How Do Bond Traders Make Money Chegg

Holbox

Mar 16, 2025 · 6 min read

Table of Contents

- How Do Bond Traders Make Money Chegg

- Table of Contents

- How Do Bond Traders Make Money? A Deep Dive into Fixed Income Strategies

- Understanding the Bond Market: The Foundation of Profit

- 1. Yield: This is the return an investor receives on a bond, expressed as a percentage of the face value. Yield is influenced by several factors, including the coupon rate (stated interest rate), the bond's price, and time to maturity.

- 2. Maturity Date: This is the date when the issuer repays the principal to the bondholder. Bonds can range from short-term (maturing in less than a year) to long-term (maturing in decades).

- 3. Credit Rating: This reflects the issuer's ability to repay its debt. Higher credit ratings (like AAA) indicate lower risk and usually lower yields, while lower ratings (like BB or below) signify higher risk and potentially higher yields to compensate investors.

- 4. Price: The price of a bond fluctuates based on supply and demand, influenced by changes in interest rates, creditworthiness of the issuer, and overall market sentiment.

- Key Strategies Employed by Bond Traders

- 1. Trading on Interest Rate Changes: This is perhaps the most prevalent strategy. Bond prices and interest rates have an inverse relationship. When interest rates rise, bond prices fall (and vice-versa). Savvy traders profit by anticipating these shifts:

- 2. Credit Spread Trading: This strategy focuses on the difference in yield between bonds with different credit ratings. Traders might buy higher-yielding, lower-rated bonds (taking on more risk) and simultaneously sell lower-yielding, higher-rated bonds. The profit hinges on the expectation that the credit spread will narrow (the lower-rated bond's yield will fall relative to the higher-rated bond's yield). This strategy is often complex, requiring deep understanding of credit analysis and market dynamics.

- 3. Duration Management: Bond duration measures the sensitivity of a bond's price to interest rate changes. Traders can manage duration to optimize returns in different market environments. For instance, in anticipation of rising interest rates, they might reduce the duration of their portfolio (by investing in shorter-term bonds or bonds with lower duration) to minimize potential losses.

- 4. Relative Value Trading: This involves identifying mispricings between similar bonds. Traders might compare bonds with similar maturity dates, credit ratings, and other characteristics, looking for discrepancies in their yields. They profit by buying the undervalued bond and selling the overvalued one. This requires meticulous research and a keen understanding of bond valuation models.

- 5. Event-Driven Trading: This strategy targets bonds impacted by specific events, such as mergers and acquisitions, bankruptcies, or corporate restructurings. Traders anticipate price movements related to these events, buying or selling bonds accordingly. This approach necessitates in-depth knowledge of corporate finance and legal procedures.

- 6. Carry Trades: This involves borrowing money at a low interest rate (e.g., in a country with low interest rates) and investing it in higher-yielding bonds (e.g., in a country with high interest rates). The profit comes from the difference in interest rates. However, this strategy is exposed to significant currency risk and interest rate risk.

- Risks in Bond Trading

- The Role of Technology and Data Analytics

- The Human Element: Experience and Expertise

- Conclusion: A Complex and Rewarding Field

- Latest Posts

- Latest Posts

- Related Post

How Do Bond Traders Make Money? A Deep Dive into Fixed Income Strategies

Bond trading, a cornerstone of the financial markets, might seem opaque to the uninitiated. The image conjured often involves hushed conversations in dimly lit rooms, secretive deals, and potentially enormous profits (or losses). While some elements of mystique remain, the core principles behind how bond traders generate income are grounded in solid financial concepts. This comprehensive guide will dissect the various strategies employed, explaining the mechanics and risks involved in this complex yet lucrative field.

Understanding the Bond Market: The Foundation of Profit

Before diving into how traders profit, a fundamental understanding of the bond market is crucial. Bonds are essentially IOUs issued by governments or corporations to raise capital. Investors lend money to these entities in exchange for a promise to repay the principal (the original amount borrowed) plus interest over a specified period. Several key characteristics determine a bond's value and its potential for profit:

1. Yield: This is the return an investor receives on a bond, expressed as a percentage of the face value. Yield is influenced by several factors, including the coupon rate (stated interest rate), the bond's price, and time to maturity.

2. Maturity Date: This is the date when the issuer repays the principal to the bondholder. Bonds can range from short-term (maturing in less than a year) to long-term (maturing in decades).

3. Credit Rating: This reflects the issuer's ability to repay its debt. Higher credit ratings (like AAA) indicate lower risk and usually lower yields, while lower ratings (like BB or below) signify higher risk and potentially higher yields to compensate investors.

4. Price: The price of a bond fluctuates based on supply and demand, influenced by changes in interest rates, creditworthiness of the issuer, and overall market sentiment.

Key Strategies Employed by Bond Traders

Bond traders employ a variety of strategies to generate profits, leveraging their understanding of market dynamics and the intricacies of bond valuation. These strategies can be broadly categorized as:

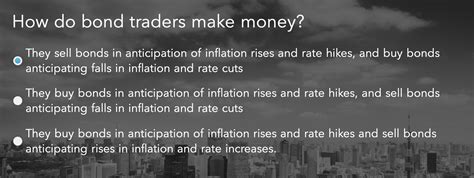

1. Trading on Interest Rate Changes: This is perhaps the most prevalent strategy. Bond prices and interest rates have an inverse relationship. When interest rates rise, bond prices fall (and vice-versa). Savvy traders profit by anticipating these shifts:

-

Buying Low, Selling High: Traders might buy bonds when interest rates are high (and prices are low), anticipating a future drop in rates, which would drive up bond prices. They then sell the bonds at a profit.

