An Increase In Nominal Gdp Will

Holbox

Mar 18, 2025 · 7 min read

Table of Contents

An Increase in Nominal GDP Will: Unpacking the Implications of Economic Growth

An increase in nominal Gross Domestic Product (GDP) signifies growth in the total value of goods and services produced within a country's borders during a specific period, typically a year or a quarter. However, understanding the implications of a rise in nominal GDP requires a nuanced approach, going beyond the simple headline figure. This article delves deep into the multifaceted effects of an increase in nominal GDP, exploring its impact on various economic aspects, and carefully distinguishing between nominal and real GDP growth.

Decoding Nominal GDP: The Difference Between Nominal and Real GDP

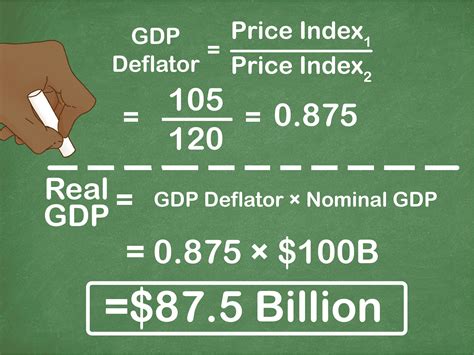

Before dissecting the consequences of a nominal GDP increase, it's crucial to understand the difference between nominal and real GDP. Nominal GDP reflects the current market value of all final goods and services produced, unadjusted for inflation. Real GDP, on the other hand, accounts for inflation by using constant prices from a base year, providing a clearer picture of actual economic output growth. An increase in nominal GDP can be driven by an increase in real output (more goods and services being produced), an increase in prices (inflation), or a combination of both.

Therefore, a rise in nominal GDP doesn't automatically translate to improved economic well-being. A significant portion of the increase might simply be due to inflation, eroding the purchasing power of consumers. Only real GDP growth reflects a genuine expansion in the economy's productive capacity.

Positive Impacts of an Increase in Nominal GDP (with caveats)

While a nominal GDP increase isn't a perfect indicator of economic health, it does signal some positive trends, especially when accompanied by real GDP growth.

1. Higher Government Revenue: Fueling Public Spending and Investment

A larger nominal GDP translates to increased tax revenues for the government. This allows for greater public spending on crucial areas such as infrastructure, education, healthcare, and social welfare programs. Increased government investment can further stimulate economic growth, creating a positive feedback loop. However, this benefit hinges on responsible government fiscal policy. Mismanagement of increased revenue can lead to wasteful spending or unsustainable debt levels.

2. Increased Corporate Profits and Investment: Driving Business Expansion

Higher nominal GDP often indicates stronger consumer demand and business activity. This leads to increased corporate profits, providing businesses with more capital for investment in expansion, research and development (R&D), and hiring. Increased investment can lead to technological advancements, improved productivity, and ultimately, higher long-term economic growth. However, this benefit depends on factors like business confidence, investor sentiment, and access to credit.

3. Higher Employment Rates: Creating Job Opportunities

With increased economic activity, businesses tend to expand their operations, leading to an increased demand for labor. This results in higher employment rates, reduced unemployment, and potentially higher wages. However, this relationship isn't always direct. Technological advancements might lead to automation, potentially offsetting job creation in some sectors.

4. Increased Consumer Spending: Boosting Economic Activity

A rise in nominal GDP, particularly when driven by real growth, usually translates to higher disposable income for households. This leads to increased consumer spending, which further stimulates economic activity, creating a virtuous cycle. However, the extent of this impact depends on factors such as consumer confidence, inflation rates, and debt levels. High inflation can erode the real value of increased income, limiting its impact on consumer spending.

Negative Impacts of an Increase in Nominal GDP (The flip side)

1. Inflation: Eroding Purchasing Power

A significant portion of nominal GDP growth might be attributable to inflation, which diminishes the purchasing power of consumers. High inflation erodes the real value of wages and savings, reducing living standards and potentially creating social unrest. Therefore, it's crucial to consider the inflation-adjusted real GDP growth rate to assess the true impact of economic expansion.

