficient cash flow management, and a keen understanding of potential risks. By implementing the strategies outlined above, individuals and businesses can significantly enhance their financial resilience and navigate market uncertainties with greater confidence. Remember, liquidity is not just about having enough money; it's about having the right kind of money at the right time. The successful management of liquidity is a key indicator of overall financial health and stability. Therefore, understanding and actively managing both dimensions is crucial for long-term financial success. Regularly reviewing and adapting your liquidity strategy based on changing circumstances is vital for continued prosperity and stability. Proactive management is the key to navigating the complexities of liquidity and ensuring financial preparedness for any eventuality.

Latest Posts

Latest Posts

-

Rank Each Of The Following Firms Based On Market Power

Mar 18, 2025

-

Correctly Label The Anterior Muscles Of The Thigh

Mar 18, 2025

-

The Best Known Self Regulatory Group Is The Blank

Mar 18, 2025

-

Your Local Movie Theater Uses The Same Group Pricing Strategy

Mar 18, 2025

-

A Set Of Bivariate Data Was Used To Create

Mar 18, 2025

Related Post

Thank you for visiting our website which covers about Liquidity Has Two Dimensions Which Are The Ability To . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.