Label Each Component Of The Circular Flow Diagram

Holbox

Mar 16, 2025 · 6 min read

Table of Contents

Decoding the Circular Flow Diagram: A Comprehensive Guide to its Components

The circular flow diagram is a fundamental concept in economics, providing a simplified yet powerful visualization of how money and resources move within an economy. Understanding its components is crucial for grasping basic economic principles and analyzing economic activity. This comprehensive guide will dissect each part of the circular flow diagram, explaining its role and interactions with other components. We'll explore both the simple and expanded models, highlighting the nuances and complexities of modern economic systems.

The Simple Circular Flow Model: Households and Firms

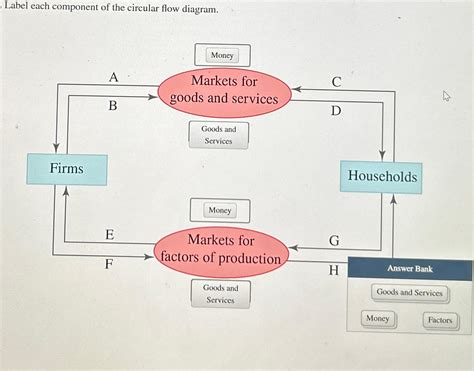

The simplest version of the circular flow diagram depicts two main actors: households and firms. These entities interact in two distinct markets: the market for goods and services and the market for factors of production.

1. Households: The Suppliers of Factors of Production

Households are the primary consumers in the economy. However, in the circular flow, they play a dual role. First, they are the suppliers of factors of production. These factors are the resources used to produce goods and services. They include:

- Labor: This encompasses the physical and mental efforts individuals contribute to production. This is perhaps the most significant factor of production for most economies.

- Land: This refers to all natural resources used in production, including raw materials, minerals, and agricultural land.

- Capital: This encompasses all man-made resources used in production, such as machinery, equipment, and factories. Note that this is different from financial capital (money).

- Entrepreneurship: This crucial factor refers to the innovative skills and risk-taking involved in organizing production and bringing new products and services to the market.

Households supply these factors to firms in exchange for factor payments.

2. Firms: The Producers of Goods and Services

Firms are the entities responsible for producing goods and services. They demand factors of production from households to engage in the production process. Once produced, these goods and services are supplied to the market for households to consume.

3. Market for Goods and Services: The Flow of Goods and Money

The market for goods and services is where households demand goods and services produced by firms. This demand is fueled by household income earned from supplying factors of production. In exchange for goods and services, households provide firms with revenue in the form of payments. This represents the flow of money from households to firms.

4. Market for Factors of Production: The Flow of Factors and Factor Payments

The market for factors of production is where firms demand factors of production supplied by households. In exchange for supplying these factors, households receive factor payments. These payments comprise:

- Wages: Payments for labor.

- Rent: Payments for land.

- Interest: Payments for capital.

- Profit: Payments to entrepreneurs for their risk-taking and innovation.

This represents the flow of money from firms to households, completing the simple circular flow. This model emphasizes the interconnectedness between households and firms, showcasing the continuous cycle of resource allocation and income generation.

Expanding the Circular Flow: Incorporating the Role of Government and the External Sector

The simple model, while useful, is a simplification. A more realistic representation includes the role of the government and the external sector (international trade).

5. The Government: Taxation and Government Spending

The government plays a significant role in the economy by influencing both the flow of goods and services and the flow of factors of production. It intervenes in the circular flow through:

- Taxation: The government collects taxes from both households and firms, reducing their disposable income and profits. This represents a leakage from the circular flow.

- Government Spending: The government utilizes tax revenue (and borrowing) to purchase goods and services (e.g., infrastructure, defense) and to provide social welfare programs. This represents an injection into the circular flow.

Government spending on goods and services influences the demand side of the economy, creating jobs and stimulating production. Government transfer payments, such as unemployment benefits and social security, directly increase household income.

6. The External Sector: Exports and Imports

The external sector comprises international trade, encompassing exports and imports.

- Exports: These are goods and services produced domestically and sold to other countries. They represent an injection into the circular flow, increasing national income.

- Imports: These are goods and services purchased from other countries. They represent a leakage from the circular flow, as money flows out of the domestic economy.

The balance between exports and imports – the net export (NX) – significantly influences the overall level of economic activity. A trade surplus (exports exceeding imports) boosts national income, while a trade deficit (imports exceeding exports) reduces it.

7. Financial Institutions: Savings and Investment

Financial institutions play a vital role by channeling savings into investment. Households often save a portion of their income instead of spending it. These savings are then channeled into investments by financial intermediaries, such as banks and investment firms. This process connects the savings and investment sectors, enabling firms to access funds for capital accumulation and expansion. Savings represent a leakage from the circular flow, but they are simultaneously an injection through investment.

Leakages in the circular flow model are factors that withdraw money from the circular flow (e.g., savings, taxes, imports). Injections are factors that add money to the circular flow (e.g., government spending, investment, exports). The balance between leakages and injections determines the overall level of economic activity.

Understanding the Interconnections and Feedback Loops

The expanded circular flow diagram highlights the complex interplay between households, firms, government, and the external sector. Changes in one sector can have ripple effects throughout the entire system. For instance, an increase in government spending can boost aggregate demand, leading to increased production, higher employment, and potentially higher inflation. Conversely, a decrease in exports can reduce national income and lead to job losses.

The circular flow diagram is not just a static representation but a dynamic model showcasing feedback loops and continuous interactions. For example, increased consumer spending (demand) leads to higher production, which creates more jobs and income, further stimulating consumer spending. Understanding these feedback loops is crucial for comprehending economic growth, fluctuations, and policy impacts.

Limitations of the Circular Flow Diagram

While the circular flow diagram is an invaluable tool for understanding basic economic principles, it has limitations. It simplifies a complex reality by:

- Ignoring the informal economy: The model doesn't account for activities in the informal sector, where transactions are often not officially recorded.

- Oversimplifying the role of financial institutions: The model provides a simplified representation of the complex role of financial intermediaries in channeling savings into investment.

- Omitting environmental considerations: The model doesn't explicitly account for environmental externalities and resource depletion.

- Ignoring inequality: The model doesn't depict the distribution of income, potentially masking income inequality.

Despite these limitations, the circular flow diagram remains a fundamental tool for understanding the basic functioning of an economy and the interactions between its key players. It serves as an excellent starting point for exploring more complex economic models and analyses.

Conclusion: Mastering the Circular Flow for Economic Understanding

This detailed exploration of the circular flow diagram's components underscores its significance in comprehending economic activity. By understanding the roles of households, firms, the government, the external sector, and financial institutions, we can analyze how money and resources flow within an economy. While the model has limitations, its simplicity makes it a valuable tool for grasping fundamental economic principles and visualizing the interconnections between different sectors. This knowledge empowers individuals, businesses, and policymakers to make informed decisions and contribute to a more robust and sustainable economy. Remember to always consider the limitations while utilizing the model, and always strive to build a more nuanced understanding of the economic landscape.

Latest Posts

Latest Posts

-

How Does A Shortcut Link To Another File

Mar 17, 2025

-

Cash Flows From Financing Activities Do Not Include

Mar 17, 2025

-

A Positive Return On Investment For Education Happens When

Mar 17, 2025

-

What Is The Value Of I

Mar 17, 2025

-

The Accounts In The Ledger Of Monroe Entertainment Co

Mar 17, 2025

Related Post

Thank you for visiting our website which covers about Label Each Component Of The Circular Flow Diagram . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.