Gross Profit Equals The Difference Between

Holbox

Mar 21, 2025 · 6 min read

Table of Contents

- Gross Profit Equals The Difference Between

- Table of Contents

- Gross Profit: The Difference Between Revenue and Cost of Goods Sold

- What is Gross Profit?

- Revenue (or Sales):

- Cost of Goods Sold (COGS):

- Calculating Gross Profit: A Step-by-Step Guide

- Gross Profit Margin: A Percentage Perspective

- The Significance of Gross Profit and Gross Profit Margin

- Gross Profit vs. Net Profit: Key Differences

- Limitations of Gross Profit

- Improving Gross Profit Margin: Strategies and Tactics

- Conclusion: Gross Profit – A Cornerstone of Financial Health

- Latest Posts

- Latest Posts

- Related Post

Gross Profit: The Difference Between Revenue and Cost of Goods Sold

Understanding gross profit is fundamental to assessing a business's financial health and profitability. It's a crucial metric used by investors, lenders, and internal management to evaluate performance and make informed decisions. This comprehensive guide delves into the core concept of gross profit, explaining its calculation, significance, and practical applications. We'll explore how it differs from net profit, its limitations, and how to improve your gross profit margin.

What is Gross Profit?

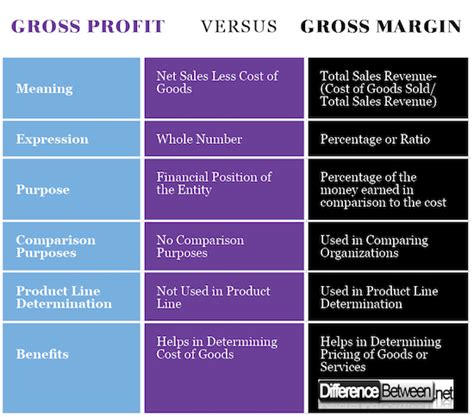

Gross profit represents the difference between a company's revenue (or sales) and its cost of goods sold (COGS). It shows the profit a business makes after deducting the direct costs associated with producing its goods or services. Think of it as the profit made before considering operating expenses like rent, salaries, marketing, and administrative costs.

Gross Profit = Revenue - Cost of Goods Sold (COGS)

Let's break down the two key components:

Revenue (or Sales):

Revenue encompasses the total income generated from the sale of goods or services. This includes all sales transactions, regardless of whether they've been paid for yet (accounts receivable).

Cost of Goods Sold (COGS):

COGS represents the direct costs incurred in producing the goods sold or delivering the services rendered. These costs are directly attributable to the creation or delivery and vary depending on the industry. For a manufacturing company, COGS would include raw materials, direct labor, and manufacturing overhead. For a retailer, COGS would encompass the cost of purchasing the goods sold. For a service-based business, it might include the direct costs of providing the service, such as materials, labor specifically tied to the service, and potentially a portion of subcontractor fees.

Examples of COGS:

- Manufacturing: Raw materials, direct labor, factory rent, utilities directly used in production.

- Retail: Cost of goods purchased from wholesalers or manufacturers.

- Restaurant: Cost of food and beverages, direct labor (kitchen staff).

- Software Company: Direct labor costs for software developers directly involved in the creation of the sold software.

It's crucial to differentiate between direct costs (included in COGS) and indirect costs (operating expenses, not included in COGS). Direct costs are easily traceable to a specific product or service, while indirect costs are more general and harder to allocate precisely to individual items.

Calculating Gross Profit: A Step-by-Step Guide

Calculating gross profit is straightforward once you've identified revenue and COGS. Let's illustrate with an example:

Example:

Imagine a bakery that generated $50,000 in revenue during a month. Their cost of goods sold (including ingredients, direct labor for bakers, and packaging) was $20,000.

Gross Profit = $50,000 (Revenue) - $20,000 (COGS) = $30,000

The bakery's gross profit for the month is $30,000.

Gross Profit Margin: A Percentage Perspective

While gross profit provides an absolute value, the gross profit margin offers a more insightful comparative metric. It shows the percentage of revenue remaining after deducting COGS. It's calculated as follows:

Gross Profit Margin = (Gross Profit / Revenue) x 100%

In our bakery example:

Gross Profit Margin = ($30,000 / $50,000) x 100% = 60%

This means that for every dollar of revenue generated, the bakery retains 60 cents as gross profit. This percentage is crucial for benchmarking performance against competitors and identifying areas for improvement.

