In Economics The Term Capital Refers To

Holbox

Mar 18, 2025 · 6 min read

Table of Contents

In Economics, the Term "Capital" Refers To... A Deep Dive

The term "capital" in economics is far more nuanced than its everyday usage. While we commonly think of capital as money, in the economic sense, it represents a much broader concept crucial to understanding production, growth, and wealth creation. This article will delve deep into the multifaceted meaning of capital in economics, exploring its different forms, its role in economic systems, and its implications for economic policy.

Defining Capital in Economics: Beyond Just Money

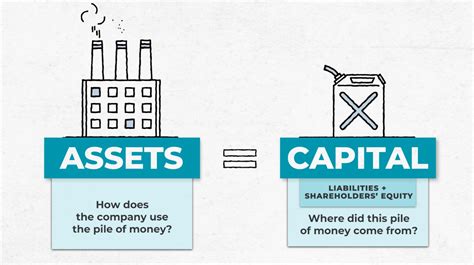

In economics, capital refers to produced means of production. This is a key distinction from the everyday understanding of capital as simply money or financial assets. Economic capital encompasses tangible and intangible assets utilized in the production of goods and services. These assets are produced, meaning they are the result of prior economic activity, unlike land or natural resources which are considered primary factors of production.

Think of it this way: money itself doesn't produce anything. It's a medium of exchange. Capital, however, is the means by which goods and services are produced. It's the machinery, factories, tools, software, and knowledge that facilitate the transformation of inputs into outputs.

Key Characteristics of Capital:

- Produced: Capital goods are created through human effort and prior economic activity. They are not naturally occurring.

- Durable: Capital goods generally have a lifespan extending beyond a single production cycle. They can be used repeatedly.

- Indirectly Satisfies Wants: Unlike consumer goods which directly satisfy human wants, capital goods contribute to production, ultimately fulfilling wants indirectly.

- Subject to Depreciation: Over time, capital goods wear out or become obsolete, reducing their productive capacity. This is known as depreciation.

Types of Capital: A Multifaceted Asset

The concept of capital encompasses various forms, each playing a distinct role in the economic process. These include:

1. Physical Capital: The Tangible Assets

This is the most easily understood type of capital. Physical capital comprises tangible assets used in production. Examples include:

- Machinery and Equipment: From simple hand tools to sophisticated robotic systems, these are fundamental to manufacturing, agriculture, and many other sectors.

- Buildings and Structures: Factories, offices, warehouses, and infrastructure like roads and bridges are all forms of physical capital.

- Infrastructure: This broader category includes utilities like electricity grids, communication networks, and transportation systems. These are crucial for supporting economic activity.

- Inventories: Raw materials, work-in-progress, and finished goods held by businesses are also considered physical capital, representing a stock of goods ready for production or sale.

2. Human Capital: The Investment in People

Human capital represents the knowledge, skills, experience, and health of individuals. It's the productive capacity embodied in people, accumulated through education, training, and on-the-job experience. Investing in human capital—through education, healthcare, and skill development—is crucial for economic growth. A skilled workforce is a more productive workforce.

3. Financial Capital: The Medium of Investment

While not directly involved in production itself, financial capital plays a crucial role in acquiring and utilizing other forms of capital. It includes money, stocks, bonds, and other financial instruments used to finance investment in physical and human capital. It's the lubricant that keeps the engine of capital accumulation running.

4. Intellectual Capital: The Intangible Assets

Intellectual capital encompasses intangible assets like patents, copyrights, trademarks, brand reputation, and organizational knowledge. These assets contribute significantly to a firm's competitive advantage and long-term profitability. The value of a company often lies significantly in its intellectual property and organizational knowledge.

5. Natural Capital: The Often-Overlooked Component

While not strictly "produced," natural capital – encompassing resources like forests, minerals, and fertile land – plays a significant role in production. Its sustainable use is increasingly recognized as vital for long-term economic prosperity. Overexploitation of natural capital can lead to environmental damage and hinder future economic growth.

The Role of Capital in Economic Growth and Development

Capital accumulation – the process of increasing the stock of capital – is a cornerstone of economic growth. A larger stock of capital allows for increased productivity, leading to higher output and improved living standards. This is often expressed through the concept of capital deepening, where the ratio of capital to labor increases.

The Solow-Swan Model: A Classic Framework

The Solow-Swan model, a fundamental neoclassical growth model, highlights the importance of capital accumulation in driving economic growth. It demonstrates that sustained economic growth requires not only capital accumulation but also technological progress and improvements in human capital.

Technological Progress and Capital: A Synergistic Relationship

Technological advancements often necessitate investment in new forms of capital. For example, the digital revolution led to massive investments in computers, software, and communication networks. This highlights the symbiotic relationship between technological progress and capital accumulation.

Capital and Economic Policy: Government's Role

Governments play a critical role in influencing capital accumulation and allocation through various policy instruments. These include:

- Investment Incentives: Tax breaks, subsidies, and other incentives encourage businesses to invest in new capital goods.

- Infrastructure Development: Government investment in infrastructure like roads, bridges, and communication networks is essential for supporting economic activity.

- Education and Training: Public investment in education and training improves human capital, enhancing productivity and earning potential.

- Intellectual Property Rights: Protecting intellectual property rights encourages innovation and investment in research and development.

- Regulation: Appropriate regulations can ensure the efficient allocation of capital and prevent market failures.

Capital and Market Failures: Addressing the Inefficiencies

Despite its crucial role, the market mechanism may not always lead to the optimal allocation of capital. Potential market failures include:

- Information Asymmetry: Businesses may have better information about investment opportunities than investors, leading to inefficient investment decisions.

- Externalities: Investment decisions may have unintended consequences, such as pollution or environmental damage, that are not reflected in market prices.

- Market Power: Monopolies or oligopolies may restrict investment to maintain high prices, hindering efficient resource allocation.

- Public Goods: Some types of capital, like infrastructure, are public goods that are non-excludable and non-rivalrous. The private sector may underinvest in these goods, requiring government intervention.

Capital and Inequality: A Persistent Challenge

The accumulation and distribution of capital are often linked to income inequality. Unequal access to capital resources can exacerbate existing inequalities, creating a cycle of poverty and wealth concentration. Policies aimed at promoting inclusive growth and addressing wealth inequality often focus on improving access to education, healthcare, and financial resources for disadvantaged groups.

Conclusion: The Enduring Importance of Capital

In economics, the concept of capital extends far beyond its colloquial meaning. Understanding its various forms – physical, human, financial, intellectual, and natural – is essential for comprehending economic growth, development, and policy. The efficient allocation and sustainable management of capital are vital for achieving long-term economic prosperity and improving living standards. The interplay between capital accumulation, technological progress, and effective government policies will continue to shape the economic landscape for years to come. Furthermore, ongoing research and discussion are crucial to addressing the challenges related to capital inequality and environmental sustainability. The economic concept of capital remains a dynamic and ever-evolving field of study with significant implications for our understanding of the world around us.

Latest Posts

Latest Posts

-

Identify The Characteristics That Describe Each Good Listed Below

Mar 18, 2025

-

Tactical Plans Are Directly Based On The

Mar 18, 2025

-

Find The Domain Of The Vector Function

Mar 18, 2025

-

Why Are Heat And Alcohol Used To Disinfect Medical Equipment

Mar 18, 2025

-

An Increase In Nominal Gdp Will

Mar 18, 2025

Related Post

Thank you for visiting our website which covers about In Economics The Term Capital Refers To . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.