For A Firm To Price Discriminate

Holbox

Mar 19, 2025 · 7 min read

Table of Contents

Price Discrimination: A Deep Dive into Strategies and Implications for Firms

Price discrimination, the practice of charging different prices for the same product or service to different customers, is a powerful tool for firms seeking to maximize profits. However, it's a complex strategy with significant legal and ethical considerations. This comprehensive guide explores the intricacies of price discrimination, delving into its various forms, the conditions necessary for its successful implementation, and the potential impacts on consumers and the market as a whole.

What is Price Discrimination?

Price discrimination occurs when a seller charges different prices for the same good or service to different buyers, despite the costs of supplying the good or service being the same. It's crucial to distinguish this from price differentiation, where different prices reflect differences in costs associated with serving different customers (e.g., bulk discounts). The key differentiator in price discrimination is that the price variation isn't directly linked to cost differences.

There are several reasons why a firm might engage in price discrimination. Primarily, it aims to capture consumer surplus – the difference between what a consumer is willing to pay and what they actually pay. By charging different prices, firms can extract more value from the market. This leads to higher profits compared to a single uniform price strategy.

Types of Price Discrimination

Economists categorize price discrimination into three main degrees, based on the extent to which a firm can segment its market and extract consumer surplus:

First-Degree Price Discrimination (Perfect Price Discrimination)

This is the most extreme form of price discrimination. The firm charges each customer the maximum price they are willing to pay for each unit of the good or service. This effectively captures the entire consumer surplus. Perfect price discrimination is rarely achievable in practice, as it requires extensive knowledge of each customer's individual willingness to pay, and the ability to prevent arbitrage (customers reselling the product at a higher price). Examples, albeit theoretical ones, include personalized pricing on e-commerce platforms, where algorithms attempt to infer willingness to pay based on browsing history and other data.

Second-Degree Price Discrimination (Quantity Discounts)

This involves charging different prices based on the quantity purchased. Customers who buy larger quantities receive a lower price per unit. This strategy exploits the fact that consumers often have different demand elasticities. Those with higher demand are willing to pay a premium for smaller quantities, while those with lower demand are more price-sensitive and will only buy larger quantities at a lower price. Examples are common: bulk discounts at grocery stores, tiered pricing for software subscriptions, and economies of scale for larger industrial orders.

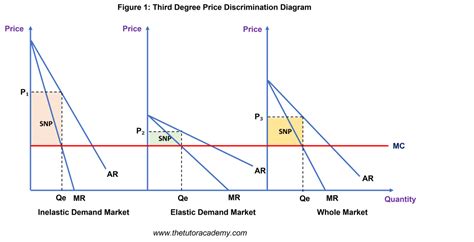

Third-Degree Price Discrimination (Market Segmentation)

This is the most common type of price discrimination. The firm divides its market into distinct segments based on observable characteristics (e.g., age, location, income) or inferred behavior (e.g., frequent flyer programs, student discounts). Each segment faces a different price. The key is that the firm can effectively prevent arbitrage between the segments. This is often achieved through geographical restrictions (e.g., different prices in different countries), or by offering distinct products tailored to specific segments (e.g., economy versus business class air travel).

Conditions Necessary for Price Discrimination

Several conditions must be met for a firm to successfully implement price discrimination:

- Market Power: The firm must possess a degree of market power, meaning it can influence the price of its product without losing all its customers. Perfect competition prevents price discrimination because firms are price takers.

- Market Segmentation: The firm must be able to segment its market into groups with different price elasticities of demand. This segmentation can be based on observable characteristics or inferred behavior.

- Prevention of Arbitrage: The firm must be able to prevent customers from buying the product at a lower price and reselling it at a higher price. This is often the most challenging condition to satisfy.

- Information: The firm needs some information about consumer preferences or willingness to pay. This could be direct (e.g., through surveys) or indirect (e.g., through observed purchasing behavior).

Implications of Price Discrimination

Price discrimination has significant implications for various stakeholders:

For Firms:

- Increased Profits: The primary benefit for firms is increased profitability. By capturing more consumer surplus, firms can earn higher profits than they would under a uniform pricing strategy.

