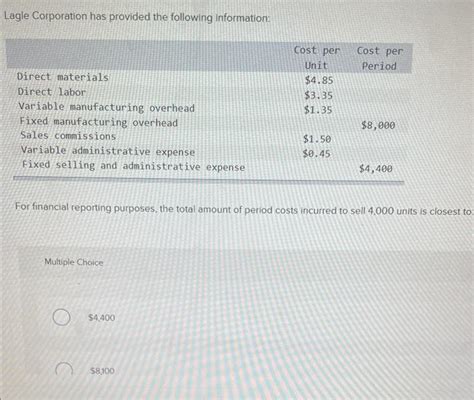

Lagle Corporation Has Provided The Following Information

Holbox

Mar 29, 2025 · 6 min read

Table of Contents

Lagle Corporation: A Deep Dive into Financial Performance and Strategic Positioning

Lagle Corporation (fictional entity for illustrative purposes), a hypothetical multinational conglomerate, provides a compelling case study for analyzing financial performance and strategic positioning. While we don't have access to Lagle's actual financial data, we can construct a hypothetical scenario to illustrate how to analyze such information effectively. This analysis will encompass key financial ratios, industry benchmarks, strategic considerations, and potential future challenges. This detailed exploration will serve as a practical guide for understanding the complexities of corporate financial analysis.

Understanding Lagle Corporation's Hypothetical Financial Data

Let's assume Lagle Corporation operates across several diverse sectors, including technology, manufacturing, and consumer goods. To analyze its performance, we'll consider hypothetical data points encompassing revenue, expenses, assets, liabilities, and equity. This data will be used to calculate key financial ratios and assess its overall financial health and strategic direction.

Key Financial Ratios: Unveiling Lagle's Performance

Analyzing Lagle Corporation requires examining a range of financial ratios that offer insight into its profitability, liquidity, solvency, and efficiency. These ratios provide a comprehensive understanding of Lagle's financial health, helping to uncover areas of strength and weakness.

1. Profitability Ratios:

- Gross Profit Margin: This ratio (Gross Profit / Revenue) measures the profitability of Lagle's core operations after deducting the cost of goods sold. A higher margin suggests efficient cost management and strong pricing power. For example, a gross profit margin of 40% indicates that for every dollar of revenue, 40 cents are gross profit.

- Net Profit Margin: This ratio (Net Profit / Revenue) represents the percentage of revenue that translates into net profit after all expenses are deducted. A higher net profit margin indicates greater efficiency in managing all aspects of the business. Let's say Lagle’s net profit margin is 15%, showcasing decent profitability.

- Return on Assets (ROA): This ratio (Net Profit / Total Assets) indicates how efficiently Lagle uses its assets to generate profit. A high ROA suggests effective asset utilization. An ROA of 8% would suggest a reasonably efficient use of assets.

- Return on Equity (ROE): This ratio (Net Profit / Shareholders' Equity) measures the return generated on the shareholders' investment. A high ROE is generally desirable for shareholders. An ROE of 12% would signify a healthy return for investors.

2. Liquidity Ratios:

- Current Ratio: This ratio (Current Assets / Current Liabilities) measures Lagle's ability to meet its short-term obligations. A ratio above 1 indicates sufficient liquidity. Let's assume Lagle’s current ratio is 1.5, suggesting a comfortable liquidity position.

- Quick Ratio: Similar to the current ratio but more conservative (Current Assets - Inventory) / Current Liabilities. It excludes inventory, which might not be readily convertible to cash. A quick ratio of 1.2 would reinforce Lagle's strong short-term liquidity.

3. Solvency Ratios:

- Debt-to-Equity Ratio: This ratio (Total Debt / Total Equity) indicates the proportion of Lagle's financing that comes from debt compared to equity. A higher ratio suggests higher financial risk. Let's assume Lagle’s debt-to-equity ratio is 0.8, indicating a manageable level of debt.

- Times Interest Earned: This ratio (Earnings Before Interest and Taxes (EBIT) / Interest Expense) measures Lagle's ability to cover its interest payments. A higher ratio signifies lower risk of default. A times interest earned ratio of 5 would suggest a strong capacity to pay interest on its debts.

