In Order To Be Reported Liabilities

Holbox

Mar 17, 2025 · 6 min read

Table of Contents

In Order to Be Reported as Liabilities: A Comprehensive Guide

Understanding liabilities is crucial for accurate financial reporting. A liability, in accounting terms, represents a company's financial obligations to outside parties. These obligations require future sacrifice of economic benefits, like cash outflows or the provision of services. This comprehensive guide delves into the criteria necessary for an item to be recognized and reported as a liability on a company's balance sheet. We'll explore various types of liabilities, common reporting challenges, and the importance of accurate liability accounting.

Defining a Liability: The Key Characteristics

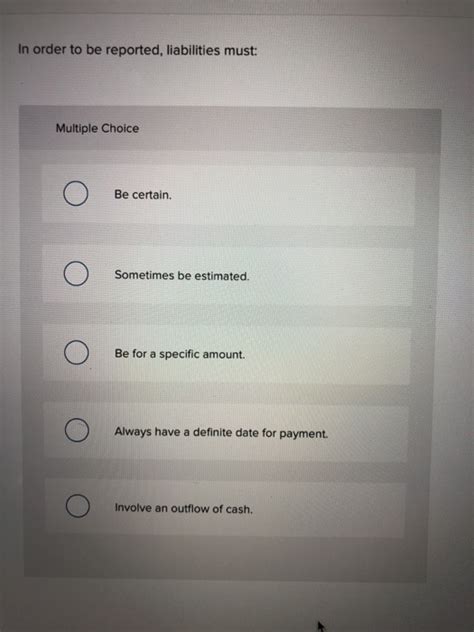

Before delving into specific examples, let's establish the fundamental characteristics that must be present for an item to qualify as a liability:

-

Present Obligation: A liability exists only when a company has a present obligation (a duty or responsibility) to transfer an economic resource to another entity. This obligation stems from a past transaction or event. It's not enough to simply anticipate a future obligation; there must be a legally enforceable commitment or a constructive obligation based on customary business practices or a valid expectation.

-

Transfer of Economic Resources: The obligation must involve the potential transfer of economic benefits to another entity. This could take various forms: cash payments, delivery of goods, provision of services, or the exchange of other assets.

-

Past Transaction or Event: The obligation arises from a past transaction or event. This means the liability wasn't simply a prediction of a future event, but a consequence of something that already happened. For example, purchasing goods on credit creates a liability for the amount owed.

Categories of Liabilities: A Detailed Overview

Liabilities are broadly categorized based on their timing and nature. Understanding these categories is critical for accurate financial reporting.

1. Current Liabilities: Short-Term Obligations

Current liabilities are obligations expected to be settled within one year or the company's operating cycle, whichever is longer. Examples include:

-

Accounts Payable: Amounts owed to suppliers for goods or services purchased on credit. These are typically short-term, requiring payment within a defined period.

-

Salaries Payable: Wages owed to employees for work performed but not yet paid. These are typically paid on a regular payroll cycle.

-

Interest Payable: Interest accrued on outstanding loans or bonds but not yet paid. Accurate calculation and timely recording of interest payable are vital.

-

Taxes Payable: Taxes owed to governmental authorities, such as income tax, sales tax, property tax, etc. Failure to accurately report and pay taxes can result in significant penalties.

-

Short-Term Loans Payable: Amounts borrowed from banks or other lenders that are due within one year. These often come with specific repayment terms and interest rates.

-

Unearned Revenue: Payments received from customers for goods or services not yet delivered or rendered. This represents a liability until the performance obligation is fulfilled. For instance, if a magazine receives a subscription payment for a full year, the revenue is recognized over time, and the unearned portion is treated as a liability.

2. Non-Current Liabilities: Long-Term Obligations

Non-current liabilities, also known as long-term liabilities, are obligations expected to be settled beyond one year or the operating cycle. These often involve significant financial commitments and careful planning:

-

Long-Term Loans Payable: Amounts borrowed with repayment terms extending beyond one year. These might include mortgages, equipment financing, or other significant borrowings.