The Significance of Gross Profit and Gross Profit Margin

Gross profit and its margin are vital for several reasons:

-

Profitability Assessment: It's a primary indicator of a company's ability to generate profit from its core operations. A high gross profit margin indicates efficient production or service delivery, potentially translating into stronger overall profitability.

-

Pricing Strategies: Understanding your gross profit margin helps you to set competitive prices while maintaining profitability. It aids in analyzing the impact of pricing changes on profitability.

-

Inventory Management: A low gross profit margin might signal problems with inventory management, suggesting the need for more efficient purchasing or stock control strategies.

-

Cost Control: Analyzing gross profit helps pinpoint areas where cost-cutting measures can be implemented without compromising product quality or service.

-

Investment Decisions: Investors closely watch gross profit margins when assessing a company's financial health and investment potential. Consistent high margins are generally viewed favorably.

-

Performance Benchmarking: Comparing your gross profit margin to industry averages or competitors' margins allows you to assess your company's relative performance.

Gross Profit vs. Net Profit: Key Differences

It's essential to distinguish between gross profit and net profit. While gross profit focuses on profit after deducting direct costs, net profit considers all expenses, including operating expenses, interest, and taxes.

Net Profit = Revenue - COGS - Operating Expenses - Interest - Taxes

Net profit represents the overall profit a company earns after accounting for all its expenses. Gross profit is a stepping stone towards calculating net profit. A high gross profit doesn't automatically guarantee a high net profit if operating expenses are excessively high.

Limitations of Gross Profit

While valuable, gross profit has some limitations:

-

Doesn't Reflect Operating Efficiency: Gross profit doesn't account for operating expenses, providing an incomplete picture of overall profitability. A high gross profit could be offset by high operating expenses, resulting in low net profit.

-

Industry-Specific Interpretation: Gross profit margins vary significantly across industries. Comparing a high-margin industry (e.g., software) with a low-margin industry (e.g., grocery) requires careful consideration.

-

Ignores Non-Cash Items: Gross profit doesn't account for non-cash items like depreciation and amortization, which can impact a company's overall financial position.

Improving Gross Profit Margin: Strategies and Tactics

Boosting your gross profit margin can significantly improve your company's financial health. Here are some key strategies:

-

Increase Prices: Carefully consider whether you can raise prices without significantly affecting demand. Market research is vital in this process.

-

Reduce COGS: This could involve negotiating better deals with suppliers, improving production efficiency, minimizing waste, or switching to cheaper but equally effective raw materials or components.

-

Improve Operational Efficiency: Streamline processes to reduce waste and improve productivity. This could involve implementing lean manufacturing techniques, optimizing workflows, or adopting automation.

-

Enhance Product Mix: Focus on higher-margin products or services. This could involve developing new products, discontinuing low-margin items, or selectively focusing on specific customer segments.

-

Increase Sales Volume: While not directly impacting the margin, higher sales volume can contribute to overall gross profit growth, even with a consistent margin.

Conclusion: Gross Profit – A Cornerstone of Financial Health

Gross profit is a vital financial metric that provides critical insights into a company's profitability. Understanding its calculation, significance, and limitations is essential for making informed business decisions. By consistently monitoring your gross profit margin and implementing strategies to improve it, you can enhance your company's financial health and competitiveness. Remember to always analyze gross profit in conjunction with other financial metrics, such as net profit and operating expenses, to gain a comprehensive understanding of your business performance. Regular analysis and a proactive approach to cost management and pricing strategies are key to maximizing your gross profit and ensuring the long-term success of your business.

Latest Posts

Latest Posts

-

What Ipv4 Address Class Has The Ip Address 221 1 2 3

Mar 28, 2025

-

Economic Growth Rates In Follower Countries

Mar 28, 2025

-

How Might A Wildfire Influence Mass Movement

Mar 28, 2025

-

From The Plot Of Yield Strength Versus

Mar 28, 2025

-

A Budget Is Best Described As

Mar 28, 2025

Related Post

Thank you for visiting our website which covers about Gross Profit Equals The Difference Between . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.