-

Short Selling: This involves borrowing bonds, selling them at the current market price, and buying them back later at a lower price when interest rates rise. The difference is the profit. This strategy is inherently riskier, as unlimited losses are possible if interest rates fall unexpectedly.

-

Interest Rate Swaps: This involves exchanging fixed-income payments for floating-income payments with another party. This allows traders to hedge against interest rate risk or speculate on future rate movements.

2. Credit Spread Trading: This strategy focuses on the difference in yield between bonds with different credit ratings. Traders might buy higher-yielding, lower-rated bonds (taking on more risk) and simultaneously sell lower-yielding, higher-rated bonds. The profit hinges on the expectation that the credit spread will narrow (the lower-rated bond's yield will fall relative to the higher-rated bond's yield). This strategy is often complex, requiring deep understanding of credit analysis and market dynamics.

3. Duration Management: Bond duration measures the sensitivity of a bond's price to interest rate changes. Traders can manage duration to optimize returns in different market environments. For instance, in anticipation of rising interest rates, they might reduce the duration of their portfolio (by investing in shorter-term bonds or bonds with lower duration) to minimize potential losses.

4. Relative Value Trading: This involves identifying mispricings between similar bonds. Traders might compare bonds with similar maturity dates, credit ratings, and other characteristics, looking for discrepancies in their yields. They profit by buying the undervalued bond and selling the overvalued one. This requires meticulous research and a keen understanding of bond valuation models.

5. Event-Driven Trading: This strategy targets bonds impacted by specific events, such as mergers and acquisitions, bankruptcies, or corporate restructurings. Traders anticipate price movements related to these events, buying or selling bonds accordingly. This approach necessitates in-depth knowledge of corporate finance and legal procedures.

6. Carry Trades: This involves borrowing money at a low interest rate (e.g., in a country with low interest rates) and investing it in higher-yielding bonds (e.g., in a country with high interest rates). The profit comes from the difference in interest rates. However, this strategy is exposed to significant currency risk and interest rate risk.

Risks in Bond Trading

While the potential for profit is substantial, bond trading is not without its risks:

-

Interest Rate Risk: Changes in interest rates can significantly impact bond prices. Rising rates typically lead to falling bond prices, and vice versa.

-

Credit Risk: The risk that the issuer of a bond will default (fail to repay the principal or interest). This risk is higher with lower-rated bonds.

-

Reinvestment Risk: This is the risk that when a bond matures or makes coupon payments, the investor won't be able to reinvest the proceeds at the same or a higher rate of return.

-

Inflation Risk: Inflation erodes the purchasing power of money. If inflation rises unexpectedly, the real return on bonds may be lower than expected.

-

Liquidity Risk: The risk that a bond may be difficult to sell quickly without incurring a significant price loss, especially during periods of market stress.

-

Market Risk: Broader market movements can influence bond prices, regardless of the individual bond's characteristics.

The Role of Technology and Data Analytics

Modern bond trading relies heavily on technology and sophisticated data analytics. High-frequency trading algorithms, complex pricing models, and vast datasets are utilized to identify trading opportunities, manage risk, and execute trades efficiently. The ability to process and analyze large volumes of data quickly is paramount in this fast-paced environment.

The Human Element: Experience and Expertise

Despite the increasing role of technology, human expertise remains indispensable. Successful bond traders possess a combination of:

-

Deep understanding of financial markets: A thorough grasp of interest rate dynamics, credit analysis, and macroeconomic factors.

-

Analytical skills: The ability to interpret complex data, assess risk, and develop profitable trading strategies.

-

Risk management skills: The ability to effectively manage and mitigate the risks inherent in bond trading.

-

Networking and communication skills: Building relationships with other market participants and effectively communicating with clients and colleagues.

-

Discipline and patience: The ability to stick to a well-defined trading strategy and avoid emotional decision-making.

Conclusion: A Complex and Rewarding Field

Bond trading is a multifaceted field requiring a combination of analytical prowess, risk management expertise, and deep market understanding. While the potential for substantial profits exists, it's crucial to acknowledge the inherent risks and the need for meticulous planning and disciplined execution. Success in this arena demands continuous learning, adaptation, and a commitment to staying abreast of ever-evolving market dynamics. The strategies discussed above provide a foundation for comprehending the mechanics of profit generation in bond trading, but it's important to remember that successful trading involves far more than simply knowing the theory – it demands practical experience, rigorous testing, and constant refinement of approach.

Latest Posts

Latest Posts

-

A Positive Return On Investment For Education Happens When

Mar 17, 2025

-

What Is The Value Of I

Mar 17, 2025

-

The Accounts In The Ledger Of Monroe Entertainment Co

Mar 17, 2025

-

A Process Cost Accounting System Is Most Appropriate When

Mar 17, 2025

-

An Example Of A Breach Of Ephi Is

Mar 17, 2025

Related Post

Thank you for visiting our website which covers about How Do Bond Traders Make Money Chegg . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.