-

Bonds Payable: Amounts raised through the issuance of bonds, which represent debt securities with specific maturity dates and interest payments. Understanding the terms of bonds payable, including interest rates and maturity dates, is crucial.

-

Deferred Tax Liabilities: These arise from temporary differences between financial reporting and tax accounting. These are essentially taxes that will be owed in the future due to timing differences in recognition. Accurately forecasting and accounting for these liabilities requires understanding tax laws and regulations.

-

Pension Liabilities: Obligations to pay retirement benefits to employees. These are often complex to account for, requiring actuarial calculations to estimate future benefit payouts.

-

Lease Liabilities: Amounts owed under long-term lease agreements for the use of assets. Under IFRS 16 and ASC 842, most leases are recognized on the balance sheet as a right-of-use asset and a corresponding liability.

-

Deferred Revenue (Long-Term): Similar to unearned revenue, but the obligation extends beyond one year.

Contingent Liabilities: Uncertain Future Obligations

Contingent liabilities represent potential obligations that may or may not arise depending on the outcome of future events. They are not recorded as liabilities on the balance sheet unless it's probable that an outflow of resources will be required and the amount can be reasonably estimated. If these conditions are met, then the contingent liability is recognized; if not, it's disclosed in the notes to the financial statements. Examples include:

-

Guarantees: Promises to pay the debt of another party if that party defaults. The likelihood of having to make a payment will impact how this is treated.

-

Lawsuits: Potential liabilities arising from lawsuits or legal claims. The outcome of the lawsuit and the potential damages will influence the accounting treatment.

-

Environmental Liabilities: Potential costs associated with environmental cleanup or remediation. These are often significant and challenging to estimate.

Reporting Liabilities: Key Considerations and Challenges

Accurate and transparent reporting of liabilities is essential for providing a true and fair view of a company's financial position. However, certain challenges exist:

-

Estimating Future Obligations: Many liabilities, particularly long-term liabilities, require estimations of future cash flows or other obligations. The accuracy of these estimations is crucial. Inaccurate estimations can misrepresent the company’s financial situation.

-

Accounting Standards: Different accounting standards (e.g., IFRS, US GAAP) have different requirements for recognizing and measuring liabilities. Compliance with the applicable standards is vital.

-

Complex Transactions: Some transactions can result in complex liability structures. Proper understanding of these structures is crucial for correct accounting.

-

Changes in Estimates: Estimates of future obligations may need to be revised as new information becomes available. These revisions should be reflected in the financial statements.

The Importance of Accurate Liability Accounting

Accurate liability accounting is vital for several reasons:

-

Credibility and Transparency: Accurate financial reporting builds trust with investors, creditors, and other stakeholders. It reflects a responsible financial management approach.

-

Decision-Making: Accurate information on liabilities is essential for informed decision-making regarding investment, financing, and operations.

-

Compliance: Accurate liability accounting ensures compliance with accounting standards and regulations, avoiding potential penalties.

-

Financial Planning: Understanding the company's liability profile is crucial for effective financial planning and forecasting.

Conclusion: A Continuous Process

Recognizing and reporting liabilities accurately is a continuous process that requires careful attention to detail, a strong understanding of accounting principles, and the ability to effectively manage risk. By understanding the key characteristics of a liability, the different types of liabilities, and the challenges associated with their reporting, companies can ensure the financial statements present a true and fair view of their financial position, contributing to informed decision-making and building trust among stakeholders. Maintaining accurate records, engaging qualified accounting professionals, and staying updated on evolving accounting standards are crucial components of a robust liability management system. Remember, consistency and careful evaluation of all potential obligations are vital to responsible and accurate financial reporting.

Latest Posts

Latest Posts

-

A Favorable Labor Rate Variance Indicates That

Mar 17, 2025

-

Split The Worksheet Into Panes At Cell D16

Mar 17, 2025

-

A Winning Strategy Is One That

Mar 17, 2025

-

The Objective Of Inventory Management Is To

Mar 17, 2025

-

A Bond Is Issued At Par Value When

Mar 17, 2025

Related Post

Thank you for visiting our website which covers about In Order To Be Reported Liabilities . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.