4. Efficiency Ratios:

- Inventory Turnover: This ratio (Cost of Goods Sold / Average Inventory) shows how efficiently Lagle manages its inventory. A higher turnover suggests effective inventory management. Suppose Lagle's inventory turnover is 6, indicating quick inventory movement.

- Days Sales Outstanding (DSO): This ratio measures the average number of days it takes Lagle to collect payments from customers. A lower DSO indicates efficient credit management. Assume Lagle's DSO is 35 days, a reasonable figure.

Benchmarking Lagle Corporation's Performance

Comparing Lagle’s ratios against industry averages and competitors is crucial. This benchmarking process helps assess Lagle's relative performance and identify areas where it excels or lags behind. For instance, if Lagle’s net profit margin is significantly higher than the industry average, it suggests superior profitability. Conversely, if its DSO is significantly higher, it may indicate issues with credit collection processes that need improvement.

Strategic Analysis of Lagle Corporation

Beyond financial ratios, a comprehensive analysis of Lagle Corporation necessitates examining its strategic positioning. This includes exploring its competitive advantages, market share, growth strategies, and diversification efforts.

1. Competitive Advantage: Does Lagle possess a sustainable competitive advantage? This could stem from proprietary technology, strong brand recognition, efficient operations, or superior customer service. Understanding its competitive advantage is key to predicting its future success.

2. Market Share: What is Lagle's market share in its various sectors? A large market share suggests significant influence and stability, while a smaller share may signify vulnerability.

3. Growth Strategies: How is Lagle pursuing growth? Is it focusing on organic growth through increased sales or acquisitions and mergers to expand its market reach? Understanding its growth strategies provides insight into its future trajectory.

4. Diversification: How diversified is Lagle’s business portfolio? Diversification can mitigate risk by spreading investments across multiple sectors. However, over-diversification can lead to inefficiencies.

5. SWOT Analysis: A SWOT (Strengths, Weaknesses, Opportunities, Threats) analysis provides a framework for evaluating Lagle's internal strengths and weaknesses, as well as external opportunities and threats. This assessment can guide strategic decision-making.

Potential Future Challenges and Opportunities for Lagle Corporation

Analyzing Lagle’s future prospects requires considering potential challenges and opportunities. Economic downturns, increased competition, technological disruptions, and regulatory changes are potential headwinds. Conversely, emerging markets, technological advancements, and innovative products could present significant growth opportunities.

1. Economic Uncertainty: Recessions or economic slowdowns can significantly impact Lagle’s revenue and profitability, particularly in cyclical industries.

2. Competitive Landscape: The intensity of competition within Lagle's various sectors will impact its ability to maintain market share and profitability. The emergence of disruptive technologies or new competitors could pose significant threats.

3. Technological Disruptions: Rapid technological advancements could render Lagle's products or services obsolete, necessitating continuous innovation and adaptation.

4. Regulatory Changes: New regulations or stricter enforcement of existing ones can increase compliance costs and potentially limit Lagle's operations.

5. Global Economic Conditions: Global economic fluctuations, such as currency exchange rate volatility, can affect Lagle's international operations and profitability.

Conclusion: A Holistic Perspective on Lagle Corporation

Analyzing Lagle Corporation, even with hypothetical data, highlights the importance of a comprehensive approach to financial analysis. Examining key financial ratios, benchmarking against industry standards, and assessing its strategic positioning provides a holistic understanding of its financial health and future prospects. Identifying potential challenges and opportunities allows for proactive strategic planning and enhances the company's resilience in a dynamic business environment. This multifaceted approach underscores the necessity of considering both quantitative and qualitative factors for a thorough and insightful corporate evaluation. Remember, this analysis is hypothetical and serves as a template for understanding real-world corporate analysis, adapting the same principles to actual financial statements and market conditions.

Latest Posts

Latest Posts

-

Which Of The Reactions Are Spontaneous Favorable

Apr 02, 2025

-

Two Systems Of Equations Are Given Below

Apr 02, 2025

-

Match The Hormone Abbreviations With Their Function

Apr 02, 2025

-

What Is Are The Product S Of The Following Reaction

Apr 02, 2025

-

Not Yielding To Visually Impaired Pedestrians Is A Misdemeanor

Apr 02, 2025

Related Post

Thank you for visiting our website which covers about Lagle Corporation Has Provided The Following Information . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.