- Improved Resource Allocation: Price discrimination can lead to a more efficient allocation of resources. By charging different prices, firms can serve a wider range of consumers and maximize output. However, it is important to note that this efficiency gain is often accompanied by a reduction in consumer welfare.

For Consumers:

- Increased Consumer Surplus (Potentially): In some cases, particularly with second-degree price discrimination, some consumers might benefit from lower prices due to quantity discounts. However, it is important to remember that the overall goal of price discrimination is to benefit the firm.

- Reduced Consumer Surplus: The overall effect of price discrimination is often a reduction in consumer surplus for many consumers, who are forced to pay higher prices than they otherwise would under uniform pricing.

- Inequity: Price discrimination can lead to inequities, particularly if the segmentation is based on discriminatory criteria such as race or ethnicity.

For Society:

- Increased Efficiency (Potentially): As mentioned, price discrimination might lead to increased productive efficiency by enabling firms to supply more goods and services. However, this efficiency gain often comes at the expense of consumer welfare.

- Reduced Welfare: Overall social welfare is often reduced by price discrimination, as the loss of consumer surplus often outweighs the gain in producer surplus.

- Legal and Ethical Concerns: Price discrimination can raise significant legal and ethical concerns. Antitrust laws in many jurisdictions prohibit price discrimination that is deemed anti-competitive.

Legal and Ethical Considerations

Many countries have laws regulating price discrimination to prevent anti-competitive practices. The specific regulations vary across jurisdictions, but generally, laws prohibit price discrimination that:

- Substantially lessens competition: Price discrimination can be illegal if it's used to eliminate competitors or create a monopoly.

- Is predatory: This involves setting prices below cost to drive out competitors, followed by raising prices after the competitors have been eliminated.

- Is discriminatory based on protected characteristics: Price discrimination based on race, religion, gender, or other protected characteristics is generally illegal.

Furthermore, even if price discrimination is not illegal, it can be ethically questionable if it is perceived as unfair or exploitative. Firms should carefully consider the ethical implications of their pricing strategies.

Examples of Price Discrimination in Action

Let's look at some real-world examples illustrating different types of price discrimination:

- Airlines: Airlines frequently practice third-degree price discrimination by segmenting the market based on factors like time of booking, destination, and passenger type (e.g., business travelers vs. leisure travelers). Business travelers often pay significantly more for the same flight.

- Movie Theaters: Movie theaters often offer discounted tickets to specific groups (e.g., students, seniors) or on certain days (e.g., matinees). This is a form of third-degree price discrimination.

- Software Companies: Software companies often use second-degree price discrimination by offering tiered subscriptions with varying features and prices based on the number of users or level of functionality.

- Pharmaceutical Companies: Pharmaceutical companies sometimes engage in third-degree price discrimination by charging different prices for the same drug in different countries, reflecting differences in income levels and regulatory environments.

Conclusion

Price discrimination is a complex and multifaceted strategy employed by firms to maximize profits. While it can lead to increased efficiency in some cases, it often reduces overall consumer surplus and raises ethical and legal concerns. The success of price discrimination depends on the firm's ability to segment the market, prevent arbitrage, and possess sufficient market power. Understanding the various forms of price discrimination, the conditions necessary for its implementation, and its implications for consumers and society is crucial for both businesses and policymakers. Firms must carefully weigh the potential benefits against the risks and ethical considerations before employing such strategies. Ultimately, a balanced approach is needed to ensure fair competition and protect consumer welfare.

Latest Posts

Latest Posts

-

Predict The Product For The Reaction Shown

Mar 19, 2025

-

Real Time Physics Lab 7 Homework Answers

Mar 19, 2025

-

What Do Sutures Gomphoses And Syndesmoses Have In Common

Mar 19, 2025

-

In Order To Promote Growth In Living Standards Policymakers Must

Mar 19, 2025

-

Suppose That A Small Town Wants To Install Street Lamps

Mar 19, 2025

Related Post

Thank you for visiting our website which covers about For A Firm To Price Discriminate . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.