2. Income Inequality: Widening the Gap Between Rich and Poor

Economic growth doesn't always benefit all segments of the population equally. Often, the benefits of increased nominal GDP are disproportionately concentrated among high-income earners, leading to a widening income gap and social inequality. This can create social instability and hinder long-term sustainable development. Policies aimed at equitable distribution of wealth and income are crucial to mitigate this negative impact.

3. Asset Bubbles: Creating Financial Instability

Rapid nominal GDP growth, especially when fueled by excessive credit expansion, can lead to asset bubbles in sectors like real estate or the stock market. These bubbles are inherently unsustainable and can burst, causing significant economic disruption and financial crises. Prudent regulation and monitoring of financial markets are essential to prevent the formation and bursting of asset bubbles.

4. Environmental Degradation: The Cost of Growth

Rapid economic growth often comes at the cost of environmental degradation. Increased industrial activity and consumption patterns can lead to pollution, deforestation, and depletion of natural resources. This has long-term implications for sustainability and human well-being. Implementing sustainable economic policies and incorporating environmental costs into economic calculations is crucial for mitigating this negative impact.

5. External Debt Accumulation: International Economic Vulnerabilities

For countries heavily reliant on imports, rapid nominal GDP growth might be accompanied by a surge in imports, leading to an accumulation of external debt. This can make the country vulnerable to external shocks and fluctuations in global financial markets. Careful management of international trade and finance is essential to avoid unsustainable levels of external debt.

Analyzing the Increase: Factors to Consider

Understanding the implications of a nominal GDP increase requires a holistic assessment of various interconnected factors.

1. Inflation Rate: Separating Real from Nominal Growth

The inflation rate is a critical factor in determining the real GDP growth. A high inflation rate diminishes the real value of the nominal GDP increase. Adjusting the nominal GDP growth rate for inflation provides a clearer picture of the actual expansion of the economy's productive capacity.

2. Composition of Growth: Which Sectors are Driving Growth?

The sectors driving the nominal GDP increase are equally important. Growth driven by unsustainable sectors, like speculative bubbles, is inherently less sustainable than growth driven by productive investments in real assets. Analyzing the contribution of each sector provides a richer understanding of the sustainability and inclusiveness of the growth.

3. Income Distribution: Who Benefits from the Growth?

The distribution of income resulting from the nominal GDP increase is crucial. If the benefits are concentrated among a small segment of the population, it can lead to increased inequality and social unrest. A more equitable distribution of income fosters inclusive growth and enhances social stability.

4. Sustainable Development Goals: Aligning Growth with Environmental and Social Priorities

Nominal GDP growth should be aligned with sustainable development goals. Growth that comes at the expense of environmental degradation or social inequality is unsustainable in the long run. Incorporating environmental and social considerations into economic decision-making is crucial for achieving sustainable and equitable growth.

5. External Factors: Global Economic Conditions and Trade Relationships

Global economic conditions and trade relationships significantly influence a country's nominal GDP growth. External shocks, such as global recessions or trade wars, can severely impact a country's economic performance. Understanding and mitigating the impact of external factors is crucial for achieving stable and sustainable economic growth.

Conclusion: A Holistic View is Essential

An increase in nominal GDP is not a simple indicator of economic progress. It's a complex phenomenon with multifaceted consequences, both positive and negative. A comprehensive understanding of its impact requires a nuanced analysis considering various factors such as inflation, income distribution, sustainability, and external influences. Therefore, simply focusing on the nominal GDP figure without considering these crucial aspects can lead to misleading conclusions and potentially harmful policy decisions. A holistic perspective that incorporates real GDP growth, inflation, income distribution, and sustainability is essential for effective economic policy-making and for achieving genuine and inclusive economic progress. Only then can we truly assess whether an increase in nominal GDP translates into improved living standards and a more prosperous society.

Latest Posts

Latest Posts

-

John Is Rollerblading Down A Long

Mar 19, 2025

-

Hydrolysis Of Sucrose A Disaccharide Results In

Mar 19, 2025

-

What Is The Difference Between Mutualism And Synergism

Mar 19, 2025

-

The Supply Of A Good Will Be More Elastic The

Mar 19, 2025

-

What Do Economists Mean When They Say Behavior Is Rational

Mar 19, 2025

Related Post

Thank you for visiting our website which covers about An Increase In Nominal Gdp Will . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.