A Bond Is Issued At Par Value When:

Holbox

Mar 17, 2025 · 7 min read

Table of Contents

A Bond is Issued at Par Value When: A Comprehensive Guide

A bond is a fixed-income instrument that represents a loan made by an investor to a borrower (typically corporate or governmental). Understanding when a bond is issued at par value is crucial for investors and issuers alike. This comprehensive guide delves into the intricacies of par value issuance, exploring the factors that influence it, its implications for both parties, and the broader context within the bond market.

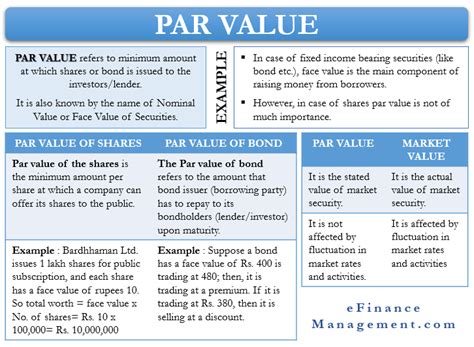

What is Par Value (Face Value)?

Before we dive into when a bond is issued at par value, let's clarify what par value, also known as face value, actually means. Par value is the nominal value of a bond, representing the amount the issuer promises to repay the investor at the bond's maturity date. This is the principal amount of the loan. It's important to note that the par value is generally fixed and doesn't fluctuate with market conditions. For example, a bond with a par value of $1,000 means the issuer will pay the bondholder $1,000 when the bond matures.

When is a Bond Issued at Par Value?

A bond is issued at par value when its offering price equals its face value. In simpler terms, the investor pays the issuer the exact amount that will be repaid at maturity. This typically occurs when the bond's coupon rate (the interest rate paid on the bond's face value) is equal to the prevailing market interest rate for similar bonds with comparable risk profiles.

The key factor determining par value issuance is the equilibrium between the coupon rate and the market interest rate.

-

Coupon Rate = Market Interest Rate: When these two rates are equal, the bond's present value (calculated by discounting future cash flows) matches its face value. Investors are willing to pay the face value because the return they receive matches what they can obtain from comparable investments. This creates a balance, leading to a par value issuance.

-

Coupon Rate > Market Interest Rate: If the coupon rate is higher than the market interest rate, the bond will be issued at a premium. Investors are willing to pay more than the face value to secure a higher yield than available in the market.

-

Coupon Rate < Market Interest Rate: Conversely, if the coupon rate is lower than the market interest rate, the bond will be issued at a discount. Investors will only pay less than the face value to compensate for the lower yield compared to other opportunities.

Factors Influencing Par Value Issuance

Several factors influence whether a bond is issued at, above, or below its par value. These factors are interconnected and dynamically affect the market interest rates and the issuer's creditworthiness.

1. Market Interest Rates: The Dominant Factor

The prevailing market interest rate is the most significant determinant. Changes in broader economic conditions, central bank policies (like interest rate adjustments), and inflation expectations directly impact interest rates. A rise in market interest rates makes existing bonds with lower coupon rates less attractive, leading to issuance at a discount. Conversely, a fall in market interest rates increases demand for higher-yielding bonds, often resulting in issuance at a premium.

2. Credit Rating and Risk Profile: A Crucial Consideration

The credit rating of the issuer significantly influences the bond's yield and price. A higher credit rating (like AAA) implies lower risk, allowing the issuer to offer a lower coupon rate and still attract investors. Conversely, issuers with lower credit ratings (or higher perceived risk) need to offer higher coupon rates to incentivize investors, often resulting in par value issuance or even a slight discount to offset the elevated risk.

3. Time to Maturity: A Time-Value-of-Money Impact

The time to maturity plays a role, primarily through the time value of money. Bonds with longer maturities generally require higher coupon rates to compensate investors for the increased risk associated with holding the investment for a more extended period. This can affect the price at issuance – longer-term bonds might be issued at par if their coupon rate appropriately reflects the time value of money and risk premium.

4. Call Provisions and Other Features: Embedded Options

The presence of call provisions (allowing the issuer to redeem the bond before maturity) or other embedded options can affect the bond's value and issuance price. Callable bonds, for example, might trade at a discount because investors face the risk of early redemption. These features affect the effective yield, potentially influencing whether a bond is issued at par.

5. Market Demand and Supply: The Dynamics of Equilibrium

The overall supply and demand dynamics within the bond market influence prices. High demand for bonds from investors may push prices up, potentially leading to premium issuance. Conversely, low demand might result in bonds being issued at a discount to attract investors.

Implications of Par Value Issuance

The issuance of a bond at par value has several significant implications for both the issuer and the investor.

Implications for the Issuer

-

Simplicity in Accounting: Issuing at par simplifies the accounting process. There's no need to account for premiums or discounts, reducing complexities in financial reporting.

-

Accurate Interest Expense Calculation: The interest expense is easily calculated based on the face value and the coupon rate. No adjustments are needed to account for amortization of premiums or discounts.

-

Cost-Effective Financing: If the market conditions allow for par value issuance, it represents a relatively cost-effective way for the issuer to raise capital.

Implications for the Investor

-

Predictable Returns: Investing in a bond issued at par provides investors with predictable returns based on the stated coupon rate and the face value received at maturity. There's no complexity involved with the amortization of premiums or discounts.

-

Transparency and Simplicity: Par value issuance offers greater transparency and simplicity for investors, making it easier to understand the investment's potential returns.

-

Potential for Capital Appreciation (or Loss): While the coupon payments are fixed, the bond's market price can fluctuate depending on market interest rate changes. Investors can still experience capital appreciation (if market rates fall) or losses (if rates rise) even if the bond was initially issued at par.

Par Value Issuance vs. Premium/Discount Issuance: A Comparison

It's helpful to contrast par value issuance with premium and discount issuances to highlight the key differences:

| Feature | Par Value Issuance | Premium Issuance | Discount Issuance |

|---|---|---|---|

| Offering Price | Equal to Face Value | Greater than Face Value | Less than Face Value |

| Coupon Rate | Equal to Market Interest Rate | Greater than Market Interest Rate | Less than Market Interest Rate |

| Accounting | Simpler | More Complex | More Complex |

| Investor Return | Predictable (excluding market price fluctuations) | Higher than stated coupon rate | Lower than stated coupon rate |

| Issuer Cost | Relatively lower | Relatively higher | Relatively lower (initially) |

Conclusion: Navigating the Bond Market

Understanding when a bond is issued at par value requires a grasp of the interplay between coupon rates, market interest rates, credit ratings, and market conditions. Par value issuance represents a point of equilibrium where the bond's offered yield aligns with prevailing market yields for comparable investments. While it simplifies accounting and provides predictable returns for investors, it's essential to remember that the market price of even a par-value bond can still fluctuate due to changes in interest rates and the overall market environment. This comprehensive understanding is crucial for both issuers seeking to efficiently raise capital and investors aiming to make informed decisions in the bond market. Careful analysis of all these factors is crucial to navigating the complexities and opportunities within the bond market.

Latest Posts

Latest Posts

-

An Air Filled Parallel Plate Capacitor

Mar 17, 2025

-

Report For Experiment 9 Properties Of Solutions Answers

Mar 17, 2025

-

Write A Tragic Six Line Poem About Music

Mar 17, 2025

-

Determine The Equation To Be Solved After Removing The Logarithm

Mar 17, 2025

-

Research Shows That People Who Smoke Cigarettes Are More Likely

Mar 17, 2025

Related Post

Thank you for visiting our website which covers about A Bond Is Issued At Par Value When: . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.