Fixed Costs Expressed On A Per Unit Basis

Holbox

Mar 19, 2025 · 5 min read

Table of Contents

Fixed Costs Expressed on a Per-Unit Basis: Understanding the Implications for Business Decisions

Fixed costs, unlike variable costs that fluctuate with production volume, remain constant regardless of the number of units produced or sold. However, expressing these fixed costs on a per-unit basis – a seemingly straightforward calculation – can lead to significant misunderstandings and flawed business decisions if not carefully considered. This article delves deep into the concept of fixed costs expressed per unit, exploring its implications for various aspects of business management, including pricing strategies, break-even analysis, and capacity planning.

Understanding the Nature of Fixed Costs

Before diving into per-unit calculations, let's solidify our understanding of fixed costs themselves. These are expenses that a company incurs regardless of its production output. Examples include:

- Rent: Monthly rent for office space or factory premises remains the same whether you produce 100 units or 10,000 units.

- Salaries: Fixed salaries paid to administrative staff, managers, and other non-production employees remain consistent irrespective of production levels (excluding bonuses tied to performance metrics).

- Insurance Premiums: Insurance costs for property, equipment, or liability are usually fixed annually or semi-annually.

- Depreciation: The systematic allocation of an asset's cost over its useful life is a fixed cost, independent of production.

- Interest Payments: Payments on loans with fixed interest rates are consistent regardless of production volume.

- Property Taxes: Property taxes are generally fixed annually, irrespective of production levels.

These expenses represent a significant portion of the overall cost structure for many businesses, particularly those with high capital investment or a significant administrative overhead.

Calculating Fixed Costs Per Unit: The Simple Formula

The calculation itself is elementary:

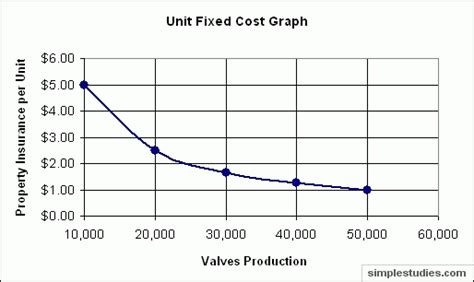

Fixed Cost per Unit = Total Fixed Costs / Number of Units Produced

For instance, if a company has total fixed costs of $100,000 and produces 10,000 units, the fixed cost per unit is $10 ($100,000 / 10,000). This appears simple enough, but the implications require careful examination.

The Pitfalls of Using Fixed Cost per Unit in Decision-Making

While the calculation is straightforward, relying solely on the per-unit fixed cost can be misleading and potentially detrimental to sound business decisions. Here's why:

1. Misinterpretation of Cost Behavior: The Illusion of Variable Costs

The most significant pitfall is the mistaken belief that fixed costs per unit behave like variable costs. They do not. While the per-unit cost decreases as production increases (as seen in the example above), the total fixed cost remains unchanged. This can lead to inaccurate forecasting and planning, especially when projecting profitability at different production levels. Management might erroneously assume that increasing production will linearly reduce costs, leading to overly optimistic profit projections.

2. Impact on Pricing Strategies: Underpricing and Lost Profitability

Incorrectly using per-unit fixed cost in pricing decisions can significantly undermine profitability. If a company underestimates its true cost base by focusing solely on the declining per-unit fixed cost at higher production volumes, it might set prices too low, resulting in insufficient margins to cover fixed costs even at high production levels. This can lead to losses, even with substantial sales volume.

3. Break-Even Analysis Distortions: Inaccurate Predictions

Break-even analysis, which determines the production volume needed to cover all costs, relies heavily on the accurate determination of fixed and variable costs. Using a per-unit fixed cost that varies with production volume distorts the break-even point calculation. A manager using the per-unit fixed cost may miscalculate the break-even point, leading to inaccurate production targets and potential financial losses.

4. Capacity Planning Errors: Overestimation or Underestimation of Resources

Capacity planning involves determining the optimal production level and the resources required to meet anticipated demand. If the per-unit fixed cost is incorrectly used to estimate future costs, capacity planning will be flawed. This might lead to overestimating the required capacity, resulting in unnecessary capital expenditure, or underestimating it, potentially leading to production bottlenecks and lost sales opportunities.

5. Investment Decisions: Misallocation of Capital

Fixed costs are crucial in evaluating investment opportunities. For instance, when considering expanding production capacity or investing in new equipment, the impact of increased fixed costs needs careful consideration. Using inaccurate per-unit fixed cost projections can lead to flawed investment decisions, misallocation of capital, and ultimately, reduced profitability.

The Importance of Understanding Total Fixed Costs

Instead of focusing solely on the per-unit fixed cost, businesses should prioritize understanding and managing their total fixed costs. This approach provides a more accurate reflection of the cost structure and supports better decision-making.

- Cost Control: Focus on reducing total fixed costs through efficient resource management, negotiating better deals with suppliers, and streamlining operations.

- Strategic Planning: Use total fixed costs in long-term planning, considering their impact on profitability at various production levels.

- Investment Appraisal: Evaluate the impact of investments on total fixed costs and their consequences for profitability.

- Performance Measurement: Track total fixed costs over time to identify trends and areas for improvement.

When Per-Unit Fixed Costs Can Be Useful

While focusing solely on per-unit fixed costs is generally discouraged, they can serve a useful purpose in specific contexts:

- Comparative Analysis: Comparing per-unit fixed costs across different production methods or facilities can be helpful in identifying areas for efficiency improvements. However, this comparison should always be combined with an analysis of total fixed costs and other relevant factors.

- Illustrative Purposes: Per-unit fixed costs can be used to illustrate the cost structure to non-financial stakeholders in a simplified manner. It's crucial, however, to emphasize that this is a simplified representation and shouldn't be used for critical decision-making.

- High-Volume Production: In industries with extremely high production volumes, the per-unit fixed cost can become relatively insignificant, making its impact on overall cost less crucial. However, even in these instances, understanding total fixed costs remains essential for strategic decision-making.

Conclusion: A Balanced Approach to Cost Analysis

Fixed costs expressed on a per-unit basis can be misleading if not interpreted cautiously. While the calculation is simple, its application requires careful consideration of its limitations. Focusing primarily on total fixed costs provides a more robust and reliable foundation for informed decision-making across various aspects of business management. Understanding both the total and per-unit figures, while recognizing their limitations, allows for a more balanced and effective approach to cost analysis. Remember that accurate cost analysis is fundamental to sustainable profitability and long-term business success. Combining this understanding with a comprehensive analysis of variable costs and market dynamics empowers businesses to make data-driven choices that optimize their financial performance.

Latest Posts

Latest Posts

-

What Is True Concerning Physical And Logical Topologies

Mar 19, 2025

-

A Coffee Producer Has Two Social Media Objectives

Mar 19, 2025

-

What Is The Medial Border Of The Highlighted Region Called

Mar 19, 2025

-

Select The Account Classification That Matches With The Description

Mar 19, 2025

-

An Inbound Sales Rep For A Digital

Mar 19, 2025

Related Post

Thank you for visiting our website which covers about Fixed Costs Expressed On A Per Unit Basis . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.